Latest posts

Future focus: The perils of the new financial system

This International Women’s Day, Shani explores the risks of the new financial system, and how they mirror those of the established system.

Why investors are more informed, yet less confident than ever

More information doesn't always mean more confidence. Learn what's driving the client engagement gap and how advisers can close it.

Turn market volatility into opportunity with Sharesight

Periods of market volatility can distract you from your long-term goals. Learn how Sharesight’s future-focused tools can help you plan ahead with confidence.

2026 market outlook: Expert insights on risks, rates and opportunities

We talk to industry experts about their expectations for markets in 2026 — from inflation and interest rates to market opportunities, the AI bubble and more.

Sharesight's top 10 investing blogs of 2025

We look back on your favourite Sharesight blogs, from Sharesight feature explainers to users' favourite brokers, a compilation of world's best blogs and more.

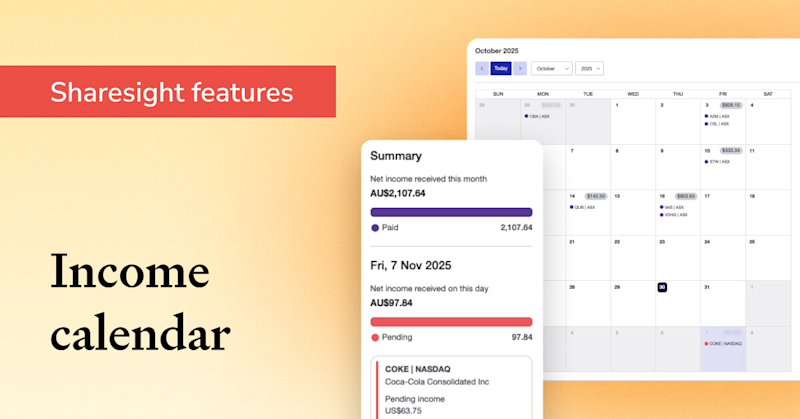

Track your dividend income with Sharesight’s income calendar

With Sharesight's income calendar, you can see past, upcoming and forecasted dividend payments laid out in an easy-to-read calendar view.

How everyday investors can access professional-grade portfolios

Model portfolios once reserved for advisers are becoming available to retail investors, offering professional design, transparency and flexibility.

What bull markets hide from investors

Bull markets make every strategy look smart — until they end. Learn what they hide and how to protect your portfolio when the trend reverses.

Top 10 mistakes financial advisers make with their clients

In this article, we discuss the 10 most common mistakes that financial advisers make with their clients (and how to avoid them).

Top countries and brokers Aussies use to invest in global markets

Looking at data from our user base, we delve into Aussie investors' favourite global markets and stocks, plus the brokers they use for international trades.

Time-weighted vs. money-weighted rates of return

We explain the difference between time and money-weighted returns, and why Sharesight uses the money-weighted method to track portfolio performance.

Top brokers Aussies use to invest in stocks and ETFs

We take a look at the most popular brokers among Sharesight users in FY24/25, focusing on investments in stocks and ETFs.