Dividend calculator

Estimate your monthly dividend income with Sharesight’s dividend calculator.

Estimated dividend return

$8,764.83

Dividends | $8,764.83 | 27% |

Contributions | $10,000.00 | 31% |

Growth | $3,158.66 | 10% |

Principal | $10,000.00 | 31% |

Year 1 | $41.67 |

Year 2 | $47.69 |

Year 3 | $54.03 |

Year 4 | $60.73 |

Year 5 | $67.78 |

Year 6 | $75.21 |

Year 7 | $83.04 |

Year 8 | $91.27 |

Year 9 | $99.94 |

Year 10 | $109.06 |

Holding period

How many years will you be investing in your dividend portfolio? The dividend calculator can go up to a maximum of 10 years.

Annual dividend yield

How much dividend income will you earn in dividend payouts per year for every dollar invested in the stock?

DRP / DRIP

Have you opted in to a dividend reinvestment plan?

Annual contribution

How much money will you be contributing to your investment every year?

Stock price appreciation

How much do you expect the price of your shares to increase each year? It is reasonable to estimate between 6% to 8%.

Dividend growth rate

How much do you estimate your dividend payouts to increase each year? It is reasonable to estimate between 3% to 5%.

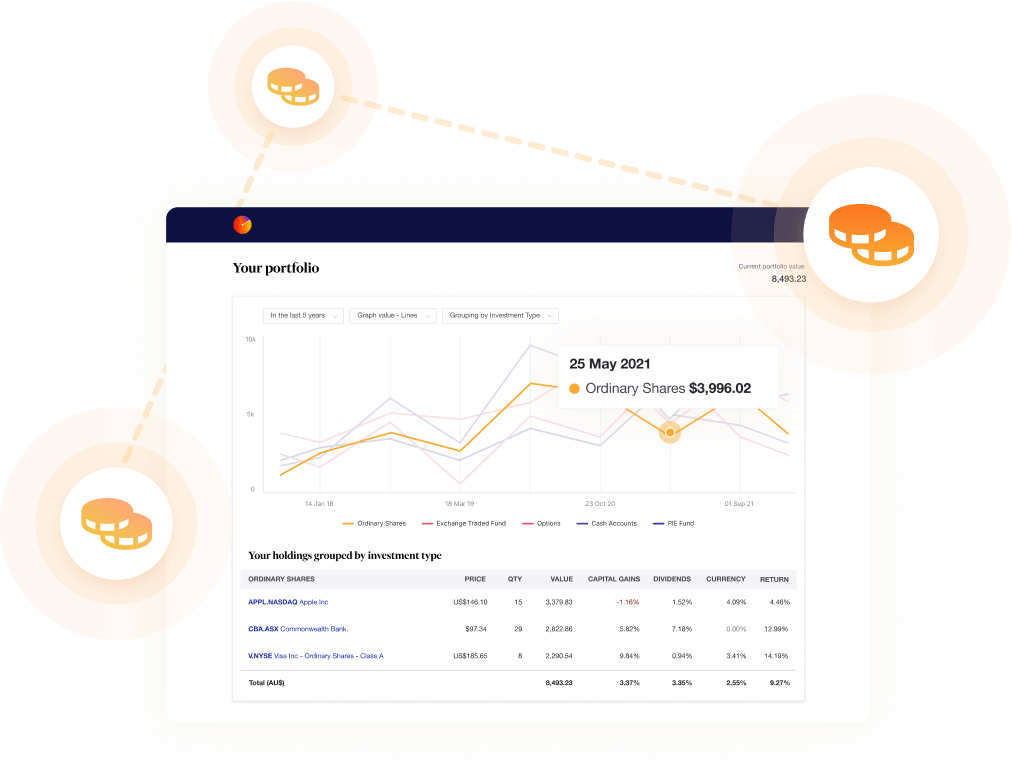

Track your dividends with Sharesight

Automatically track dividends and distributions for more than 700,000 stocks, ETFs and funds worldwide.

Sign up for free

Our supported brokers

Sharesight integrates with hundreds of brokers and finance apps, including Robinhood, Charles Schwab and Interactive Brokers.

