Tax reports for your investment portfolio

Tax reports built for investors like you. If you trade stocks, ETFs, or even cash, you need Sharesight.

Sign up for free

Investment tax reports

Easily calculate the tax implications of investing across your entire portfolio with Sharesight’s investor reports.

Dividend income tracking

Report income from dividend, distribution and interest payments for all your investments.

Secure portfolio sharing

Share secure portfolio access and tax reports with your accountant to stay on top of your investment portfolio.

Everything you need to calculate tax on your investments

With Sharesight, all your investment portfolio data lives in one place. You also have access to powerful reports that make it easy to calculate tax on your investments throughout the financial year.

Track all your investment income

Report your investment income from dividends, distributions and interest payments, broken-up by local and foreign income sources with the Taxable Income Report. With historical dividend data going back over 20 years, The report can be run at any time, over any time period to help you complete your taxes.

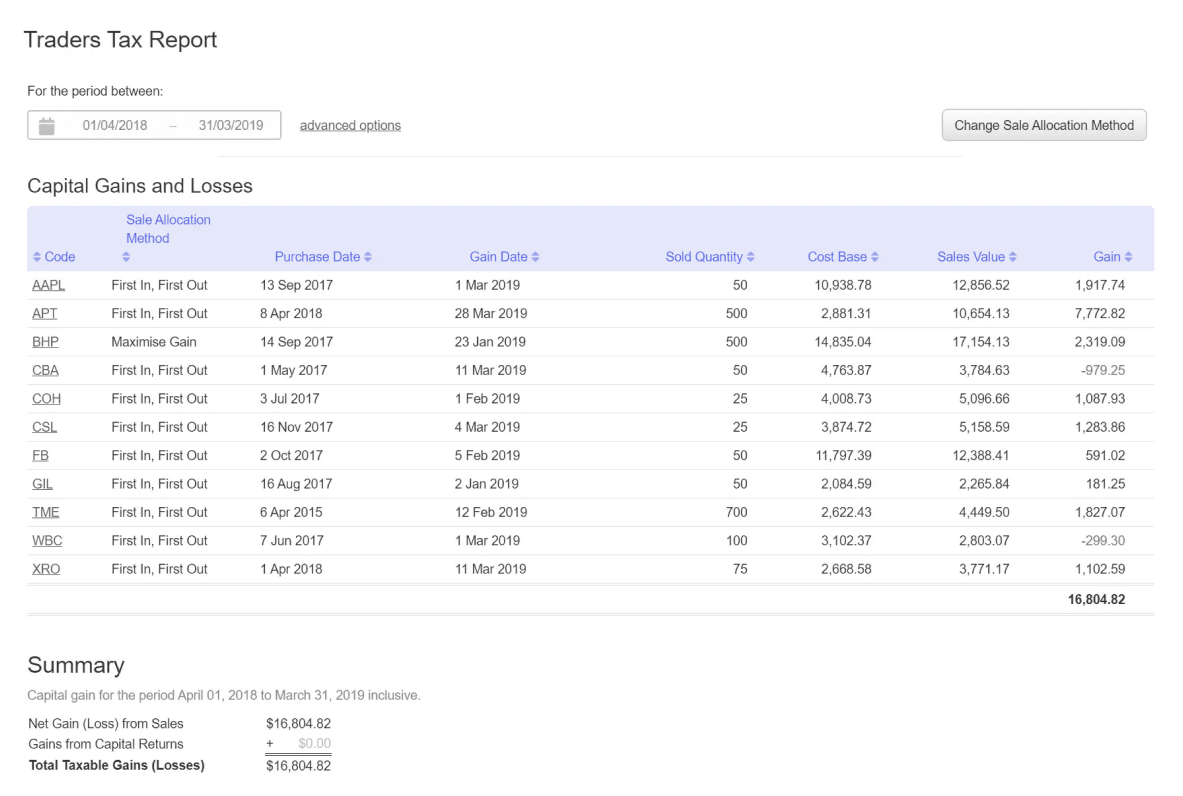

Calculate your realized gains

Calculate realised (realized) gains across all the stocks, ETFs and funds you’ve sold during the year with the Sold Securities Report. Run the report to see gains on sold positions calculated using the average cost base of holdings in your portfolio and share the report with your accountant for further analysis.

Report on all trades made

Need a complete view of all the trades you made during the financial year? View your trading history using the All Trades Report . Export your investment activity and share it with your accountant or financial advisor to make tax time a breeze.

We work with all your favourite brokers and apps

Sharesight integrates with hundreds of brokers and finance apps, including Robinhood, Charles Schwab and Interactive Brokers.

View our partners

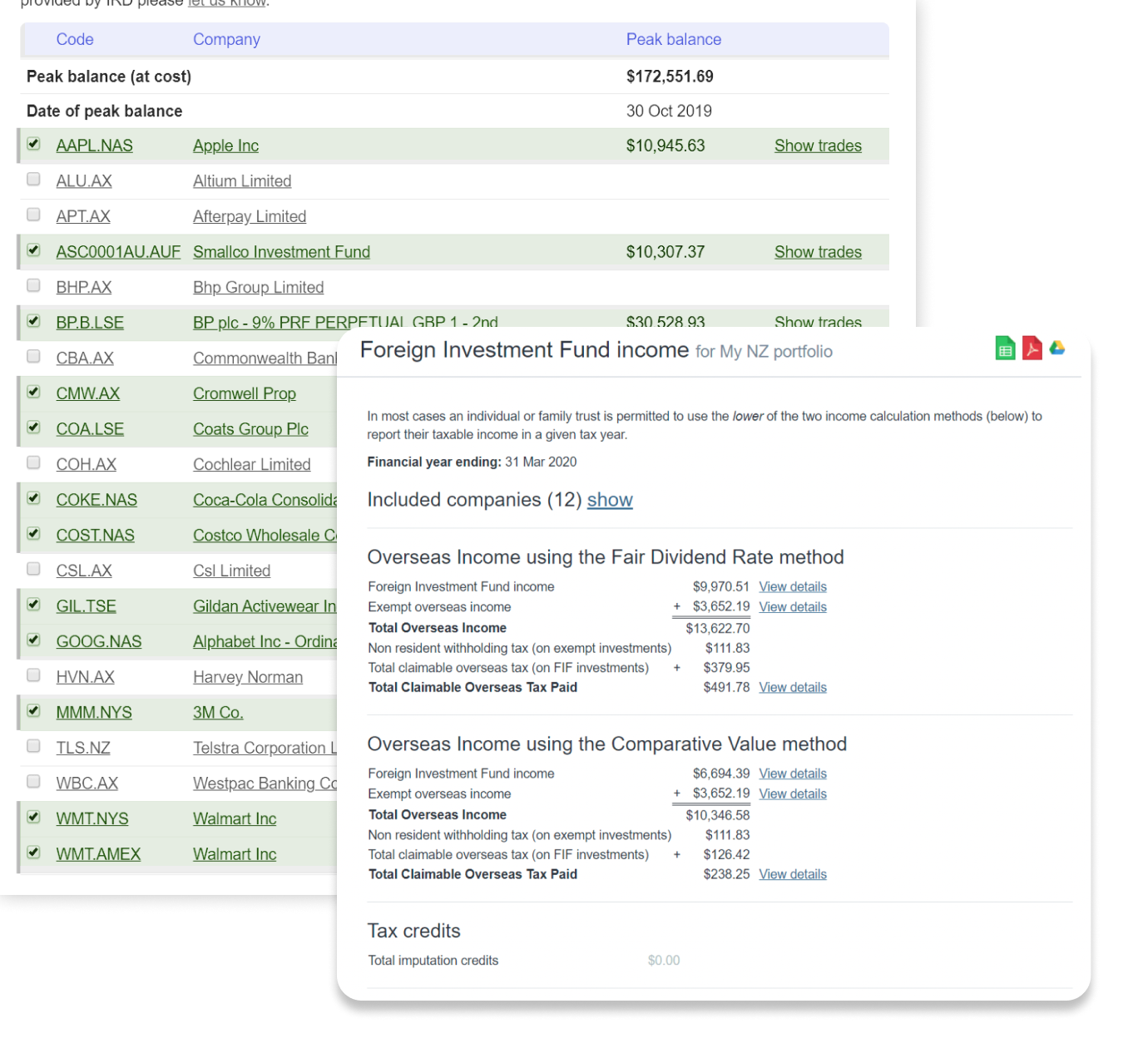

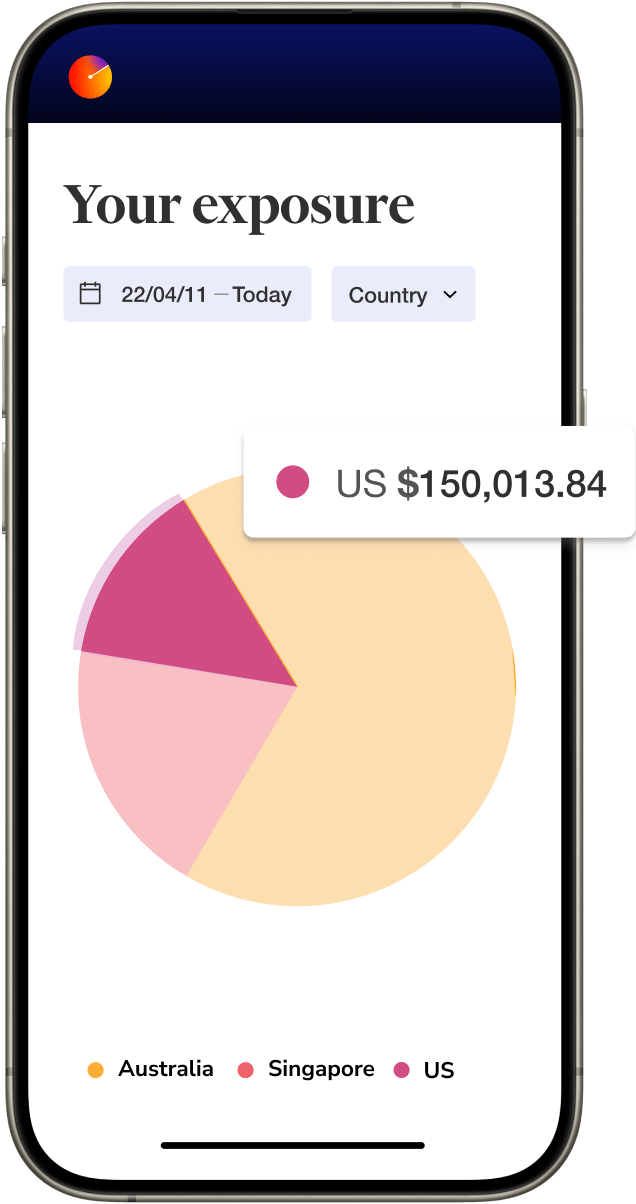

Built for investors everywhere

Investors in over 100 countries use Sharesight to effortlessly aggregate all the info they need to file their tax returns.

Tax residency

Set your portfolio base currency and automatically track currency impacts for any foreign stocks.

Custom tax year

Set your tax year to match your country’s financial year to help facilitate your tax reporting.

Over 40 markets

Track price and dividend information on over 700,000+ stocks, ETFs and funds listed on over 60 stock exchanges.

Don't just take our word for it

Over 500,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

Investment tax reporting FAQ

What is capital gains tax?

Capital gains tax is a tariff that investors pay on the profit made from selling an investment. The specific tax implications of capital gains differ depending on the tax residency of the investor, however in some countries such as the US, there are different levels of taxation depending on how long the investor holds the investment before selling. For example, in the US, short-term capital gains (for stocks held for less than a year) are taxed at ordinary income rates; however long-term capital gains (for stocks held for a year or longer) are taxed at rates of 0%, 15% and 20%, depending on the investor’s income, which is a discounted rate compared to ordinary income tax rates. In the UK, however, capital gains tax is only paid if the investor has exceeded the Annual Exempt Amount (AMA), and the tax rate for capital gains on shares ranges from 10% to 20% depending on the investor’s tax bracket.

How to calculate capital gains tax on investments?

Investors can calculate the capital gains on investments they have sold by calculating the difference between the value of the purchase price (adjusted to include any transaction fees) and the current market value at the point of sale. The tax implications resulting from this will differ depending on the tax residency of the investor, so please refer to your local tax authority or tax accountant for information on capital gains tax.

Do I need to report capital gains on taxes?

If you incur capital gains or losses on the sale of an investment, then depending on your tax residency, you may need to disclose the capital gain/loss in your tax form. For specific advice on reporting capital gains, please refer to your local tax authority or tax accountant.

