The X-Ray tool for ETF investors

See inside your ETFs and avoid overlap in your portfolio with Sharesight's exposure report - The ultimate X-ray tool for ETF investors.

Sign up for free

Track your ETFs, stocks and more

Get automatically updated price and performance data on 700,000+ global stocks, ETFs, crypto and much more.

See your ETF distribution income

Calculate your annualised return including capital gains, dividends, distributions and currency fluctuations.

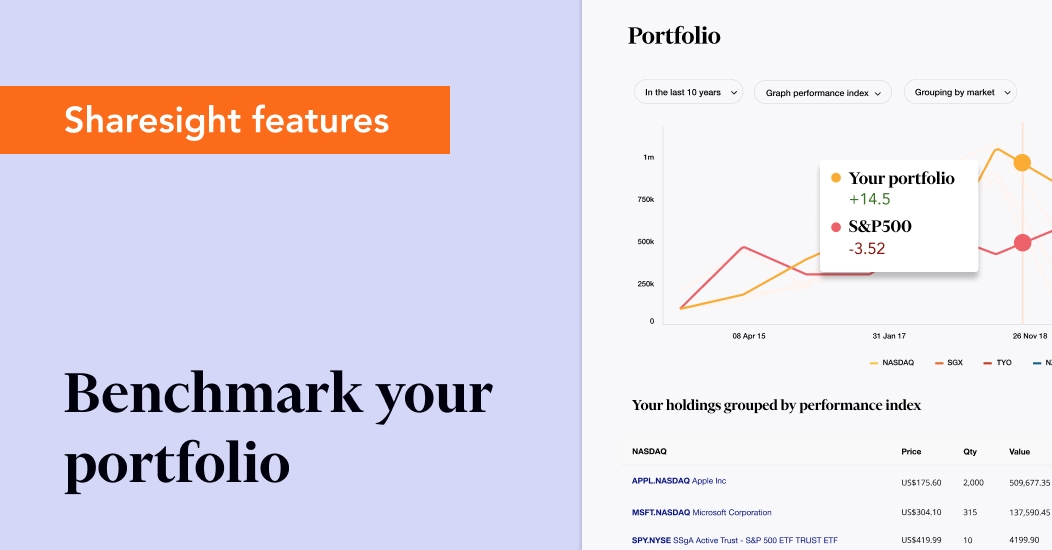

Benchmark against ETFs

Compare against a world of investments – benchmark against stocks, ETFs or funds.

