5 ways to get the most out of Sharesight's taxable income report

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Designed to help individual investors complete their tax return, Sharesight’s taxable income report lists all dividend, distribution and interest payments received during a selected period. This makes it a convenient way for investors to keep detailed records of the income earned from their investments. The report includes a range of useful features for global investors, such as the ability to select custom date ranges, split income into different components and edit payouts, as well as some more advanced features.

To find out more about how Sharesight’s taxable income report helps global investors stay on top of their investment income, keep reading.

1. Custom date ranges

The taxable income report allows investors to view all income for their investments over any specified period of time. For example, users may wish to view their income over the previous financial year for tax reporting purposes, or over a longer period to track their long-term dividend performance.

Users can select a period of their choice to assess their investment income.

2. Split income into different components

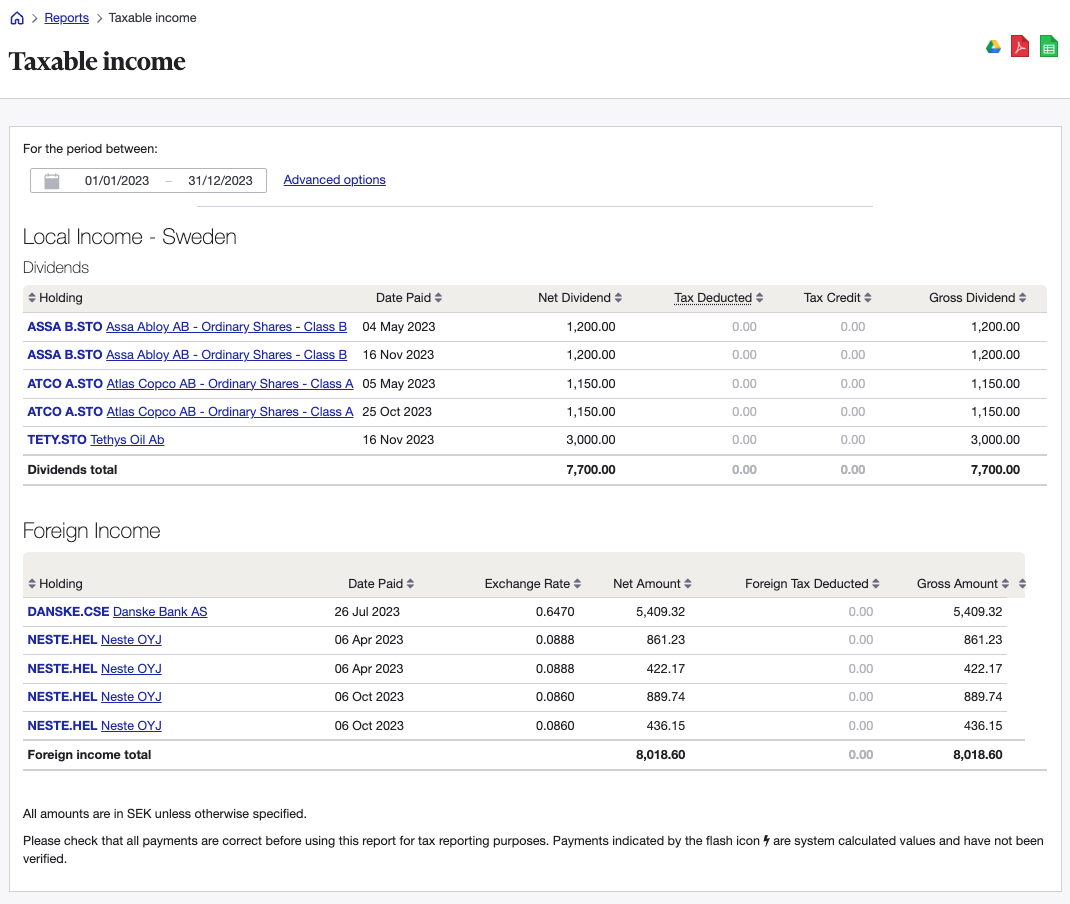

The report splits investment income into Local Income and Foreign Income. This is done to mimic tax reporting, where (depending on the country) these income categories can be taxed at different rates, and therefore have different components that need to be recorded.

