Track your dividend income with Sharesight’s income calendar

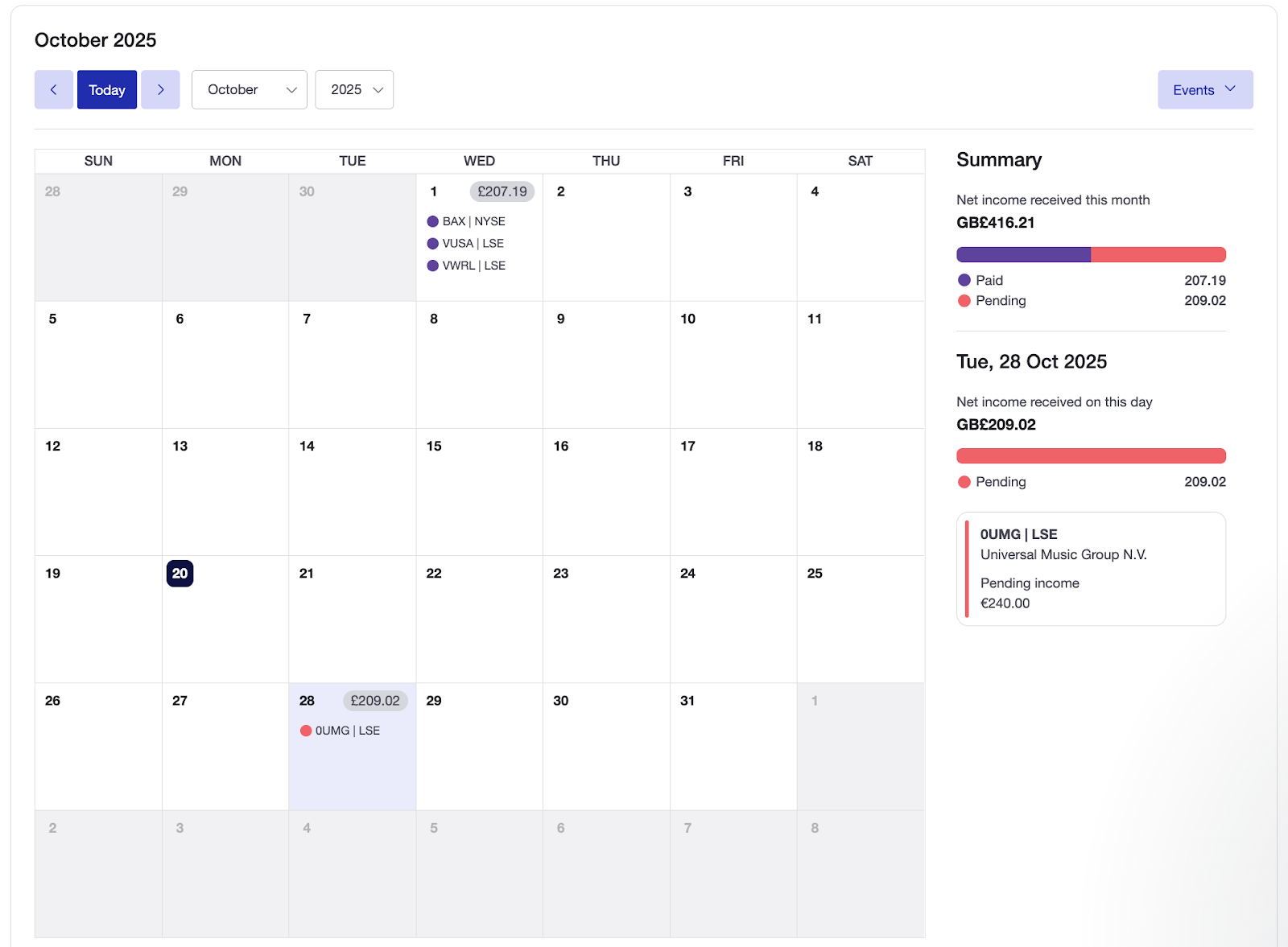

If you’re invested in dividend-paying assets, Sharesight’s income calendar is an easy way to see when and how much income you’ll receive — all clearly laid out in a calendar view. The calendar allows you to monitor any upcoming dividend income (including forecasted income), plus look back at income that’s already been paid. It’s a convenient visual summary that complements the detailed insights available through Sharesight’s future income report and the individual pages for each investment.

Keep reading to learn more about how the calendar works and how you can use it in your investing strategy.

What you can do with the income calendar

Sharesight’s income calendar gives you a clear, intuitive date-ordered view of your dividend payments. It displays the exact date, amount and payment status for each income event, along with a running summary of your total daily and monthly income. Simply click on a transaction to review or confirm payout details, and use flexible filters to focus on what matters most — whether that’s paid, pending, announced or estimated dividends (forecasted up to three years into the future).

You can also filter your calendar by payment status (including estimates) to help you plan and budget with confidence. Plus, you can access the calendar from your consolidated views to see all your income across multiple portfolios in one place, making it easier to manage dividend income across your portfolio.

Note: The calendar is available to Sharesight users on standard, premium and business plans.

While the future income report delivers an in-depth breakdown of all paid, pending, announced or estimated dividend payments, the income calendar makes it easy to visualise your income timeline and see upcoming payments at a glance. For a closer look at dividend activity for a specific investment, you can also navigate to your portfolio’s Overview page and select the Trades & income tab. There, you’ll find a detailed view of each payment, which is useful for both portfolio management and tax planning.

How the income calendar can help you with your investing strategy

The income calendar is a simple yet powerful way to visualise your investment income. By tracking your dividends and distributions in one place, it helps you plan ahead, manage cash flow and stay organised throughout the year.

Here are some of the key benefits of the calendar:

Better manage your cash flow

If you rely on dividends for regular income, you can use the calendar to see when payments will arrive and plan your expenses accordingly. By knowing when dividends are due, you can better plan reinvestments, withdrawals or transfers. Having a calendar view also makes it easy to see which months have higher or lower income, and adjust your investments for more consistent cash flow. By filtering for upcoming or estimated payments, you can also plan ahead and align your income with your lifestyle or expenses.

Keep track of upcoming and missed payments

If you invest in a number of dividend-paying assets, it can be hard to stay on top of every payment — especially if your shares are managed by multiple share registries. The income calendar helps you see which payments are upcoming, paid, pending or estimated, so you can quickly identify if something hasn’t arrived when expected. As new payments appear, you can click on them to confirm and reconcile dividend payouts directly, helping you stay on top of your investment income. This complements Sharesight’s automated dividend tracking, keeping your records accurate and your performance figures up to date.

Simply click on an income payment in the calendar to confirm and reconcile it in your portfolio.

Get a clear picture of your total investment income

By running the calendar across all of your portfolios using a consolidated view, you can see your total dividend income at a glance. This consolidated calendar view gives you a complete picture of your income dates and statuses across every portfolio, eliminating the need to check them individually. It provides a quick snapshot of how much income your investments are generating and when it’s being paid, while the future income report gives you the detailed breakdown behind those totals.

Support client communication and reporting

For financial professionals, the income calendar can be a useful tool to recommend to clients who want a clear visual summary of their upcoming dividends. While advisers and accountants may prefer the detailed data in the future income report for their own analysis and reporting, the calendar view helps clients better understand their income timelines and stay engaged with their investments between review periods.

Want more information?

For a more detailed look at the income calendar, see our instructional video here:

Stay on top of your dividend income with Sharesight

If you’re not already using Sharesight, what are you waiting for? Sign up for a free account and join hundreds of thousands of investors using Sharesight to track their portfolio’s performance, dividend income, tax and so much more.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.