Leveraging volatility for better investment decisions

While market volatility can be stressful and difficult to navigate as an investor, it can often give way to unique opportunities for long-term growth prospects. There is no "cheat sheet" to growing your wealth in a volatile market, but by looking at historical trends, we can see that investing consistently and understanding the data have yielded the best results.

In a recent webinar, Sharesight and Pearler came together to provide insights on how to take your investments to the next level in a volatile market, with the best pathways to growth and early retirement, backed by historical data trends.

Topics discussed include:

-

What is volatility?

-

Understanding volatility in your portfolio

-

Considering your investing strategy

-

Keeping costs low during volatility

-

Fostering a money mindset

Watch the full webinar

Embedded content: https://https://www.youtube.com/watch?v=O92p3ZntvxI

Connect Sharesight and Pearler to automate your investments and reporting

If you’re not already using Sharesight and Pearler, what are you waiting for?

Get started with Pearler to automate your trades based on your financial goals and investing strategy, and sign up for a free Sharesight account to track the performance of all your investments in one place. By linking your Sharesight and Pearler accounts, you can automate your investments and your reporting, helping you save time and make better investment decisions.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

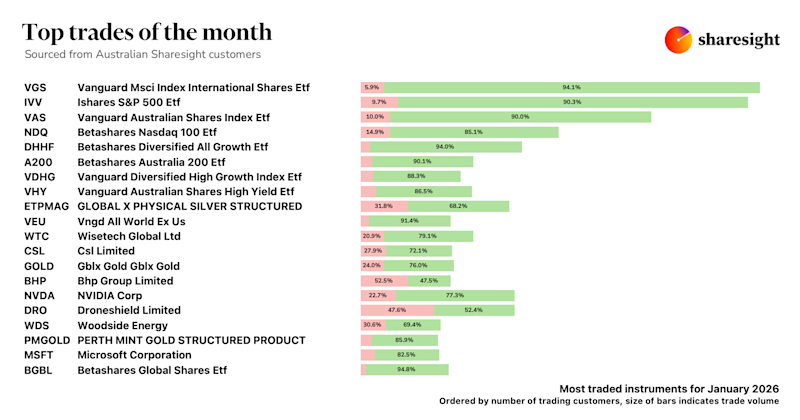

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.