Q&A with Ryan Merrett of Tribeca Financial

Ryan Merrett is the CIO at Tribeca Financial, a Melbourne-based financial advice firm and Sharesight's professional plan partner. I recently asked Ryan about Tribeca and how they’re using Sharesight to monitor the performance of their clients’ investment portfolios.

Tell me a bit about yourself.

Previously the Senior Financial Adviser at Tribeca Financial, over the last 2 and a half year my role has changed to primarily improving the way we work, how we provide advice and what extra value we can provide our clients. This includes what software we use and how it all connects together so that we can help more people live their good life.

What is Tribeca Financial, and what sets it apart from other financial advice firms?

Tribeca Financial is a Financial Wellbeing firm based in inner east Melbourne, Australia. We’re a financial advice firm -- but we’re not just about improving finances. We help people build the life they want. Financial wellness means freedom from financial stress and the ability to live your good life.

Why did Tribeca choose to partner with Sharesight?

We’ve been using Sharesight's professional plan since 2014. We found that a lot of the other software out there was focussed on use by an Accountant instead of the client, and us as the adviser. We were impressed with their approach and how quick and easy the support we received. Simple enough to be easily accessible, but deep enough to get a really clear understanding of what is happening.

How does Tribeca use Sharesight?

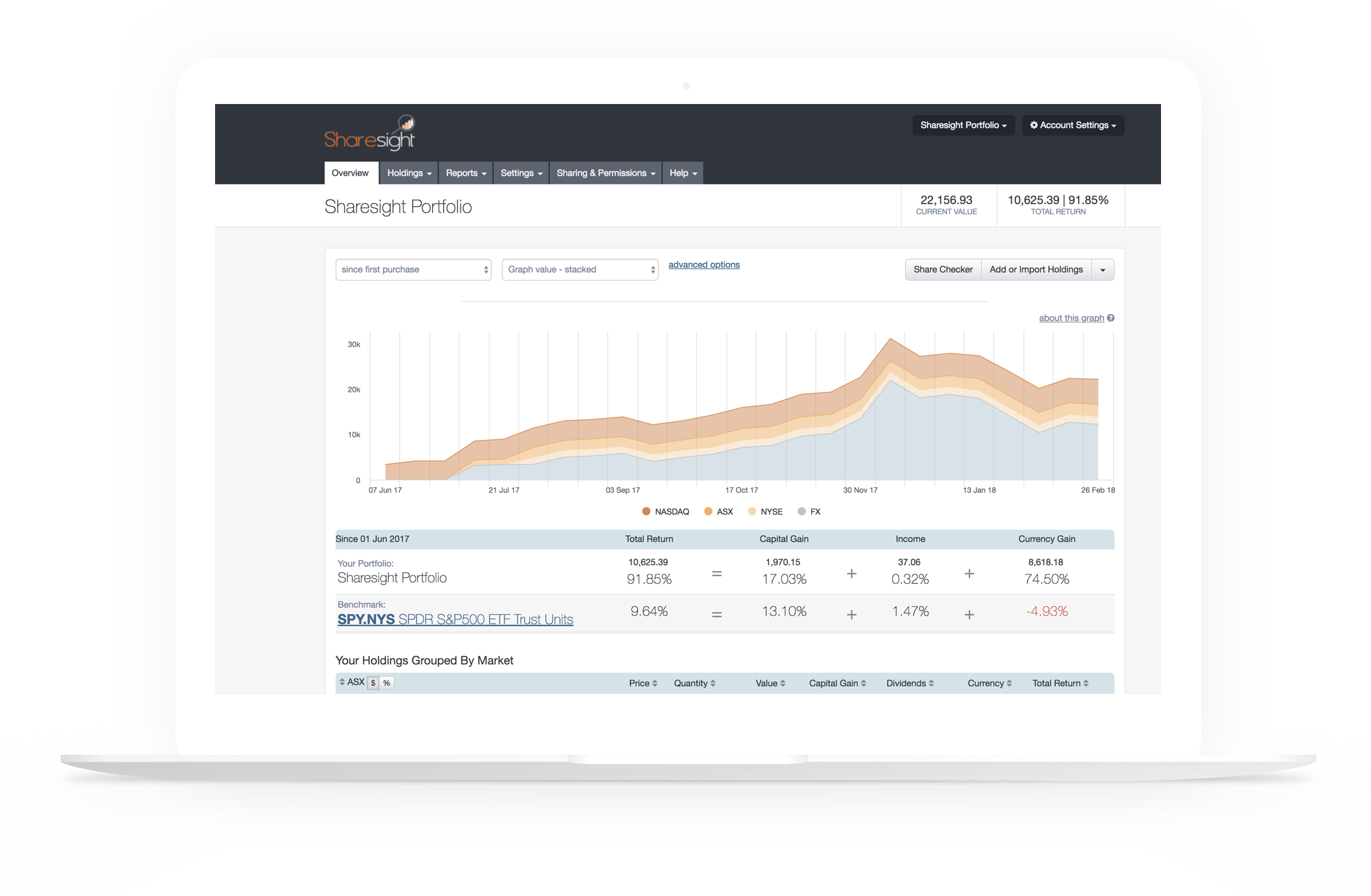

Tribeca uses Sharesight as an easy reporting tool for SMSF & Investment trust clients. Sharesight allows us to very quickly get insight into clients investments and also allows a clients to easily understand where their money is and what it’s doing. This helps us all understand if the client is on track, and OK.

Sharesight has reduced our review appointment prep time by around 30%. This adds up to around 300 hours per annum at the moment, which we are able to invest back into new clients, or adding more value to existing clients in other ways.

We also find it useful as often when a new client with an SMSF or investment trust come in, they have very little idea of what the current state of play is. They might have had an out of date tax return done, but little live info. How can you plan on where you want to get to if you don’t know where you currently are?

How has Sharesight changed the way Tribeca does business?

We have been able to cut down our reporting and review appointment preparation time by around 30% while having more certainty around correctness of information. We have been able to cut costs for some clients, and been able to provide increased transparency for them. Lastly, we have built a tool that connects in with the reports and helps us quickly do projections and what likely changes we need to make for a clients portfolio to keep it doing what it should.

Does Tribeca share secure portfolio access with its clients?

We do, but only for those who want it and value it. As long as you are able to continually demonstrate that someone is OK and On Track to Live their Good Life they reduce how often they look. There is comfort in knowing that it’s there if needed, and that their trusted adviser is able to be proactive and have access to live information when we want.

How much time/money has Tribeca saved by using Sharesight to track client portfolios?

