3 reasons why you need to be tracking dividends

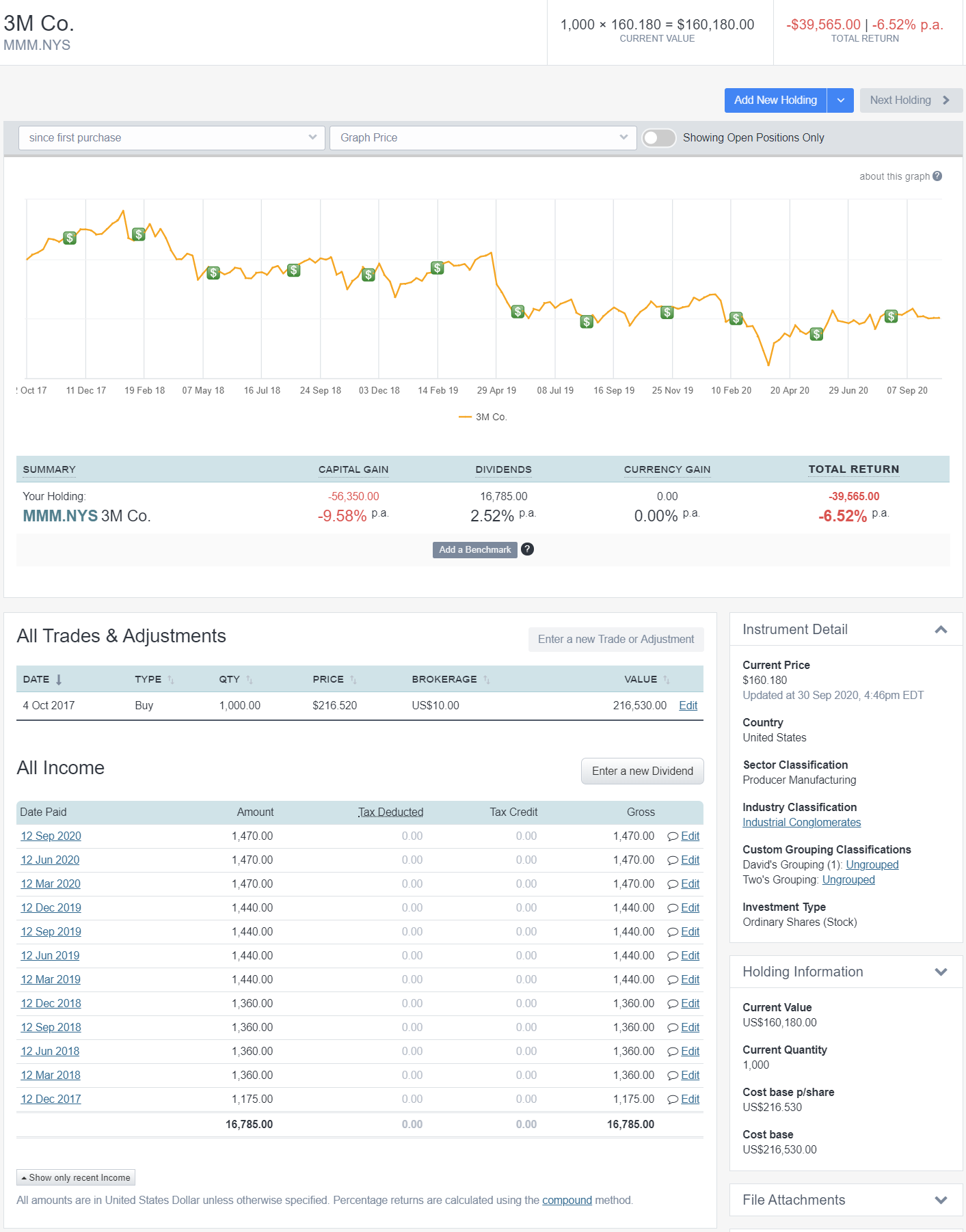

Dividend and distribution income received from investments in stocks, ETFs and mutual funds are a critical but often overlooked component of calculating investment returns.

Dividends are often seen as ‘unsexy’ compared to tracking capital growth, but dividends often have a material impact on investment returns. So to get the full picture of your investment performance -- inclusive of dividends -- you need to understand:

Tracking dividend cash income

Just tracking the cash in the bank account you receive dividends in is a great start, but understanding which investments each dividend payment comes from and how they impact your investment return is an admin nightmare.

Listed companies, Exchange Traded Funds (ETFs), and mutual funds often outsource the responsibility of tracking who owns shares, and who is paid dividends to entities such as stock agents and share registries.

This means that to get an accurate record of dividends received across an investment portfolio, investors will often need to pull together dividend data from stock agent websites, or review all the physical cheques and dividend statements mailed to you for each holding.

This gets even more complicated when you invest internationally in stocks that pay dividends in an overseas currency, and is impacted by the foriegn exchange rate that applies when those dividends are converted to your domestic currency.

Fortunately with a dedicated portfolio tracker like Sharesight you can get on top of this dividend tracking nightmare to understand the impact of dividends on your investment performance. Once your investments are tracked in Sharesight, dividend income and yield is calculated automatically -- regardless of whether the dividend is paid electronically, or via cheque.

