Sharesight adds 17,000 OTC equities and NYSE American market

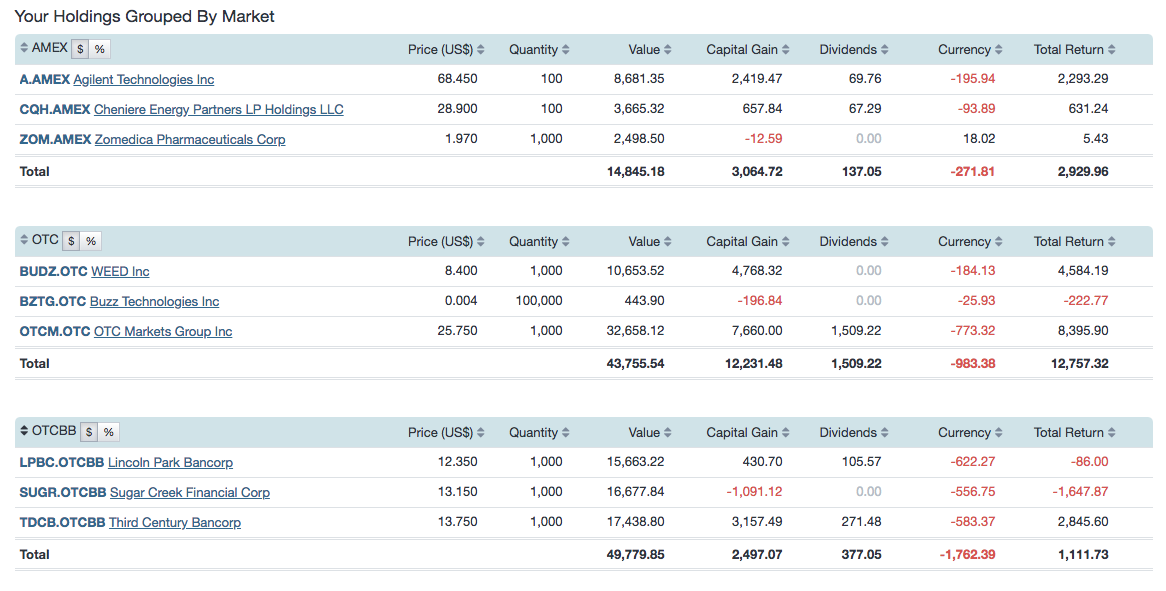

Today we’re pleased to announce the addition of 3 more global stock markets to Sharesight - adding historical, daily and intraday prices for more than 17,000 Over-The-Counter (OTC) equities and the third largest stock exchange in the USA - the NYSE American market (AMEX). With support for more than 40 global markets, including leading US markets, Sharesight is the ultimate place for investors to track all of their investments in one place.

What is the NYSE American (AMEX)?

The NYSE American exchange (also known as the NYSE MKT), previously the ‘American Stock Exchange’ (AMEX) is the third largest stock exchange in the USA. It handles about 10% of all securities traded in the USA and caters for growing companies, typically small caps as well as ETFs.

NYSE American support adds nearly 400 additional trackable instruments to Sharesight. Sharesight also supports 15 minute delayed pricing for the NYSE American market, giving investors the up-to-date price and performance information they need to make better investment decisions. You can find NYSE American instruments within Sharesight by searching for the ‘AMEX’ market code.

What are Over-The-Counter (OTC) equities?

“Over-The-Counter” equities are typically stocks, though they can include derivatives and debt securities, as well as American Depositary Receipts (ADRs) that trade via dealer networks instead of on centralised exchanges (such as the NYSE). Because OTC equities don’t usually meet the listing requirements of centralised exchanges, OTC equities are also known as unlisted stock.

Stocks traded Over-The-Counter tend to be those of smaller companies (‘penny stocks’) with less liquidity than stocks listed on the major exchanges.

Other OTC (OTC)

The Other OTC Issues market (sometimes known as the Pink Sheets, or OTCMKTS if you’re coming from Google Finance) tracks around 17,000 Over-The-Counter equities. If you’re an investor in OTC equities it’s very likely that you will find them here. When adding a holding for this market within Sharesight, you can search using the ‘OTC’ market code.

OTC Bulletin Board (OTCBB)

The Over-The-Counter Bulletin Board is a market operated by the Financial Industry Regulatory Authority (FINRA), and it currently tracks around 50 stocks. Companies listed on the OTCBB are required to report (current with SEC filings) but have no size, governance or other requirements. You can search for these holdings within Sharesight using the ‘OTCBB’ market code.

How to track the NYSE American, OTCBB, and OTC Other markets

- Sign-up for a FREE Sharesight account.

- Add your holdings to your portfolio(s).

- Sharesight converts the prices and valuations of your holdings from their listed market to your portfolio’s base currency. It also automatically calculates any currency fluctuations on a daily basis (or on a 15 minute delayed basis for AMEX) and backfills past dividends (and continues to add new ones as they are announced).

Already tracking these holdings in Sharesight?

If you are currently tracking an AMEX or OTC holding using Sharesight’s custom investment feature, you can merge it with its appropriate instrument, without losing any data.

FURTHER READING

Announcing the Sharesight Fintech Scholarship's 2024 winner

We are pleased to announce the 2024 winner of the Sharesight Fintech Scholarship, Temiremi Egwuenu, who is studying Applied Finance at Macquarie University.

Effortlessly track clients’ trades with Sharesight and Desktop Broker

Sharesight has integrated with Desktop Broker, allowing advisers to have their clients’ trading data automatically synced to Sharesight’s portfolio tracker.

Red flags: When should you avoid investing in an asset?

This article explores some of the “red flags” you should look out for when considering an investment for your portfolio.