Why alternative investments are the key to building a diverse portfolio

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

In times of market volatility, investors of all experience levels are faced with the question of how to build a strong portfolio. In many cases, the answer to this question is diversification, whether it is through investing in various assets within a single class, investing across markets or across different asset classes. In this blog, NZ real investment platform Goldie discusses various methods of diversification and the crucial role that alternative investments have to play.

What is a diversified portfolio?

This looks different for each investor, but typically there are three main strategies that investors use to diversify and strengthen their portfolio.

Sector diversification

Investing in a diverse range of assets within a particular sector can provide exposure to a variety of industries that may be affected by different market forces, thus reducing your portfolio risk. The short cut? Investing in funds that have already done it, like an index-tracking ETF.

Market diversification

If a country is affected by forces that impact a lot of industries, investors can take a hit if their portfolio is predominantly invested in one market. Access to global markets is common across most trading platforms today, making it easier than ever for investors to avoid market concentration risk. It is worth noting however that many countries have very different rules and regulations that could affect your investments (and your tax).

Asset class diversification

In terms of portfolio diversification, diversifying your asset classes is the final tier, with stocks, cash, bonds and alternatives being some of the most common options. Exposure to various asset classes can mean your portfolio has a number of different investments with a low or negative correlation. This means that when one or more investments are moving in one direction, others will typically move in the opposite direction, thus creating less risk in your portfolio.

What are alternative investments?

Alternative investments are simply any financial investments that fall outside the traditional asset classes of stocks, bonds and cash. Some examples include:

- Real estate

- Debt investments

- Commodities

- Precious metals

- Collectibles

- Hedge funds

Why alternative investments?

Alternative investments can be a great addition to any portfolio, as they often have a low or negative correlation with more traditional asset classes, and provide a diversification option that can help reduce the risk of dramatic loss. Like most investments, there are some key things that should be considered before investing.

- Risk and threats: Alternatives can provide varying amounts of risk and each should be considered in the context of individual portfolios and personal situations.

- Time horizon: This is the amount of time you intend to hold the specific investment. Holding for a longer period, for example, can be an effective way to reduce risk through smoothing shorter term fluctuations. Liquidity is also important to think about when considering the time horizon for an alternative asset, as some alternatives may not have the same liquidity as traditional investments owing to the structures or markets in this space.

- Markets/industries: Much like traditional investments, selecting alternatives from across a number of markets and industries can help diversify a portfolio. Some options are uniform across markets, such as commodities, whereas others like real estate are more likely to be impacted by market risks.

Gold as an alternative asset

Gold is a highly liquid asset which historically has preserved its value over time. It has the potential to remain strong in difficult financial environments which is why Gold is an attractive investment for many and leads many investors to consider Gold as an alternative asset.

Introducing Goldie

Goldie is Aotearoa’s first investment platform that lets you invest in small shares of real things – starting with gold. Goldie was built with the help of Kiwi developer AbleTech to provide everyday investors with access to asset classes that may not have been accessible before. They focus on REAL assets, like gold, that investors can get up close and personal with. They leverage fractionalisation through platform to offer investment in real gold up to 57% cheaper than current physical options on the market.

Get started with Sharesight and Goldie

If you’re ready to get started investing in real assets, you can sign up for a Goldie account to get $20 off your first purchase.

And if you’re not already using Sharesight, sign up for a FREE account to track the performance of your Goldie investments alongside the rest of your assets such as stocks, ETFs, funds, cash and even cryptocurrency.

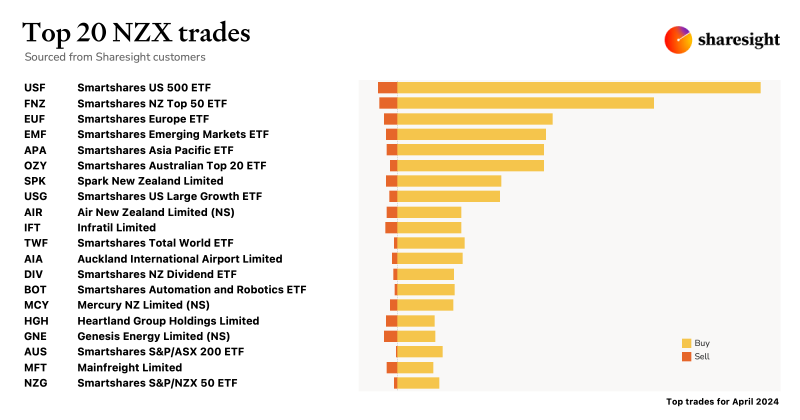

Top 20 NZX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX.

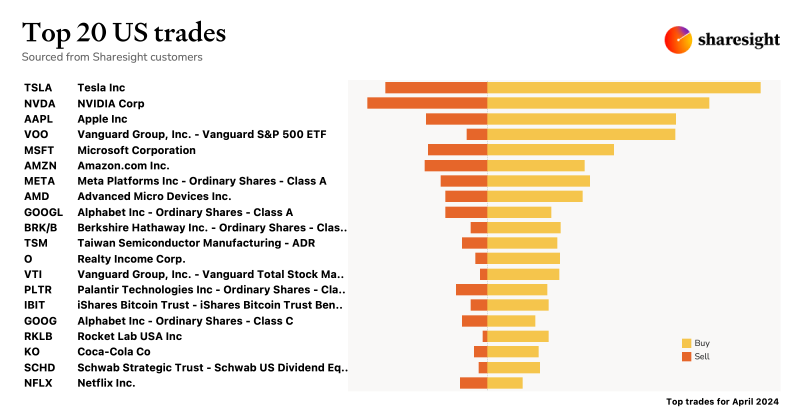

Top 20 trades in US stocks by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks.

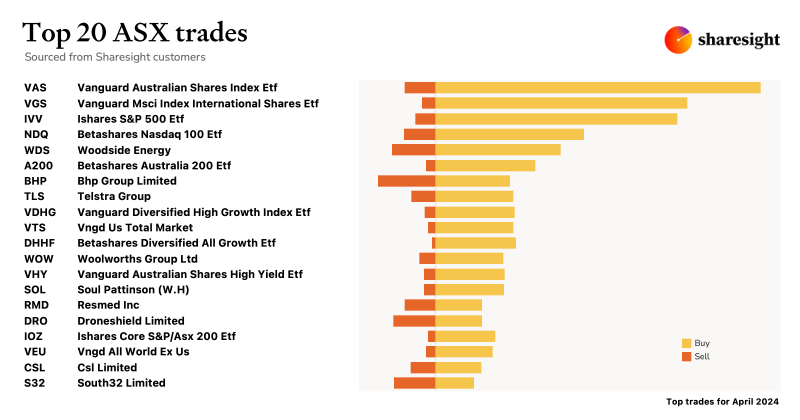

Top 20 ASX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX.