Latest posts

5 ways Sharesight keeps your data safe

Here at Sharesight, we maintain constant vigilance around cyber security. In this blog, we discuss five ways Sharesight keeps your data safe.

The investor's guide to IPOs: Risks, rewards and strategies

Discover when to invest in IPOs, how to approach them strategically, and how Sharesight helps you track and optimise your performance.

ETF overlap: How to uncover and manage hidden concentration risk

Understand ETF overlap and concentration risk through a real-world example — and see how Sharesight’s exposure report helps you uncover and avoid hidden risks.

Investing after Brexit: Managing risk through diversification

Discover how UK investors can adapt their portfolio strategy and tracking tools to stay resilient in the post-Brexit investment landscape.

How SMSF trustees can get EOFY-ready

In this article, we discuss how Sharesight saves SMSF trustees time and money at tax time, and how trustees can get EOFY-ready with Sharesight.

Sharesight product updates – June 2025

This month's focus was on earning SOC 2 Type 1 certification, expanding exposure reporting to European markets and improving the future income report.

Record-keeping requirements for Australian investors

Find out which records the ATO requires Australian investors to keep, and how to stay on top of your investment portfolio record-keeping with Sharesight.

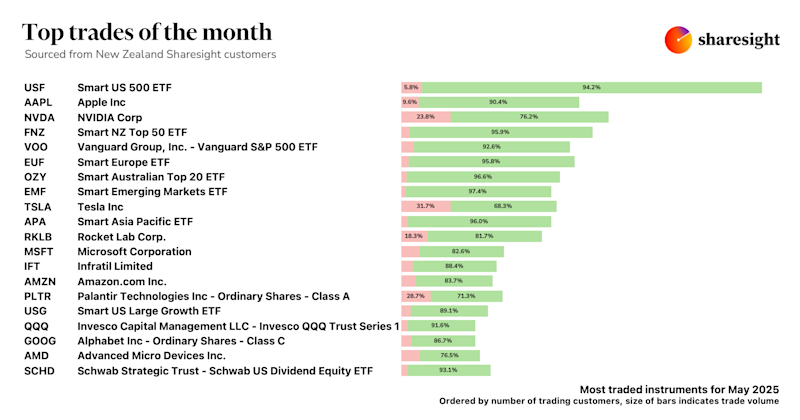

Top trades by New Zealand Sharesight users — May 2025

Welcome to the May 2025 edition of Sharesight’s trading snapshot for New Zealand investors, where we look at the top 20 trades by New Zealand Sharesight users.

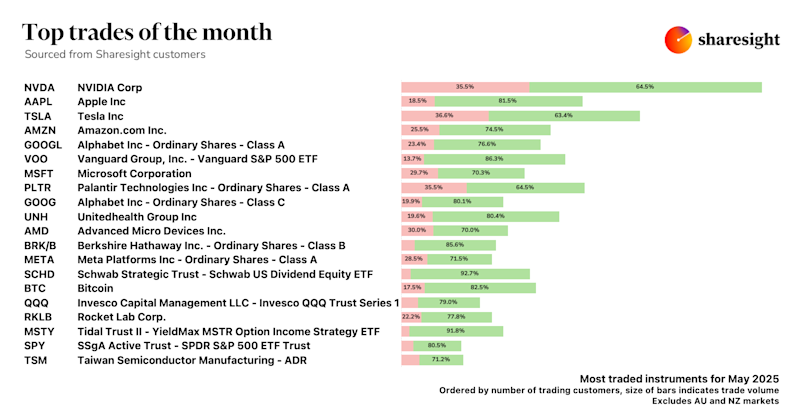

Top trades by global Sharesight users — May 2025

Welcome to the May 2025 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades by Sharesight users around the world.

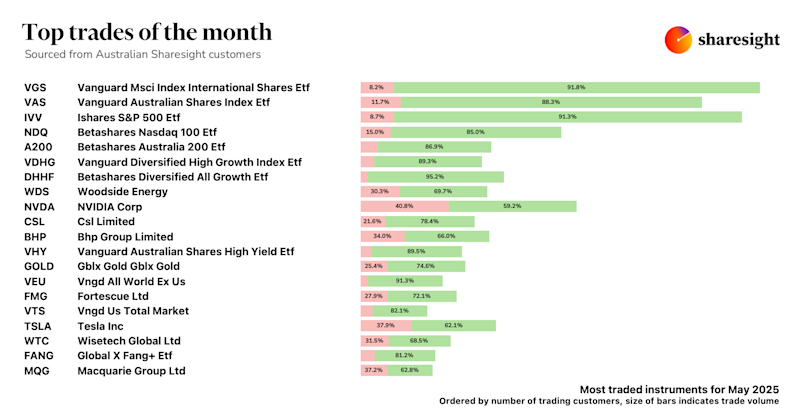

Top trades by Australian Sharesight users — May 2025

Welcome to the May 2025 edition of Sharesight’s trading snapshot for Australian investors, where we look at the top 20 trades by Australian Sharesight users.

Why Sharesight is the best alternative for Morningstar Portfolio Manager

In this article, we compare Morningstar Portfolio Manager to Sharesight and discuss why Sharesight is the best portfolio tracker for UK investors.

What today’s investors can learn from UK stock market trends

Discover what today’s investors can learn from the UK stock market’s history, from coffee house beginnings to modern-day trading trends.