Diversify or bust?

In my last blog I suggested that a lot is made of the merits of diversification without any real analysis of the costs and benefits. There often seems to be an assumption that more is better when it comes to diversification. I suggested that beyond a certain point, diversification is likely to impede, rather than contribute to, superior returns.

Investors who place a significant proportion of their savings in shares are often more diversified than they think. They should not allow themselves to be railroaded or frightened into diluting their returns by diversifying further into lower yielding assets.

For one thing, if they have followed the old adage of getting rid of their mortgage before they start saving seriously, they are likely to already have a significant investment in residential real estate.

Secondly, shares in themselves are an excellent way of diversifying across a range of different companies operating in widely varying sectors such as infrastructure, manufacturing, retail, tourism, mining, telecommunications etc. It is easy to invest in Australian as well as NZ shares so you get some country diversification too.

As an aside, many people have lost money in several different finance companies recently. No doubt they were heeding the call to diversify when, in reality, they were doing the opposite – investing in similar companies all in the same sector.

So my contention is that people with a freehold home who invest a significant proportion of their savings in NZ & Australian shares can be adequately diversified. And they are likely to end up with a significantly larger retirement nest egg than if they had diversified into other, historically lower-yielding, assets. The only major rider is to only invest funds in shares that you are confident you will not need in the short or medium term – say within 7-10 years. That way you minimise the risk that you will have to sell your shares before they have been able to generate the higher returns you want.

As a final word on diversification let’s say that 10 years ago you decided to diversify away from shares by placing some funds in an ANZ term deposit (unsecured). I’m not sure what your average interest rate over the last 10 years would have been – let’s be generous and say 7% p.a. What I can tell you (by checking it out on Sharesight) is that if you had bought ANZ shares 10 years ago instead of making that term deposit, your return would have been 25.23% p.a!

Makes you think doesn’t it?

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

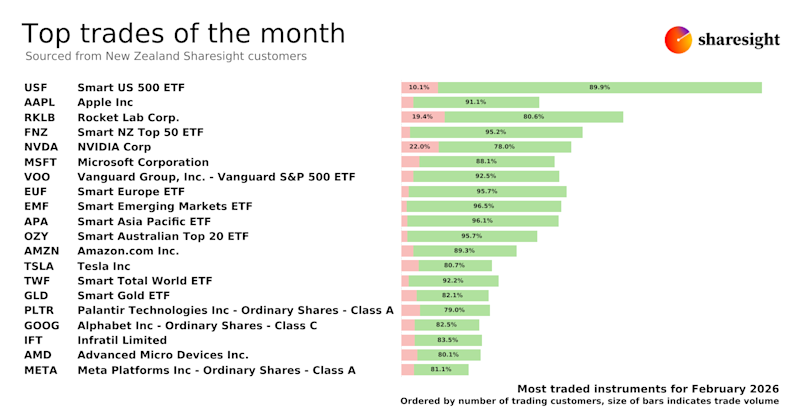

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

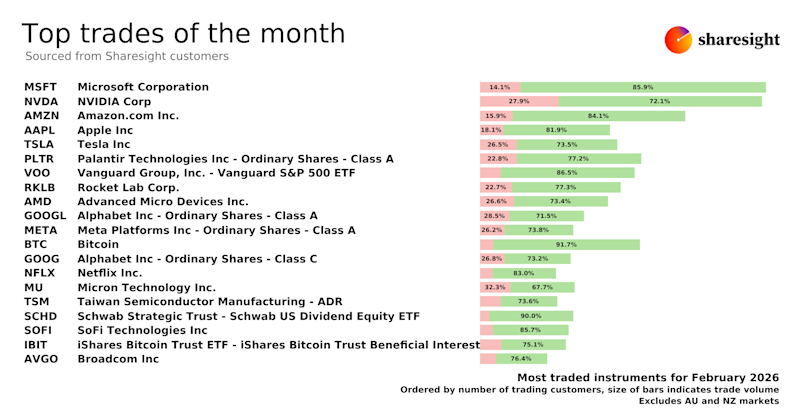

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

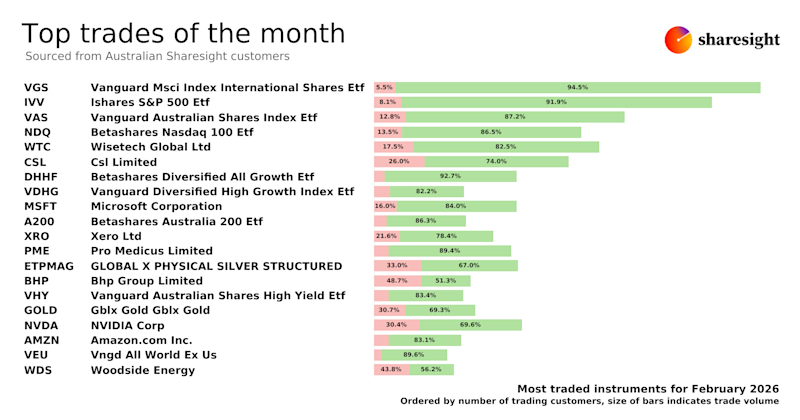

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.