3 ways Sharesight helps investors at tax time

Sharesight is the award-winning investment portfolio tracker that investors around the world are using to track the performance of millions of holdings. Beyond the platform’s powerful performance insights and dividend tracking, Sharesight is also a valuable tool during tax season.

If you prepare and file your own tax return, Sharesight provides everything you need to stay organised and save yourself hours of time spent number-crunching. And if you work with an accountant, Sharesight can potentially save you money on accounting fees by letting you share your tax reports with them, so they’re not starting from scratch and charging you for portfolio reconstruction.

How Sharesight helps investors at tax time:

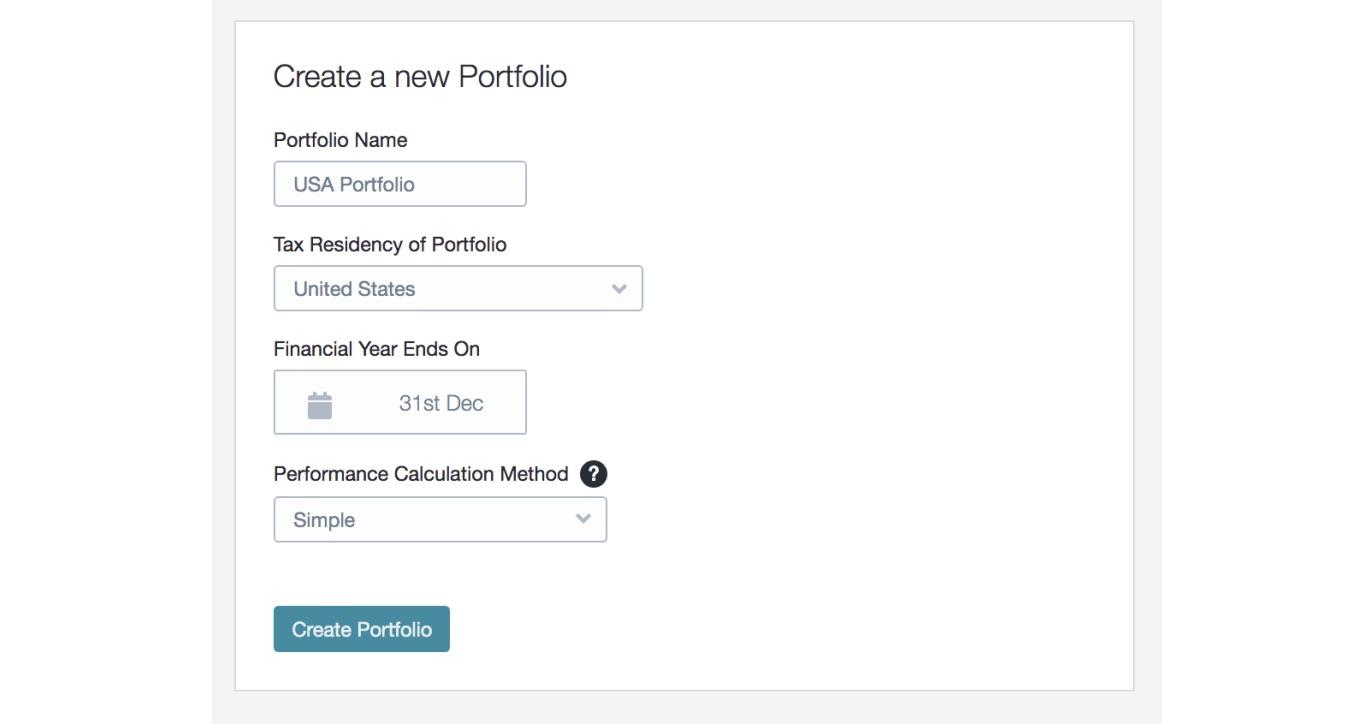

1. Global tax settings

By default, your first Sharesight’s portfolio’s tax residency will be set to the country you used to sign up with (users can sign up for Sharesight from over 100 countries), but you can create additional portfolios with other tax residencies if needed. You can also adjust the tax year end date to reflect that country’s financial year. Setting the tax residency of a portfolio determines the portfolio’s base currency, ensuring that any currency fluctuations on foreign investments are automatically incorporated into your total performance return.

Sharesight users can change the tax residency of their portfolio via the Settings tab.

