2026 market outlook: Expert insights on risks, rates and opportunities

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

The past five years have been a wild ride for markets, with the COVID-19 pandemic unleashing a domino effect that continues to shape markets and economies across the globe. We’ve witnessed the spectacular rise and fall of meme stocks, tech stocks and cryptocurrencies, alongside record prices for gold and silver. At the same time, geopolitical tensions have intensified, economies have grappled with inflation and the labour force has been disrupted by rapid advancements in AI technology. So far, to say the 2020s have been volatile would be an understatement.

Predicting the future is impossible, but we aim to offer the next best thing, speaking with industry experts about their expectations for markets in 2026 — from inflation and interest rates to potential opportunities in local and overseas markets, the AI bubble and more.

Global market outlook

If you’re a global equities investor, 2026 could present some attractive opportunities, but it’s going to be extremely important to stay up-to-date with the latest headlines, especially where the US is concerned.

“For at least the first half of 2026, we think that the outlook for global equities is favourable,” says Damien Boey, Portfolio Strategist at Wilsons Asset Management.

“[This is] because there is a cyclical upturn in global growth coming after the end of the US government shutdown, the Fed is cutting rates and injecting liquidity into the system, and leading indicators of inflation are peaking, giving the Fed some comfort in the near-term that it can credibly cut.”

The question remains however, how long it will be until inflation becomes an issue again. According to Boey, it’s a matter of whether the Fed will be able to lower rates without compromising on inflation over the long term and driving up bond yields. At the same time, inflation could also be re-ignited by rising geopolitical tensions and de-globalisation.

This sentiment is echoed by Rob Talevski, CEO of Webull, as well as Henry Jennings, Senior Investment Analyst and Portfolio Manager at Marcus Today.

“It will be a year of change at the US Federal Reserve,” says Jennings.

“Whoever takes the helm from May will likely want to drive interest rates lower – even to the point of running the US economy hot and tolerating higher inflation. That could be a concern for bond markets, particularly with prospective US tax cuts and the mid-term elections in late 2026.”

“Inflation will continue to be a key global problem throughout 2026, potentially leading to some level of fiscal contraction with weaker consumer confidence to remain a thorn throughout the majority of 2026,” adds Talevski.

The Australian market

While the RBA continued to hold interest rates throughout Q4 2025, rising inflation has put potential rate rises back on the agenda.

“We have seen the Labor government come under fire for loose fiscal spending with little gain in economic output, with swinging quarterly employment numbers continuing to weigh on RBA decision making,” notes Talevski.

“We see a larger level of fiscal contraction at home than abroad, with a possible rate increase in Q2 of 2026.”

Boey adds that global investors appear to be re-allocating capital out of Australian safe-haven assets, back into US and Chinese cyclical assets — debunking “the end of US exceptionalism” and recognising that Chinese authorities are serious about their intentions to support the economy.

“History suggests that in a rising rates environment, resources stocks tend to outperform more defensive exposures,” he says.

“We expect history to rhyme, if not repeat, noting that banks have been the Australian safe-haven asset of choice in early 2025, but are now caught up in a material unwinding of global positioning.”

Overall, the outlook for Australian equities in 2026 appears positive.

“Regarding Australian stocks specifically, our ASX coverage is looking much more reasonably priced after the recent selloff,” says Lochlan Halloway, Equity Market Strategist at Morningstar.

“Banks remain expensive (the big four trade at a 30% premium to fair value), but we see compelling opportunities in energy, healthcare, the consumer sectors, and parts of the small-cap universe. A fairly-valued market should deliver something like the long-run average return of around 9% annually. That's a far cry from the heady returns of 2023 and 2024, but a welcome improvement on the starting point investors faced just a few months ago.”

Opportunities for investors

Debate around the AI bubble shows little signs of fading in 2026, as investor focus broadens from technology valuations to the energy and commodity inputs required to support further growth.

“It’s shaping up to be an interesting year for global markets,” says Jennings.

“We’ll continue to question the AI bubble, the rates of return on the massive amounts of capital being poured into AI, and where all the energy to power it will come from. Will retail and business users actually pay for the privilege of having an AI assistant or app do their work?”

Talevski also notes the connection between the AI boom and increased energy demand.

“With the ever-increasing AI boom, demand — and the implications for energy sovereignty — will continue to play out across 2026, particularly among major economic and military powers such as the United States and China. This is especially evident in raw materials associated with batteries and advanced technologies supporting AI and military applications,” he says.

“I believe there will be significant opportunity for investors in both Australian and overseas capital markets in companies generating energy (as well as providing associated technologies), and those involved in mining key raw materials such as uranium, lithium and rare minerals.”

“We think that the macro backdrop is generally favourable for commodities, with the caveat that oil is a geopolitically charged exposure that may not behave in a linear or predictable way,” adds Boey.