Are dividends taxable income?

Depending on your tax residency, dividends may be considered taxable income. In some countries such as the US, dividend income is generally taxable (with the exception of 401ks which are typically tax-deferred until withdrawal); while in the UK investors receive an allowance for tax-free dividends, and will need to pay tax if their dividend payments exceed the threshold (excluding dividends paid into an ISA). The tax implications of dividends are different in each tax residency, so for specific information on reporting dividend income in your tax return please consult your local tax authority or tax accountant.

Are ETF distributions taxable income?

In many countries, ETF distribution income is considered taxable income, just the same as dividends paid by individual stocks. However, this is often dependent on certain factors such as how long the investor has held the ETF or whether the ETF consists entirely of stocks. The specific taxation details will depend on the investor’s tax residency.

How do I calculate taxable income from dividends?

Done manually, calculating taxable income from dividends can be a tedious process, requiring investors to sort through a combination of paper statements and digital statements via multiple share registries. However, Sharesight automates this process by automatically tracking dividends and distributions. Sharesight also makes it easy for investors to calculate the taxable income on their dividends by using Sharesight’s Taxable Income Report. This report displays a portfolio's dividends and interest payments, along with the relevant totals investors need to complete their tax return.

What are unrealised capital gains?

Unrealized capital gains occur when the value of an investment in an investor’s portfolio has increased, however the investor has not sold the investment. This means the gains have not been “realized”. Unrealized capital gains are useful information for investors who want to use tax loss selling (or tax loss harvesting) to minimize their net capital gains during the financial year for tax purposes.

Disclaimer: The above content is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content on this page, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.