Tip #9 - Diversification

Every week we post a tip that we hope will help you become a successful share market investor.

Tip #9 — Diversification

When it comes to investing, diversification is important for two reasons: it can potentially protect you against undue losses if investments in a particular company, sector or asset class fail, and it can actually improve the overall return of your portfolio. For these reasons it has been described as the only free lunch in investing but it is important not to go overboard. Diversification does not guarantee success and if it’s overdone it adds complexity and has the potential to dilute rather than improve returns.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

FURTHER READING

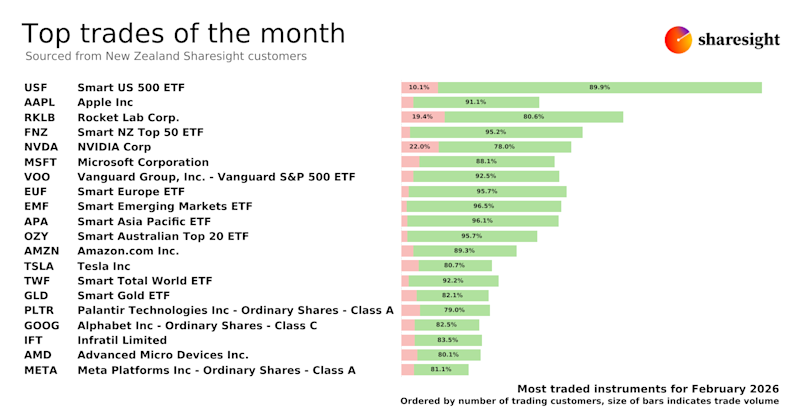

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

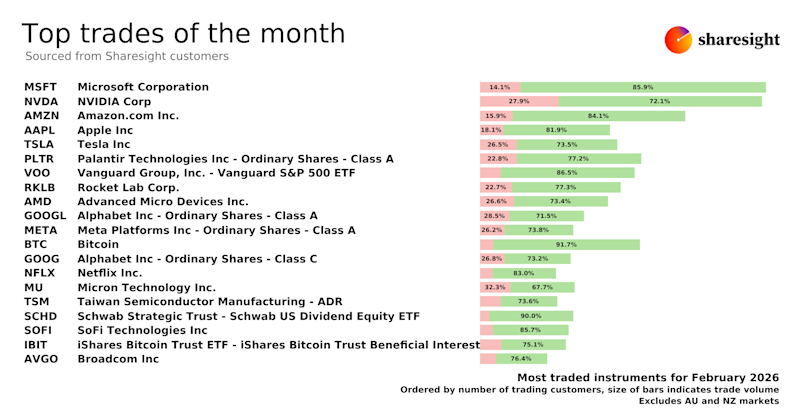

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

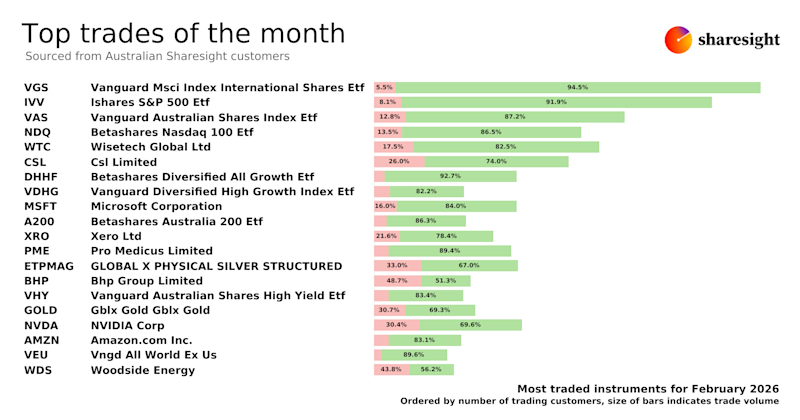

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.