View our supported partners

500

k+

700

k+

200

Plans & Pricing

Start by tracking up to 10 holdings for free! Then upgrade to a premium plan at any time to track additional holdings or portfolios, and unlock advanced features.

1 Portfolio

10 Holdings

1 Custom group

Starter

For simple reporting and portfolio management

$7

USD per month

billed annually

$9.33 USD billed monthly

1 Portfolio

30 Holdings

3 Custom groups

Standard

For advanced insights across multiple portfolios

$18

USD per month

billed annually

$24 USD billed monthly

4 Portfolios

Unlimited Holdings

5 Custom groups

Premium

For professional-grade reporting and support

$23.25

USD per month

billed annually

$31 USD billed monthly

10 Portfolios

Unlimited Holdings

10 Custom groups

Don't just take our word for it

Over 500,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

Dividend calculator - Frequently asked questions (FAQs)

What can investors use this calculator for?

- Income projection: To forecast potential future dividend income streams based on current holdings and anticipated contributions.

- Scenario modelling: To understand how variables such as dividend reinvestment plans (DRPs/DRIPs), annual contributions, and changes in growth rates can impact long-term returns.

- Goal setting: To visualise the potential growth of an investment portfolio over time, which can aid in setting and adjusting long-term financial goals.

- Comparative analysis: To model and compare the potential outcomes of different investment scenarios before committing capital.

It is important to note that the calculator is a modelling tool for estimation and planning, not a predictive instrument for guaranteed returns.

What inputs are required to use the calculator effectively?

- Unit/share price

- Number of shares

- Holding period

- Annual dividend yield

- Annual contribution

- Dividend reinvestment plan (DRP/DRIP)

- Expected annual stock appreciation

- Expected dividend growth rate.

What results does the calculator provide?

- An estimated dividend return

- A breakdown of returns, categorised into dividends, contributions, growth, and principal

- An average monthly income, shown as a bar chart and a year-by-year breakdown.

What are some key limitations of the calculator?

- Hypothetical scenarios: The calculations are based on user-provided data and general assumptions, which may not accurately reflect real-world market conditions.

- Not a prediction: The tool is a model and should not be interpreted as a definitive prediction of future dividend payments or investment returns.

- Inherent investment risks: The calculator does not account for the inherent risks of investing, including the potential for capital loss. Past performance is not indicative of future results.

- Exclusion of fees and taxes: The calculations do not factor in brokerage fees, taxes, or other variable costs that can impact returns.

- Accuracy disclaimer: Sharesight does not guarantee the accuracy, completeness, or timeliness of the calculations and is not liable for any errors or omissions.

Is the output from the calculator considered financial advice?

How does the dividend reinvestment plan (DRP/DRIP) selection affect the calculations?

How should I determine the 'expected annual stock appreciation' and 'expected dividend growth rate'?

How the calculation works

Calculations are based on limited user inputs and general assumptions, creating hypothetical scenarios to illustrate potential dividend outcomes that may not reflect actual market conditions, tax implications, or individual circumstances.

Limitations

The calculator is a model, not a prediction of dividend amounts or investment return. Investing involves risks, including the potential loss of principal. Past performance does not guarantee future results.

You acknowledge and agree that the estimate relies on you entering accurate information and on general assumptions. It does not account for fees, taxes, market conditions, or any other variable factors. We do not guarantee the accuracy, completeness, or timeliness of the calculations and are not responsible for errors, omissions, or results obtained from using this calculator. By using the calculator, you acknowledge these hypothetical calculations are for illustrative purposes only and agree to this disclaimer.

The calculator and its content are for informational purposes only, not advice of any nature and is not intended to be relied upon for the purposes of making a financial decision. You should seek advice from qualified professionals, consider your personal financial circumstances, perform your own calculations and decide what is best for you according to your own circumstances and objectives before making any investment decisions. To the extent permitted by law, we do not assume any responsibility or liability, and you waive and release us from all responsibility or liability, arising from or connected with your use or reliance on the calculator.