An example of a Swedish portfolio with local and foreign investment income.

3. Advanced options

Show comments

By enabling this feature you can display any comments associated with a payout. For example, if you added comments to flag any payouts that need verification with your accountant, these will be visible on the taxable income report. If a user has not added any comments to a holding, enabling comments will display the company’s dividend price per share, which is the default comment on all payouts. Comments will also be visible if you choose to export the report into another format such as a spreadsheet.

A comment displaying the dividend price per share for an individual payout.

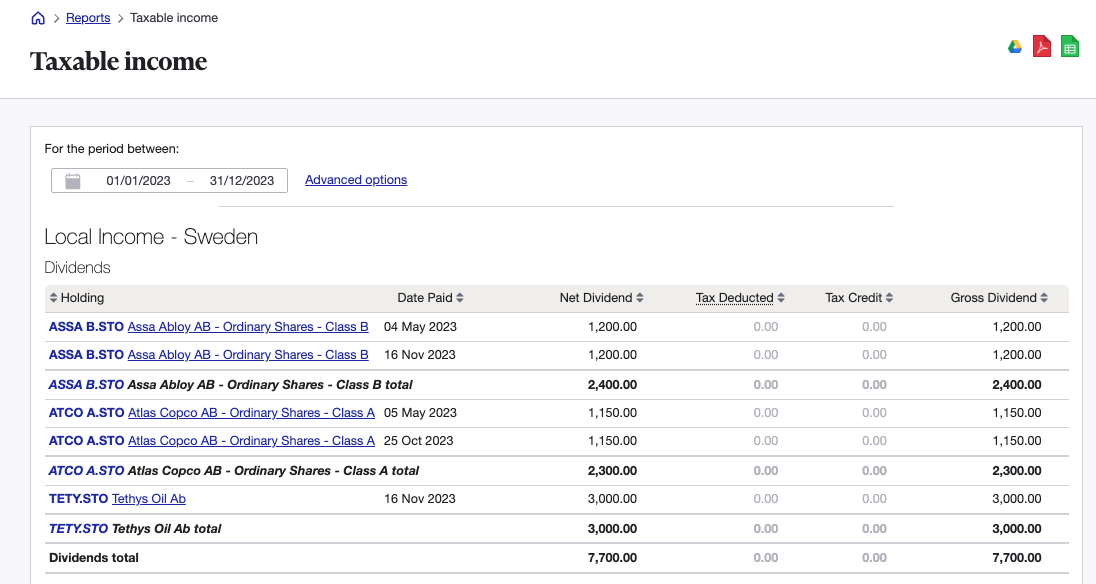

Show holding totals

This feature provides a more detailed view of your investment income by displaying the dividend or distribution values across all payouts during the selected period for a single investment. This allows Sharesight users to clearly see how each payout has contributed to their income for the investments in their portfolio.

An example of a portfolio with payouts that add up to an annual distribution amount of SEK7700.