“It is worth highlighting that Chinese funding costs are extremely low, and that capital outflows from China are not the constraint on growth that they once were. Consequently, Chinese authorities have a free option to stimulate the economy, and if they do, we expect commodities demand to be well supported. Recent rhetoric suggests that China does indeed have intentions to pursue stronger growth, albeit led by technology and power infrastructure rather than property.”

It is also expected that investors will continue to flock to cash and yield securities in 2026.

“I feel we’ll see strong levels of inflows in traditional yield securities such as bonds and cash products throughout 2026, with gold and other precious metals continuing their upward trajectory, as more and more investors become gun shy from persisting volatility in both local and global markets,” says Talevski.

“US-led agitation with key economic powers will continue to play out throughout 2026, which will continue to impact global markets through sustained volatility,” he adds.

Jennings agrees, suggesting that investors “embrace volatility, watch for signs of valuation extremes and recognise there are more themes and markets to make money in than just the US”.

What to watch out for

With that being said, investors are encouraged to prepare, not predict. In terms of portfolio construction, one key risk to watch this year is concentration risk.

“The 10 largest US stocks now account for roughly 35% of total US market capitalisation, up from just 18% a decade ago,” notes Halloway.

“When a handful of stocks does most of the heavy lifting, portfolios tied to broad benchmarks can become less diversified than they appear, and more vulnerable to sentiment reversals. Diversification remains the only ‘free lunch’ in investing, and in an environment where a few names set the tone for the entire market, maintaining exposure across sectors, regions and styles is one of the few dependable ways to manage risk.”

Turn uncertainty into insight with Sharesight

If you’re not already tracking your investment portfolio with Sharesight, what are you waiting for? Join hundreds of thousands of global investors using Sharesight to get the deep performance insights they need to navigate markets in 2026.

Sign up for a free account to get started tracking your investments today.

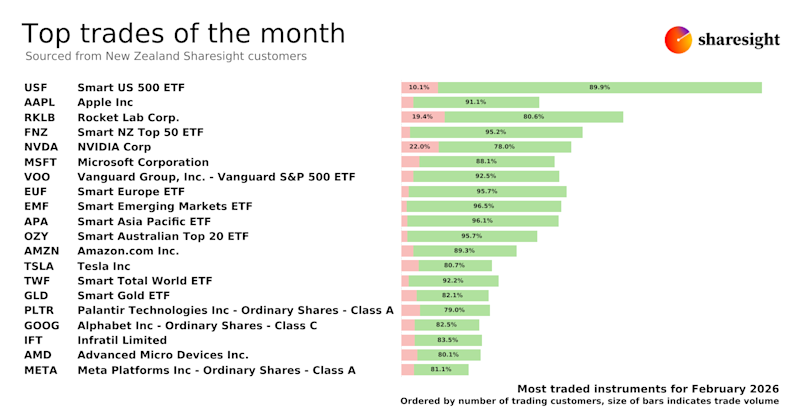

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

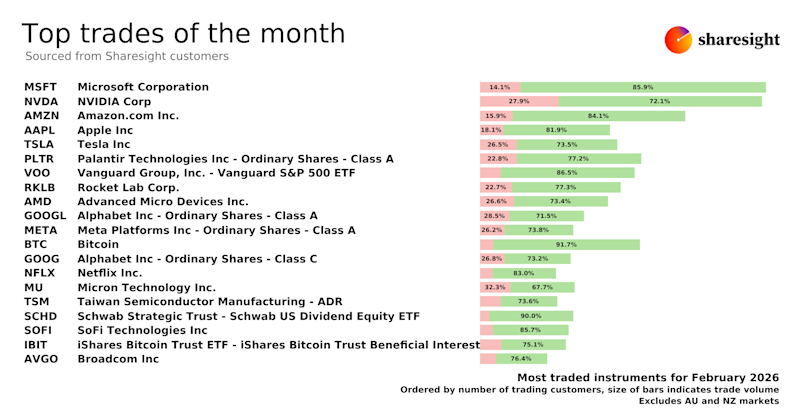

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

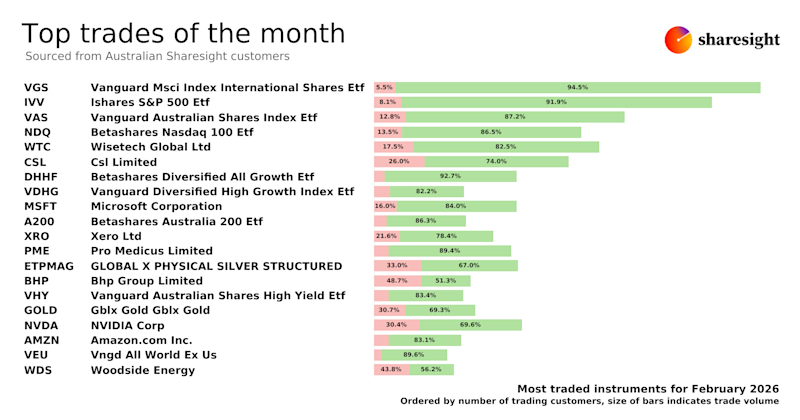

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.