The accountant's guide to simplifying tax complexity for investors

As technology adoption grows in the investing space, so does the demand for innovative and tech-forward accountants.

According to Sharesight data, the average premium user has three different portfolios with 32 holdings and 54 trades per portfolio, with these trades being executed through two or more brokers. All of this creates layers of complexity for investors, and in turn, for the accountants who will inevitably be preparing their tax returns.

With this in mind, we have developed The accountant’s guide to simplifying tax complexity for investors.

In this whitepaper, we discuss:

-

The challenges accountants face when preparing tax returns for investors;

-

The shortcomings of spreadsheets and manual data entry; and

-

How accountants can focus on higher revenue-generating outcomes while improving client retention and satisfaction.

Download the whitepaper

FURTHER READING

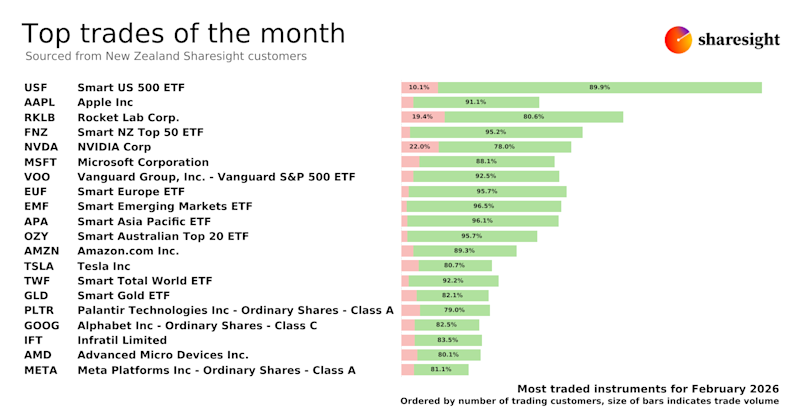

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

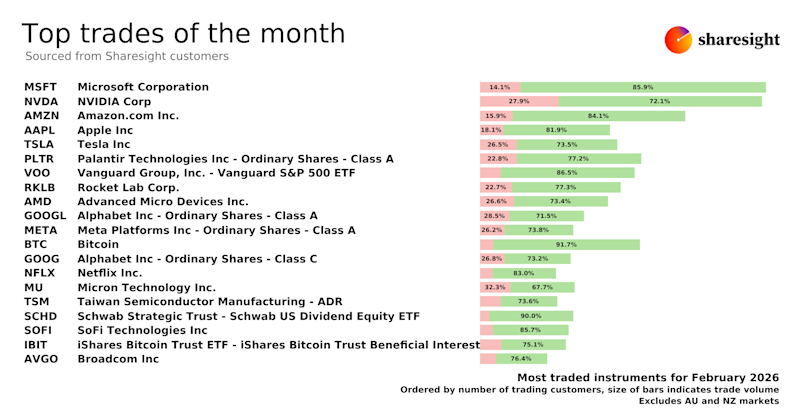

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

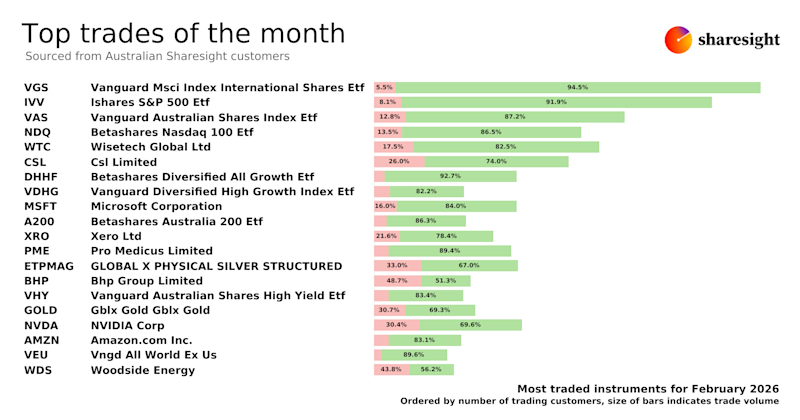

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.