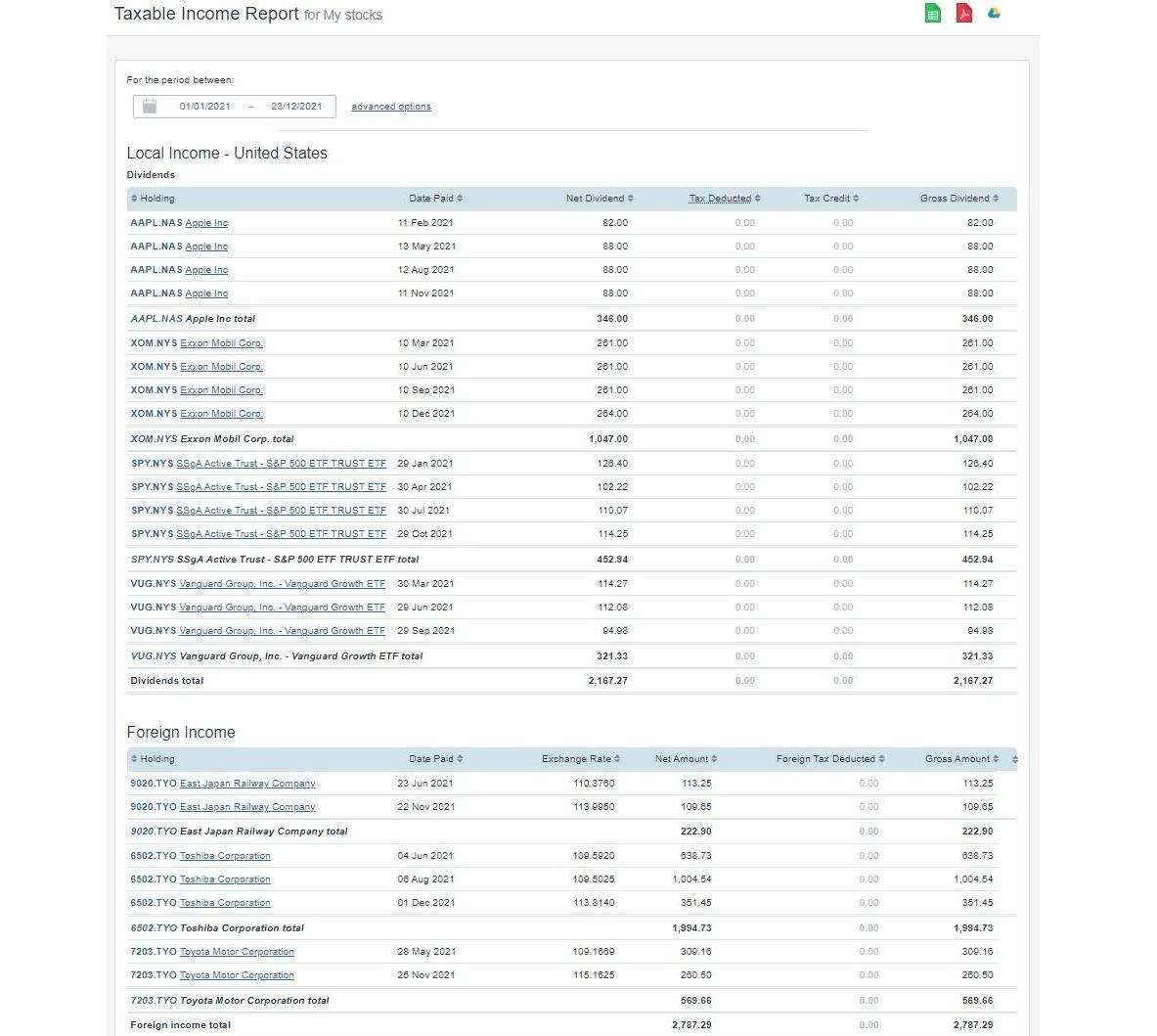

2. Taxable Income Report

With all your dividends automatically tracked and in one place, Sharesight makes tax time a breeze. The Taxable Income Report takes it one step further, allowing you to see all of your dividends broken down over any time period, organised by local and foreign income. Other convenient features include the option to display individual holding totals, as well as comments; and the ability to export the report to an Excel spreadsheet, PDF or Google Sheets file – making it easy to share the report with your accountant.

An example of Sharesight’s Taxable Income Report being used on a US portfolio with investments across global markets.

