Compound annual growth rate (CAGR) calculator

Calculate the true total return of your investments over time.

Compound annual growth rate

25.89%

25.89%

Total growth

900.00%

900.00%

What is CAGR?

The compound annual growth rate (CAGR) is the rate of return required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each year of the investment’s lifespan.

Why use CAGR?

Unlike a simple average, CAGR provides a more accurate picture of performance because it accounts for the effect of compounding. It "smooths out" the year-to-year volatility of an investment to give you a single, easy-to-understand annual growth figure.

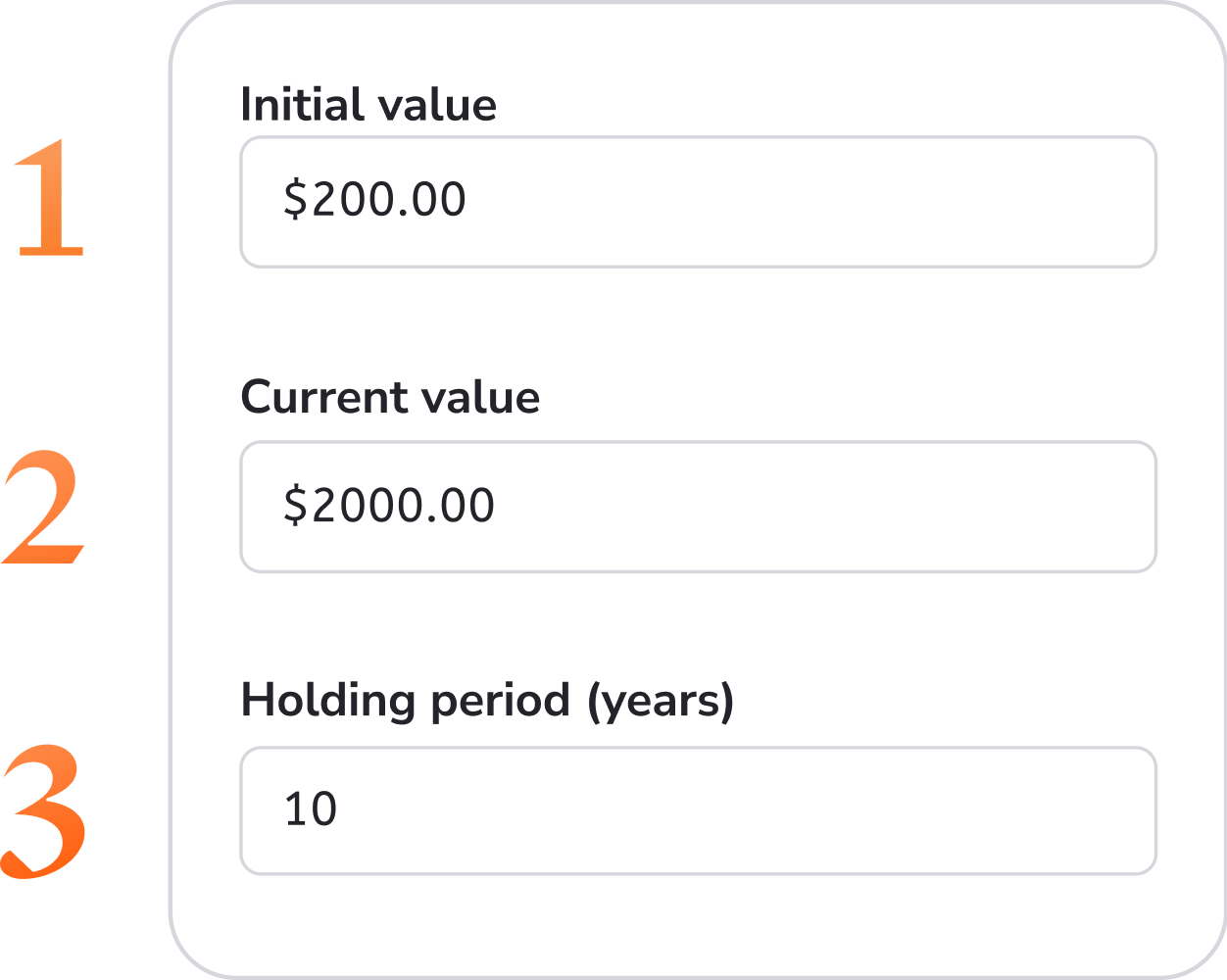

How to use the calculator?

1. Enter beginning value: Input the starting value of your investment at the beginning beginning of the period.

2. Enter ending value: Input the final value of your investment at the end of the period.

3. Enter time period: Add the total number of years the investment has been held.

Your investment’s compound annual growth rate (CAGR) will be calculated instantly.

Get more insights with Sharesight

Unlike a simple average, CAGR provides a more accurate picture of performance because it accounts for the effect of compounding. It "smooths out" the year-to-year volatility of an investment to give you a single, easy-to-understand annual growth figure.

Precision tools for performance, tax and rebalancing

Get the full picture of your performance with calculations that factor in capital gains, dividends, fees and foreign currency. Then dive deeper with reports to analyse your exposure, identify risk and generate tax-ready CGT reports.

Multi-portfolio support

Exposure reporting with ETF X-ray

See drawdown and risk insights

Performance tracking including dividends

Easy accountant collaboration

CGT & unrealised CGT reporting

Plans & Pricing

Start by tracking up to 10 holdings for free! Then upgrade to a premium plan at any time to track additional holdings or portfolios, and unlock advanced features. And as a bonus, your Sharesight subscription may be tax deductible. *

1 Portfolio

10 Holdings

1 Custom group

Starter

For simple reporting and portfolio management

£6

GBP per month

billed annually

£8 GBP billed monthly

1 Portfolio

30 Holdings

3 Custom groups

Standard

For advanced insights across multiple portfolios

£14

GBP per month

billed annually

£18.67 GBP billed monthly

4 Portfolios

Unlimited Holdings

5 Custom groups

Premium

For professional-grade reporting and support

£21

GBP per month

billed annually

£28 GBP billed monthly

10 Portfolios

Unlimited Holdings

10 Custom groups

Don't just take our word for it

Over 500,000+ investors track their investments with Sharesight. Here’s what a few of them have to say: