Taxable income report for Australian investors

Disclaimer: The below article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

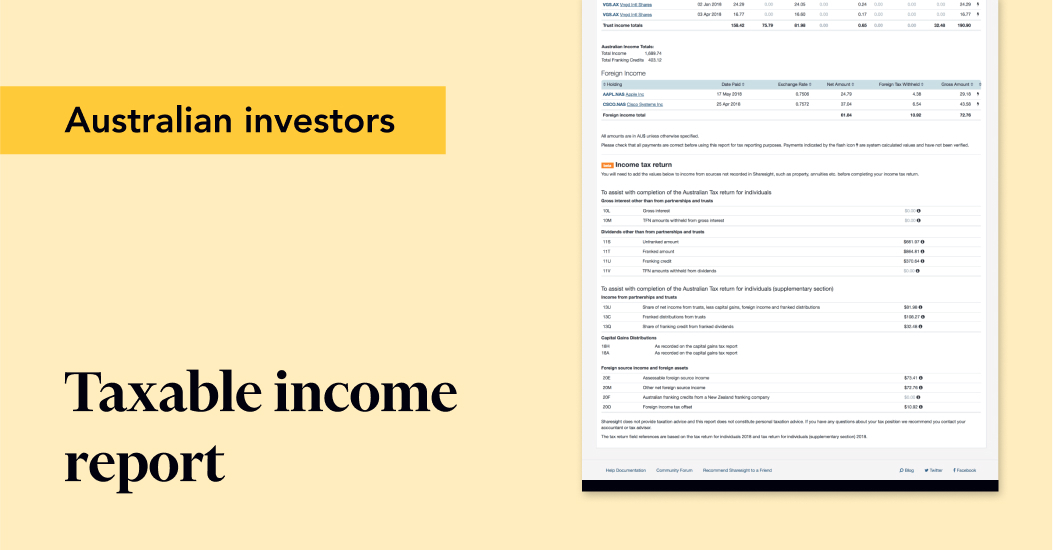

If you're an Australian investor, it's easy to calculate your investment income with Sharesight’s taxable income report. Designed to help you complete your tax return according to ATO requirements, the report provides a breakdown of a portfolio’s dividend, distribution and interest payments over any selected period. To learn more about how the taxable income report can help you with your tax return, keep reading.

See all your taxable investment income in one place

If you hold a combination of local and foreign assets, you will benefit from the ability to see all your taxable income in one place, broken down by local (trust and non-trust) and foreign income. This breakdown includes all the components you need to file your Australian tax return, such as franking credits, foreign income tax, TFN withholding tax and exchange rates.

Record your AMIT components

As can be seen in the screenshot below, you will be prompted to enter your Annual Tax Statement Components for your trust holdings. Sharesight receives this data from registries and fund managers for the majority of Australian ETFs, which means the cost base for these ETFs is automatically adjusted and recorded in your portfolio, without the need to manually update these components using Sharesight’s pro-rata form. Please note that you are still advised to check these values against your AMMA statement.

Note: ETF distribution component information is typically made available in September following the end of the financial year.

If ETF distribution component data is not available for your ETF, simply click into the Annual Tax Statement Components prompt to bring up the pro-rata form. Once you enter the values from your AMMA Statement, Sharesight will automatically pro-rate the components across all the distributions you received for the financial year.

Sharesight’s taxable income report breaks down your portfolio income by local and foreign income, including all the relevant tax components.

Prepare your tax return with ease

At the bottom of the taxable income report, you will find an income tax return section which provides field references to the relevant sections on the Australian Income Tax Return for Individuals and Income Tax Return for Individuals (supplementary section), as well as the totals required for the Income Tax Return based on non-trust and trust income.

This report feature is available for any portfolio with:

-

A tax residency set to "Australia" and;

-

A tax entity type set to "Individual or Trust" (although it’s only relevant to individual tax entities).

The income tax return feature is designed to reflect the portfolio information you are required to include in your ATO tax return.

This is a useful feature that gives you a summary of the portfolio information you need to complete your taxes. However, you must also remember to include the value of any income from sources not recorded in Sharesight before completing your tax return.

Note: Investors are always advised to consult their accountant and/or confirm the accuracy of their investment data before using this information for tax purposes.

Easily share tax information with your accountant

Another convenient feature of Sharesight’s taxable income report is the ability to export it to a Google Sheet, PDF or Excel file. This makes it easy to share the report with your accountant at tax time, which may help save you time and money on your taxes. You may also wish to securely share your full Sharesight portfolio with your accountant, which will give them real-time access to the portfolio, with the ability to see holdings, dividends, corporate actions and any trades that are made.

Want more information on the taxable income report?

For more information and a hands-on look at the report, see our instructional video here:

Start tracking your performance (and tax) with Sharesight

Join thousands of Australian investors already using Sharesight to manage their investment portfolios. Sign up for Sharesight so you can:

-

Automatically track your dividend and distribution income from stocks, ETFs, LICs and mutual/managed Funds – including the value of franking credits

-

Use the dividend reinvestment plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful tax reports to calculate your dividend income with the taxable income report

-

Plus calculate your CGT obligations with Sharesight's Australian capital gains tax report and unrealised capital gains tax report

To get started for FREE, simply sign up, import your holdings and watch as dividends and prices are automatically updated. If you decide to upgrade, you’ll unlock advanced features and everything you need to run your tax reports and gain unparalleled insights into your portfolio performance throughout the year.

Plus, as an Australian tax resident, you can save even more by claiming your Sharesight subscription fees on your tax return1.

FURTHER READING

1 If you derive income from the share market, your Sharesight subscription may be tax deductible. Check with your accountant for details.

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.