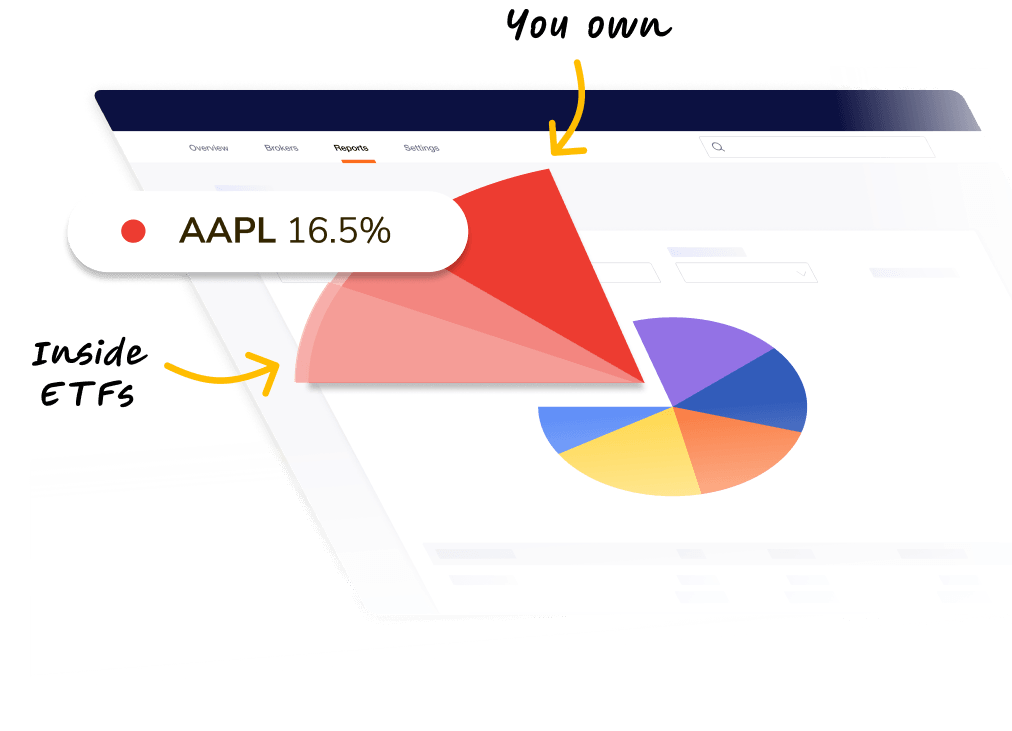

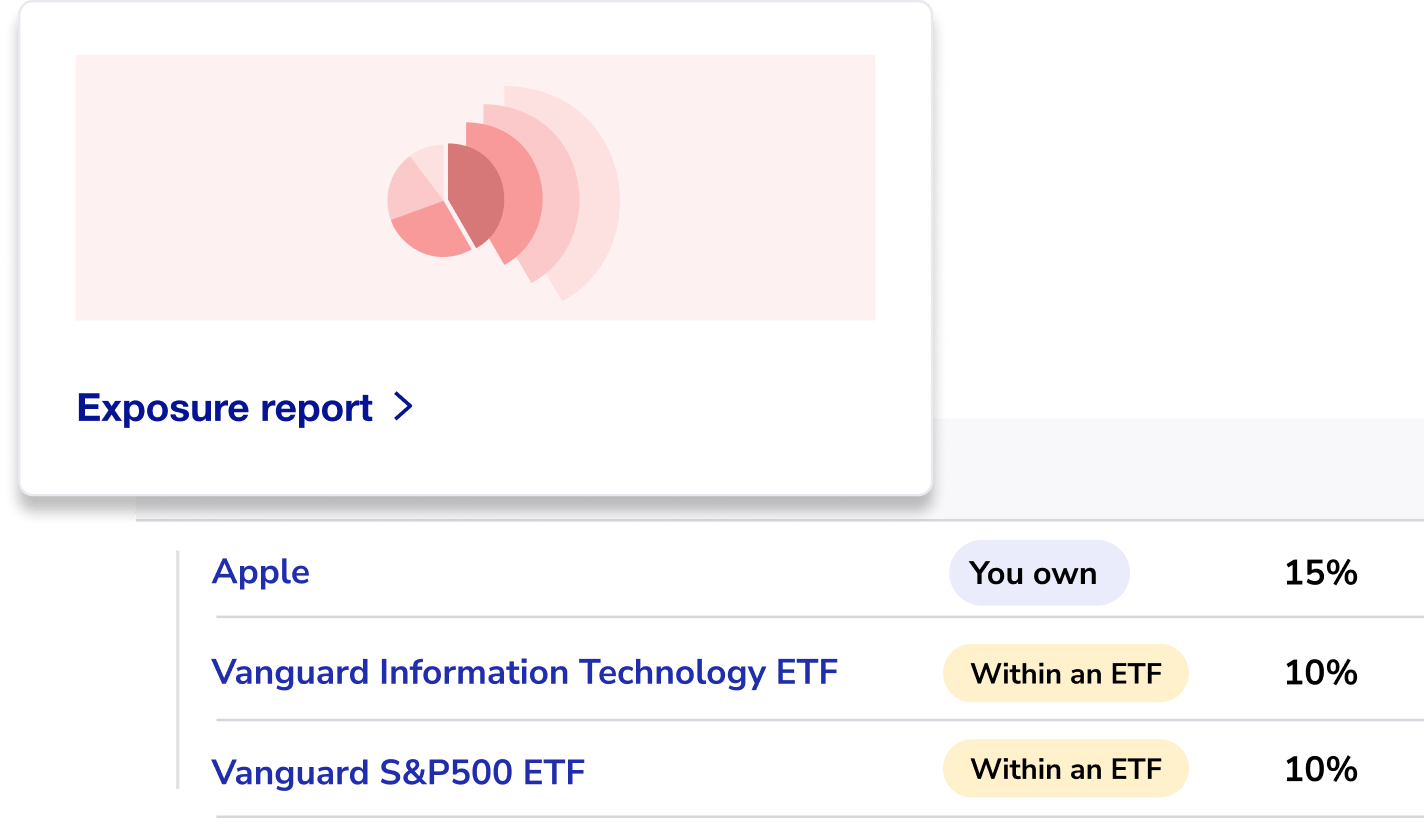

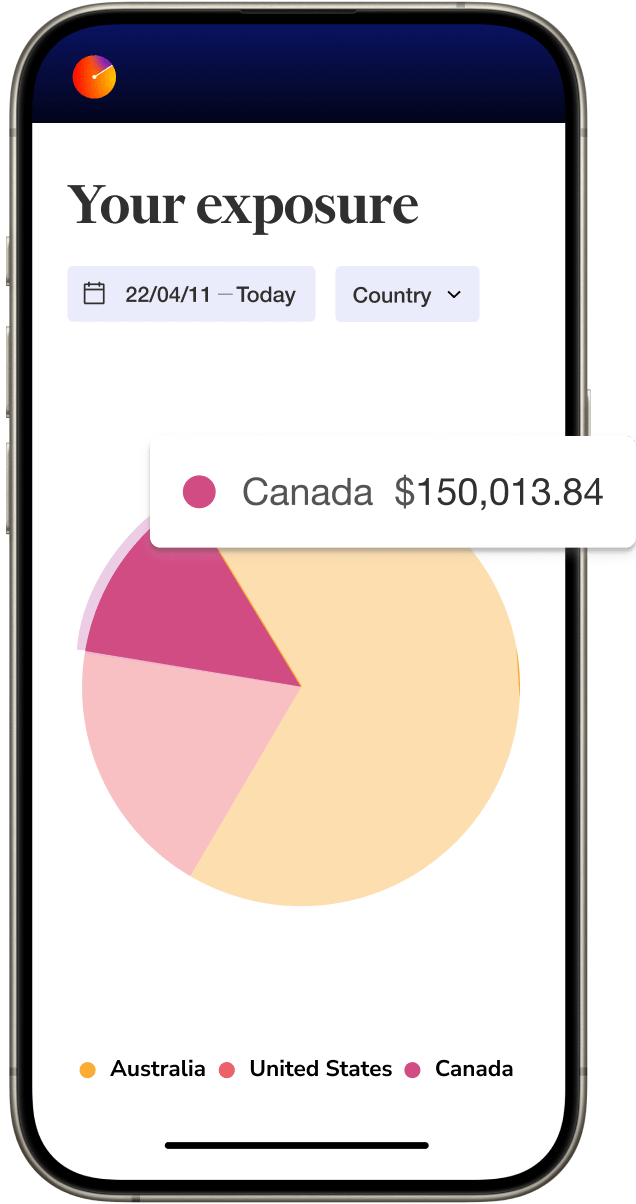

See inside your ETFs

Know what you’re actually invested in and eliminate overlap in your portfolio. Sharesight’s exposure report shows the combination of shares, bonds and securities inside your ETFs.

We work with all your favourite brokers and apps

Sharesight integrates with hundreds of brokers and finance apps, including Questrade, CIBC Investors Edge and RBC Direct.

View our partners

Plans & Pricing

Start by tracking up to 10 holdings for free! Then upgrade to a premium plan at any time to track additional holdings or portfolios, and unlock advanced features.

Free

$0

Forever

Starter

$9

CAD per month

billed annually

$12 CAD billed monthly

Investor

$23.25

CAD per month

billed annually

$31 CAD billed monthly

Expert

$29.25

CAD per month

billed annually

$39 CAD billed monthly

Benchmark your portfolio against any stock, ETF or fund

Investors using Sharesight can benchmark their portfolios against any stock, ETF, mutual/managed fund or unit trust that Sharesight currently supports.

ETFs vs. stocks

Stocks and ETFs can both be a valuable addition to an investor’s portfolio, however it’s important to understand the pros and cons of these two asset types.

How to track exchange-traded funds (ETFs)

Like all investments, it’s critical to track the performance of and distributions earned by exchange-traded funds (ETFs) in your portfolio.