As previously mentioned, it has reduced our review appointment prep time by around 30%. This adds up to around 300 hours per annum at the moment, which we are able to invest back into new clients, or adding more value to existing clients in other ways.

What’s your favourite Sharesight feature?

The visual chart. I have a pet hate for performance figures over certain time periods. It can hide what is really going on and what it all means. To see it there visually is very handy.

In August 2018, Sharesight sponsored Tribeca Financial in the Variety Bash. Can you explain what the Variety Bash is all about, how Tribeca is involved, and how it went?

The Variety Bash is Australia’s Longest Running Charity Motoring Event. It raises money for Variety -- The children's charity.

‘All kids deserve the same opportunities in life. No matter what life throws at them. Variety – the Children’s Charity helps children and their families with much-needed financial support for things like specialist equipment, therapy, and medical supplies, when they can’t afford it, and when government assistance isn’t available.’

The 2018 Bash started in Geelong and ended in Townsville, but we definitely went the scenic route!

It’s the 2nd year that Ryan Watson (CEO) and myself have been on it. It’s a part of our Good Life. We both like driving cars, and a core why is to add value to other people. It helps that we get to do it with good people and see parts of Australia that not many people ever get to. The first year we managed to raise $12,500. Last year, we were thrilled to raise $25,000 to put towards the total of $1.6 mil for the event. We were thrilled that Sharesight were able to contribute!

We had great fun giving away a heap of hot wheels cars to plenty of kids along the way and meeting people who had been positively impacted by Variety along the way. A lot of the land we were driving through was very drought ridden which can mean a lot of the country communities are struggling.

The best memory was breaking the diff and snapping an axle in between Tibooburra and Cunnamulla. We were stuck for around 9 hours in some very barren countryside but the mobile mechanics were able to get us back on the road and we got in for the night around 2am.

How do investors get started with Tribeca Financial?

Firstly, we work with people that understand it’s NOT about keeping up with the Jones’ or chasing money for money’s sake. Instead, they are chasing their Good Life. Before coming on as a client we need to understand what that Good Life might look like over the next 10 & 3 years, as well as now.

Therefore to start working with us, people need to call and book a time to go through this excercise with one of our advisers and really understand the life that they want to live.

Is there anything else you’d like to share?

If anyone wants to get in touch to understand how we use Sharesight to improve outcomes for clients, I’m happy to share.

Or if you are interested in getting involved with the Variety Bash I’m happy to help get you involved!

FURTHER READING

4 ways to prepare your investment portfolio for retirement

In this blog, we discuss retirement planning for investors, including four important factors every investor must consider.

Evaluate your investment returns with the performance report

One of Sharesight’s most popular reports, the performance report gives you the full picture of your portfolio’s returns over any chosen period.

Sharesight product updates – May 2024

This month's focus was on expanding our broker support and streamlining the customer onboarding journey, as well as additional reporting and holding functions.