What bull markets hide from investors

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

When a market goes up, almost every investment approach will work, and people like me can safely sell almost any old theory on how to make money in the stock market without being wrong. When the market goes up, there is room for all – for value investors, for set-and-forget investing, for technical traders – because every theory works, no matter how deficient.

A bull market will hide a lot of sins, and in boom times it will hide all sins, from black box theories to mail-order DVD courses, to leveraged contracts for difference over forex, to active ETFs that buy stocks going ex-dividend every month and present that as a value-add whilst they destroy your capital in the background. A bull market allows all manner of product pushing. Even the scams ramp up.

But when the bull market trend ends, and it becomes more difficult – when the tide goes out, and we see who's swimming naked – suddenly laziness doesn't work. Complacency costs money, uncertainty eats into assumptions, and idioms like "set and forget" and "it'll be alright in the end" are revealed as hollow hope once again.

When the bull market ends, the luxury of inaction goes. When the bull market ends, even people who label themselves as long-term investors have to do something or lose a lot of time, because that's what inaction costs you – time, and missed opportunity.

At a minimum, if you want to save time (it took 11 years for the market to recover its pre-GFC level) and take advantage of the opportunity of fallen markets, you have to learn to sell.

Traders know all this. They are "on the ball" in all markets. Investors don't know it, and don't do it. And if they do know it, they are constipated by fear in case they sell and it goes up the next day.

So here are a few tips for a long-term investor faced with a turning market – a few trading lessons for someone who never sells.

To start with, the good news for inactive investors is that investing is the same as trading, just with a longer-term time frame, and the skills used in trading are applicable in the long term as well as the short term.

Key trading skills to think about

Use your existing skills

Rather than put your fundamental analysis in mothballs, use it. In a market in which share prices are driven by fear, what more valuable tool could you have than a fundamental assessment process that identifies the inherent risk in a stock? If traders think of stocks as eggs and apples, there to be traded, your edge is in having the skills to spot the good eggs and the bad apples. Fundamentals work. Using fundamental overlays limits risk. They may not be the whole equation when the herd takes over, but they are always a very large part of it.

Pay attention

Sorry, but the market is a battlefield. Sometimes it's quiet, sometimes it's dangerous. You can't sit on a picnic rug sipping tea all the time. Sometimes you have to dive into the trenches to protect your gains. You can't pretend everything is "just dandy" every day. Traders make hay while the sun shines and dive for cover when it rains. You can too.

Plan

It's no good having some willy-nilly idea of what you're trying to achieve. Traders have plans. You need details: timeframe, goals, a plan – written down. At Marcus Today we have our "Principles" – things we have learned, abide by, constantly question and improve, and can communicate through the team so we can all do the job consistently. If you don't do this, you are making it up by the seat of your pants every day, and that will leave you "not knowing" what to do at crucial moments.

Learn how to sell

The Achilles heel of an investor is never selling. At this point, you probably expect me to suggest using stop losses at all times. But I won't. We have used them for years, and we have found that stop losses have some serious flaws – the worst one being that they make you short-term and stop you out of every stock, even the great ones, at some point. But you need something – some mechanism that taps you on the back of the head when things are going wrong that says, "What are you doing?", "When are you going to do something about this?", "You are bleeding capital". It's not hard to adopt a mechanism, even on long-term positions, to guard against major events like the next GFC. Setting stop losses is an obvious one, but treat them as a prompt to re-assess rather than an order to sell.

Measure your results

Traders look at results. They pursue the activities that work and break the habits that don't. We all have bad habits, but you'll never break them if you never bother to measure or admit to them.

Focus on the money

A lot of people ruin their investment results with misplaced sentiments like loyalty to management, favourite stocks, irrational likes and dislikes. Emotional bias simply weakens your chance of success. This is a clinical game of making money out of prices (not companies). Forget loyalty, sustainability, ethics, liking, hating, favourites and the quality of sandwiches at the AGM. Anything that gets in the way of the cold assessment of share price direction is going to cost you money.

Expand your circle of friends

Get out and amongst other investors. You need objectivity. You may think you're God's gift to investment, but there are a lot of people out there who have been doing it longer than you, know more than you do, and are better at making money than you. Go and meet them.

Enjoy it

If it's not your thing, don't do it. You'll never succeed if you come to trading out of necessity. Investing needs to be a hobby, an intellectual pursuit, a social outlet, fun, a passion. If it's none of those, best you leave it to someone else. Investing should be a ravenous hobby.

Trading skills are a commodity

They are a knowledge base that is static, known and easily accessible. You don't need some slow-moving, overpriced seminars to learn them – you just need to subscribe to Marcus Today and absorb them by osmosis.

This article has been prepared by Marcus Today Pty Ltd ABN 57 110 971 689, a Corporate Authorised Representative (No. 310093) of AdviceNet Pty Ltd ABN 35 122 720 512 (AFSL 308200). The information is general in nature and does not consider the financial situation of any individual. Past performance does not necessarily indicate future performance. Before making any financial decision, consider seeking advice from a professional financial adviser.

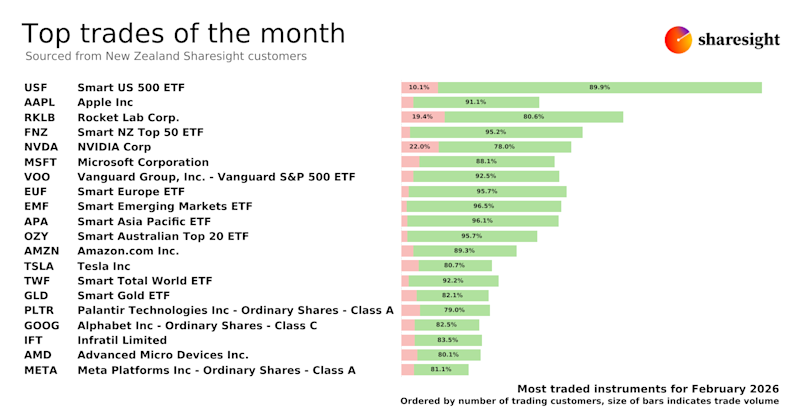

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

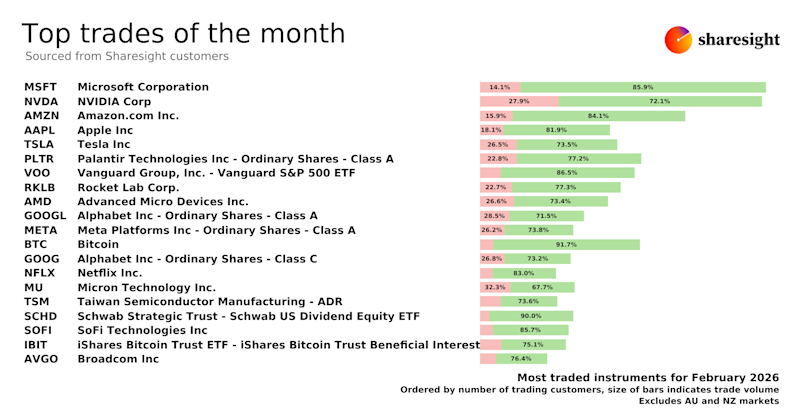

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

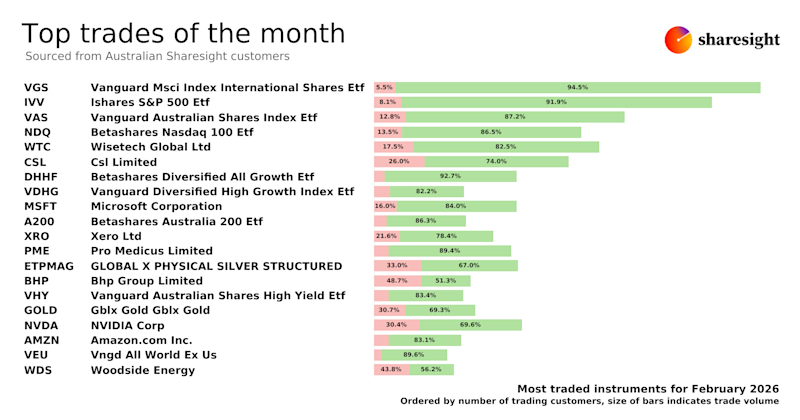

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.