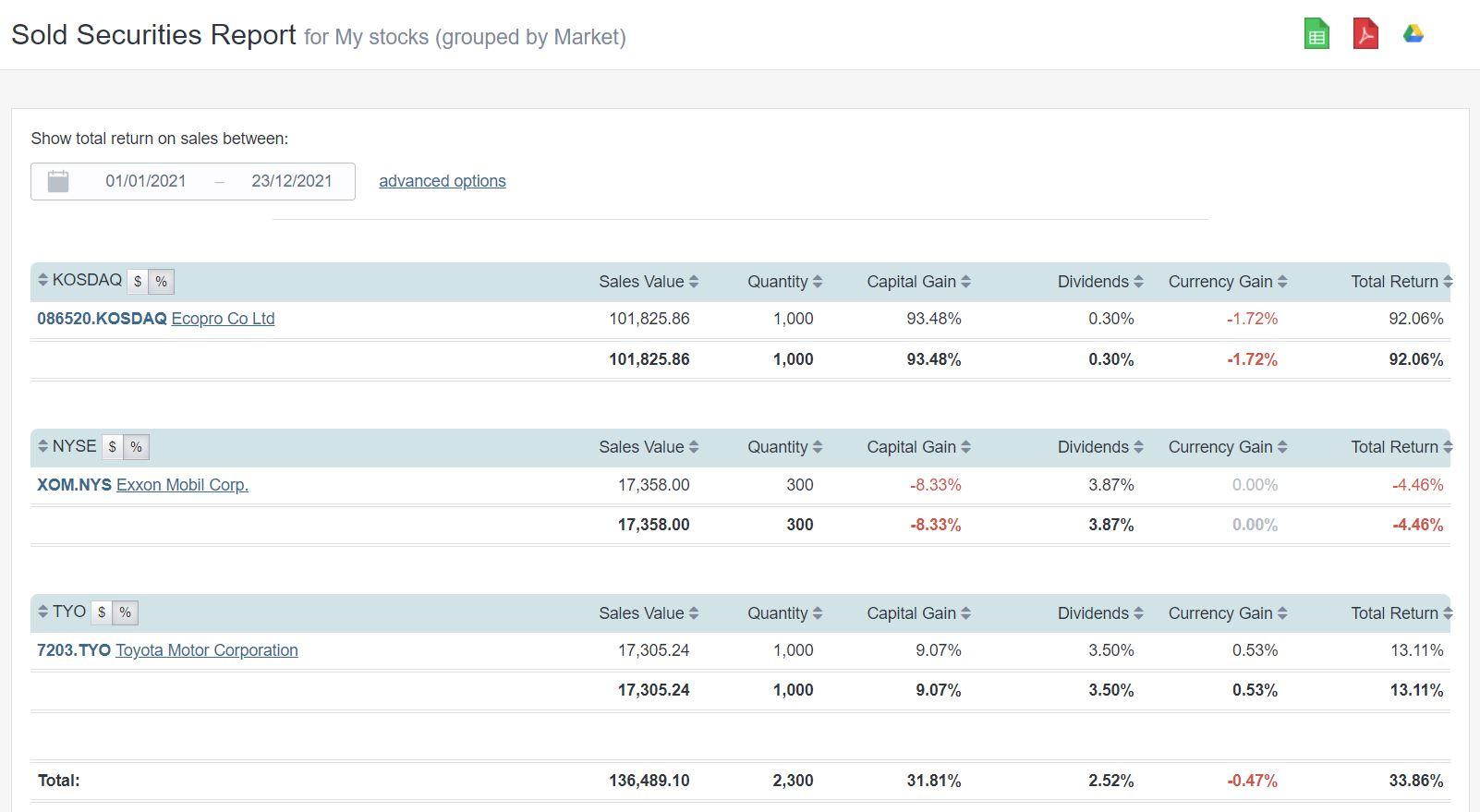

3. Sold Securities Report

If you’re looking to understand how much money you made by selling shares (capital gains), you can get a clear breakdown of this by running the Sold Securities Report. The Sold Securities Report allows you to see the total return on any shares that have been sold within your selected date range.

The report can be personalised to your needs, such as the ability to group your holdings according to a range of default groupings including market, currency, sector, industry, investment type and country, or by your own Custom Groups. You can also toggle the $ and % symbols to see the amounts in dollars or percentages. The percentages are a handy way to see your relative gains/losses, while the dollar figures can be used to report any capital gains you might need to disclose in your tax return. It’s also easy to export the report to different formats, including an Excel spreadsheet, PDF or Google Sheets.

An example of Sharesight’s Sold Securities Report being used for a US portfolio of global investments, sorted by market.

Bonus: Share your portfolio with your accountant

Another essential tax feature is the ability to share your portfolio. Rather than exporting and printing or emailing your Sharesight tax reports, you can securely share portfolio access directly with your accountant. With all your portfolio data in one place, they’ll have everything they need to prepare your tax documents. Available on all Sharesight plans, portfolio sharing ensures everyone’s on the same page and focusing on what really matters – not just at tax time but throughout the year.

Make tax time a breeze with Sharesight

Thousands of global investors are using Sharesight to track the performance of their investments while saving time and money on their taxes. If you’re not already using Sharesight, what are you waiting for? Sign up for Sharesight so you can:

-

Track all of your investments from more than 40 global stock exchanges, including global stocks, ETFs, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds in over 75 different currencies

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Multi-Period and Multi-Currency Valuation

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Key takeaways from SIAA 2025: Trends, insights & industry highlights

We summarise the key takeaways from the 2025 SIAA conference in Sydney, covering industry insights, market trends and the future of financial advice.

5 ways Sharesight keeps your data safe

Here at Sharesight, we maintain constant vigilance around cyber security. In this blog, we discuss five ways Sharesight keeps your data safe.

The investor's guide to IPOs: Risks, rewards and strategies

Discover when to invest in IPOs, how to approach them strategically, and how Sharesight helps you track and optimise your performance.