With dividend information going back 20 years and updated daily from over 170,000 stocks, ETFs and mutual funds across more than 30 global markets, Sharesight is the ultimate source of dividend and distribution information for investors.

With dividend information going back 20 years and updated daily from over 170,000 stocks, ETFs and mutual funds across more than 30 global markets, Sharesight is the ultimate source of dividend and distribution information for investors.

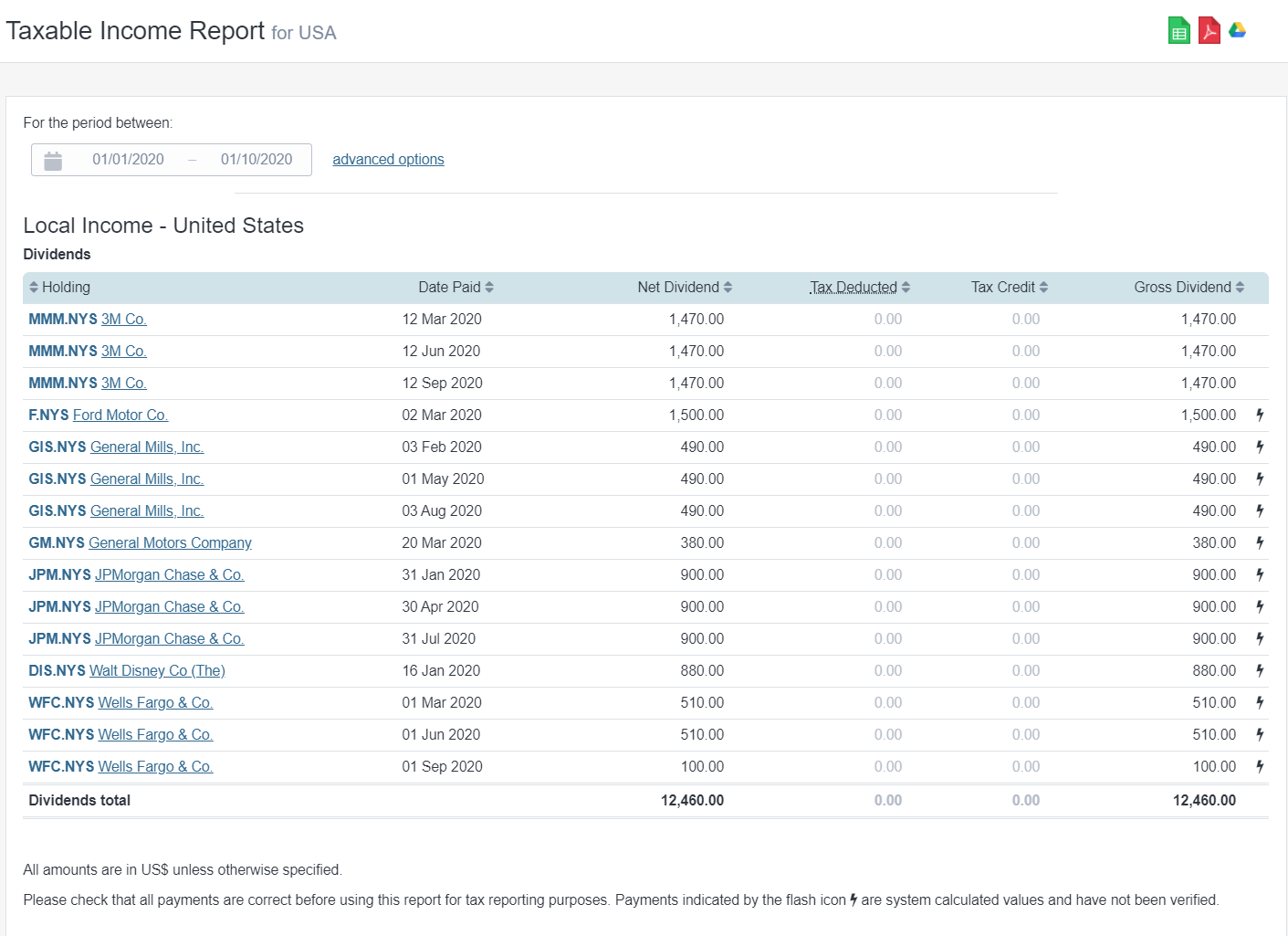

Dividend tax implications

In many countries, dividend income is taxed at the same rate as an investor’s personal income, but this income can also carry varying rates and types of taxation depending on the investment.

For instance, in the US, stocks that pay qualified dividends are taxed at a lower rate depending on the tax bracket, which can be particularly attractive to investors on the maximum income tax rate. Other investments, such as REITs are deemed non-qualified income and attract the same rate as ordinary income.

This means that looking at dividend cheques or the bank account statements won’t help, because you’ll only see the net amount paid. Going to the stock agent for the information needed to calculate dividend tax implications is a good start, but is time intensive logging into multiple stock agent websites or looking through a shoebox filled with pages of dividend statements to compile your portfolio-wide tax picture.