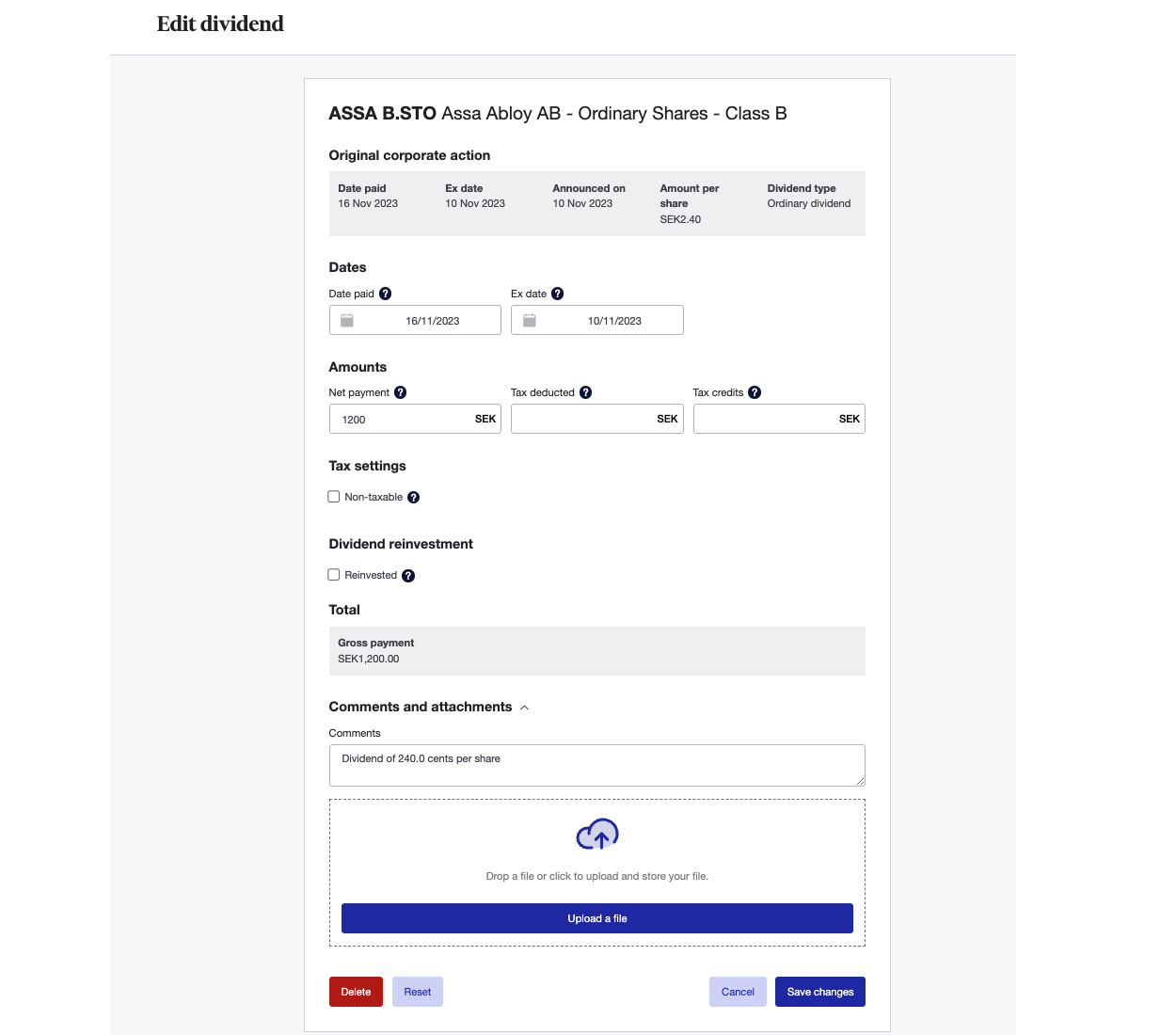

4. Edit payouts directly

By clicking on a payout, Sharesight users can directly edit the individual components within that payout. Depending on the tax residency of the user, as well as the classification of the payout, components may include values such as tax deducted, tax credit, franking credits, capital gains tax and foreign tax. If a user finds that any of these components are listed incorrectly, it is a quick and easy process to update the values and ensure all records are accurate.

Sharesight users can easily verify and edit the individual components of payouts in their taxable income report.

5. Export to a spreadsheet or PDF

Another handy feature of the taxable income report is the ability to export it to Google Sheets or an XLS or PDF file. This is useful if you want to view the report in another format or share it with your accountant for further modifications.

Need more information?

To see the taxable income report in action, watch our video below:

Sharesight – the perfect tool for global investors

Sharesight was built for the needs of global investors like you. Not only is it a helpful tool for tax reporting, but with Sharesight you can:

-

Track the performance of all of your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation, drawdown risk, exposure and future income (upcoming dividends)

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a free Sharesight account and start tracking your investments (and tax) today.

FURTHER READING

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.