How experienced value investor Kyle Grieve uses Sharesight

We talk to Kyle Grieve, experienced value and investor and podcast host for The Investor’s Podcast Network, about why he tracks his investments with Sharesight, some of his favourite features and his advice to investors.

The Investor’s Podcast Network is a business podcast network that includes the TIP Mastermind Community, which describes itself as an exclusive group of dedicated value investors — so much so that prospective members are highly vetted and there is a waitlist to join.

“Value investing is a lonely endeavour, and we wanted a space where people could have an outlet to talk about all things investing with just high-quality people,” says Kyle.

“We have many listeners who have been tuning in for years. [The community] gives them the opportunity to interact with We Study Billionaires hosts, and share their ideas and thoughts with others in a very supportive environment. While we talk a lot about investing, we also talk about life, money, wealth and thinking.”

Kyle has been using Sharesight since 2020 after realising that he needed a place where he could track all the investments he held under his various brokerage accounts as a single portfolio.

“Many investors will have multiple brokerage accounts, allowing them to combine everything into one [with Sharesight], giving them a more complete picture of their portfolio’s performance,” he adds.

“If investors want to see the performance of their entire portfolio of stocks, this is the way to do it.”

For Kyle, one of the most valuable Sharesight features is the ability to see his portfolio’s performance at different times such as yearly or quarterly. He notes that the ability to see his actual performance — not just track stock prices — is incredibly useful.

“[Stock price tracking] over short periods isn’t the best way to evaluate yourself. The ability to zoom out and see how you’ve done each and every year is great. It shows that your process may or may not be working,” he says.

Kyle is also an advocate of Sharesight’s label function, which gives him a quick way to compare the performance of different types of investments in his portfolio and identify strengths and weaknesses.

“Without Sharesight this would be very time-consuming, but with Sharesight, it’s super fast and really helpful to get insights that I wouldn’t have access to otherwise,” he adds.

“Another feature I like is the ability to see my average cost basis for each position and my concentration levels as a total of the portfolio. This has helped me improve decision-making based on where I want to allocate new capital, or where I want to re-allocate positions.”

When asked what advice he would give to his followers, he emphasises the importance of continued learning, highlighting technology as a great way to expedite the process.

“While it will never be a crutch to rely on completely, it’s an augment,” he says.

“Things like Sharesight are very helpful, AI is helpful. But you still need to take the time to think about what you are doing and reduce bias as much as you can.

Become a smarter investor with Sharesight

If you’re not already using Sharesight, sign up for a free account to track all your investments in one place and get deeper insights into your performance — helping you make more informed decisions about your portfolio.

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

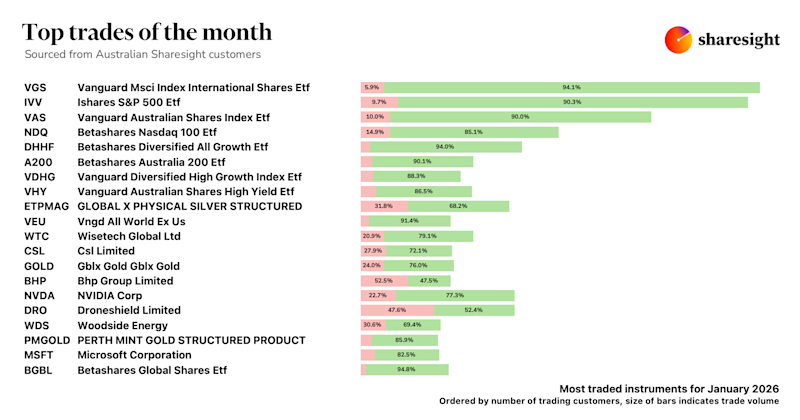

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.