Fortunately, Sharesight receives the same dividend and distribution information announced by companies to stock markets (minus the official statements). This means that all dividends are automatically recorded and can be used to easily calculate your taxable income on these investments.

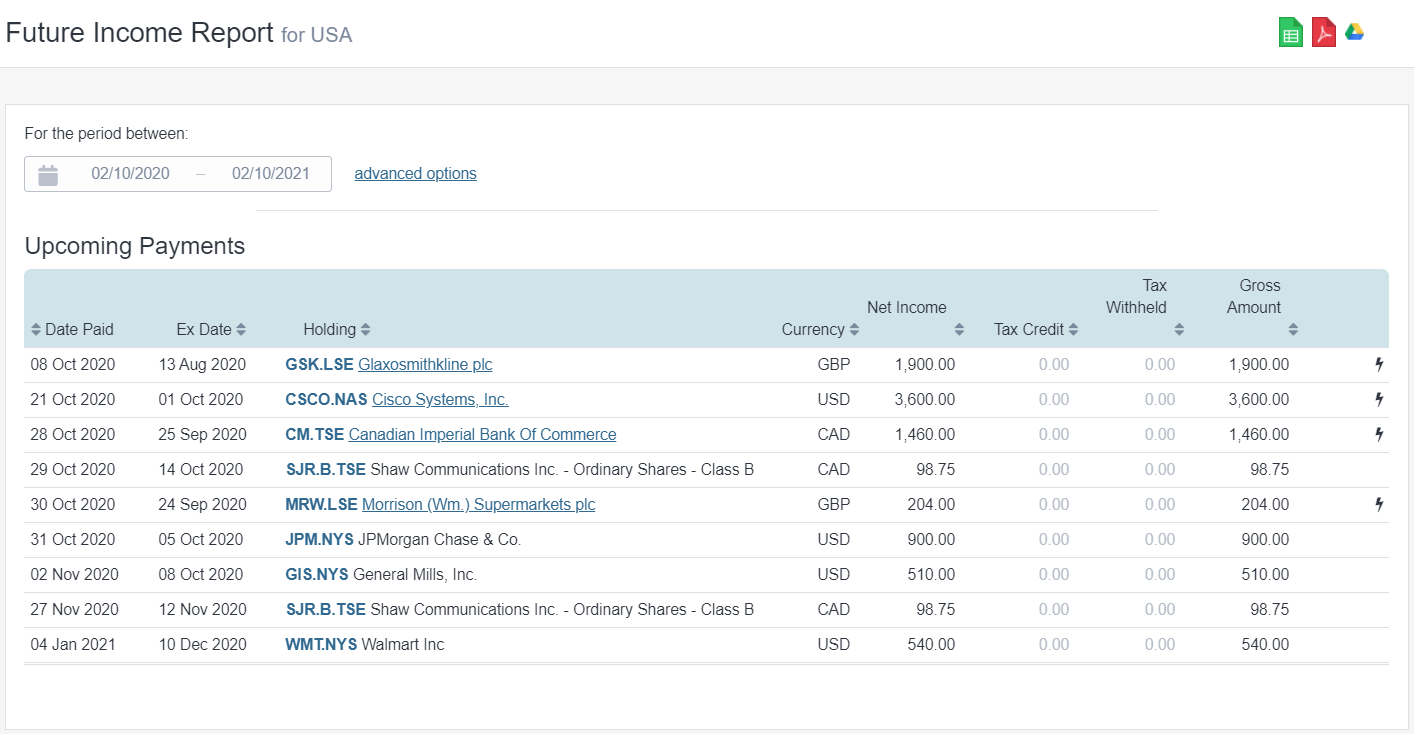

Upcoming dividend income

Knowing the timing and size of upcoming dividends is vital for investors who rely on dividend income to fund their lifestyle, particularly in retirement, so they can adjust their spending in line with expected cash flow to avoid the need to sell investments unnecessarily.

Investors would need to spend hours compiling details of the dividends announced to market for every investment in their portfolio. Fortunately Sharesight’s Future Income Report helps investors see all of the announced dividends (or distributions) for stocks, ETFs and mutual funds in their portfolio, as well as upcoming interest payments from fixed income securities.

Sharesight’s Future income report showing upcoming dividend income

Track the impact of dividends on your investment performance

With Sharesight’s advanced dividend tracking and performance reporting features, investors can access unparalleled insights into their investments at the click of a button.

Sharesight isn’t only for tracking dividends, it’s the complete investment performance tracking and reporting tool, allowing investors to:

-

Track all your investments in one place, including domestic and international stocks, mutual/managed funds, property, foreign currency and even cryptocurrency

-

Run powerful performance reports to calculate your portfolio Performance, Diversity and Contribution Analysis

-

Easily share access of your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a free Sharesight account and start tracking the impact of dividends on your investment performance (and tax) today!

FURTHER READING

IMPORTANT DISCLAIMER: Sharesight does not provide tax or investment advice. The buying of shares can be complex and varies per individual. You should seek tax and investment advice specific to your situation before acting on any of the information in this article.

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.