How to handle the Stride Investore restructure

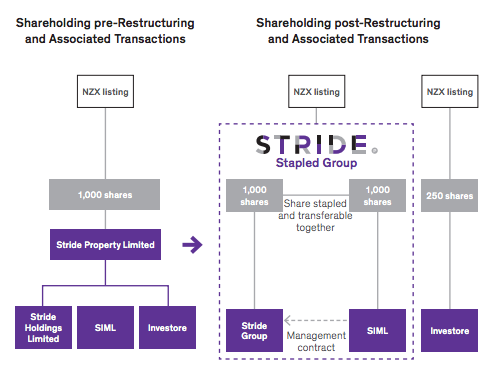

NZX-listed property companies Stride Property Limited and Investore announced a restructure of their entities to create an investment and management structure which is “fit for future purpose” and which will permit Stride to retain its PIE tax status while allowing its real estate investment management business to grow.

What the Stride Investore restructure means for investors

Under the Restructuring, Shareholders will continue to own all of Stride’s business and shareholders will retain their existing Stride Shares. In addition they will receive the same number of shares in Stride Investment Management Limited (SIML) these will trade together as a stapled security under the new name ‘Stride Property Ltd & Stride Investment Management Ltd’ (SPG). At the same time Stride will demerge Investore by distributing shares in it to Stride shareholders and certain eligible Stride shareholders will have the opportunity to acquire further shares in Investore during its IPO (Initial Public Offering).

Fortunately, Sharesight makes it easy for investors to handle corporate actions, even complicated demergers.

How to handle the Stride Investore restructure

Please note that the following steps are suggested for New Zealand Investors. They are not appropriate for traders or investors that are subject to a Capital Gains Tax.

-

Sign up for a FREE Sharesight account and add your Stride Property Limited (STR) holding.

-

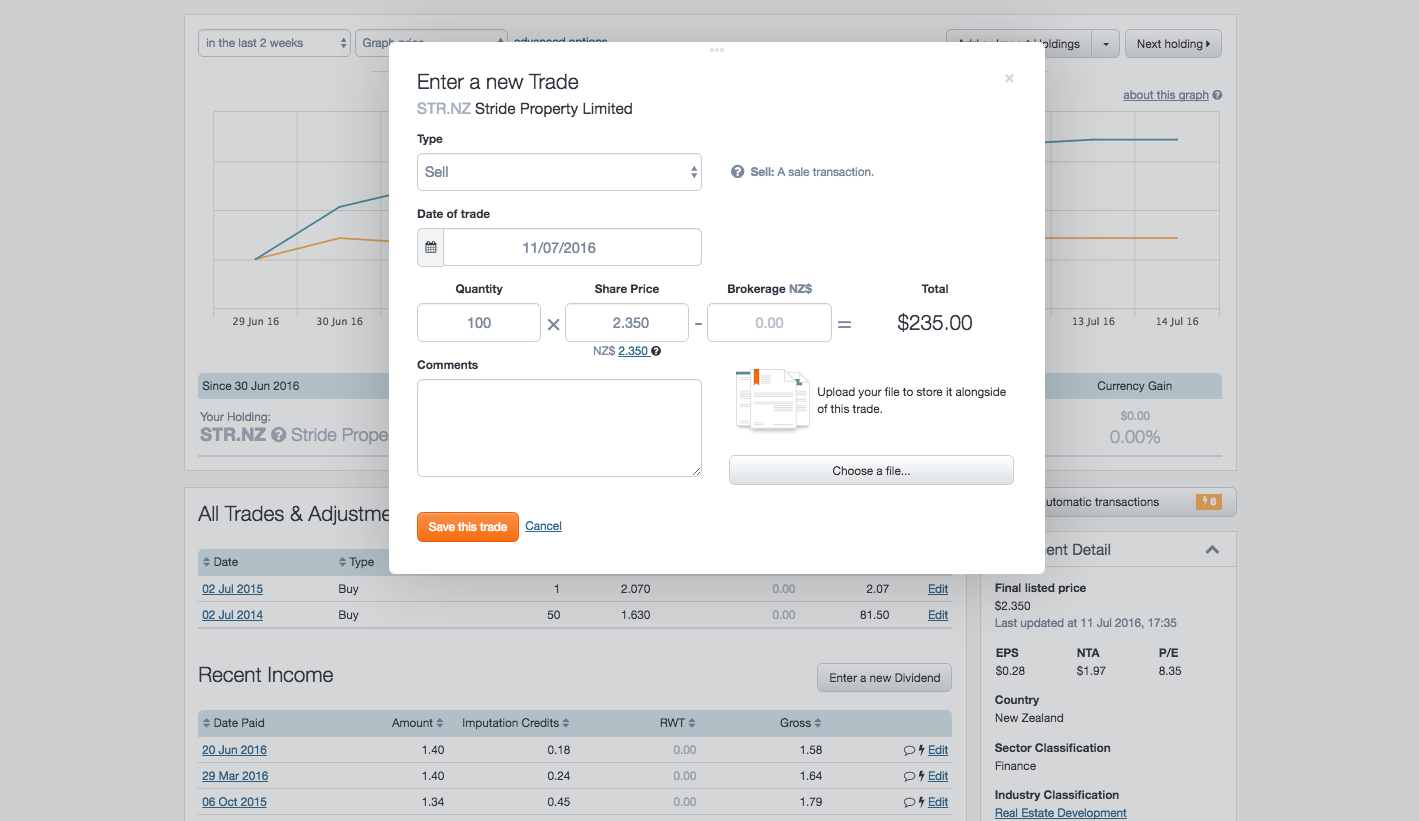

Record a sell at using the market value as at 11 July 2016:

Remove your Stride Property Limited (STR) holding by recording a sell transaction on 11 July to sell of your STR shares at the market price of $2.35.

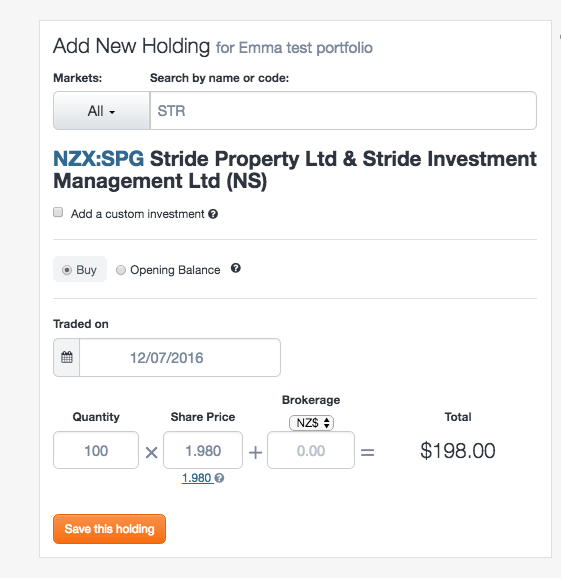

- Record a buy for SPG using the same market value as STR:

Record a buy transaction for SPG on 12 July 2016 for the same number of shares at $1.98 (this reflects the value of your STR shares, less the value of the IPL shares that were spun-off, these will be recorded in the next step).

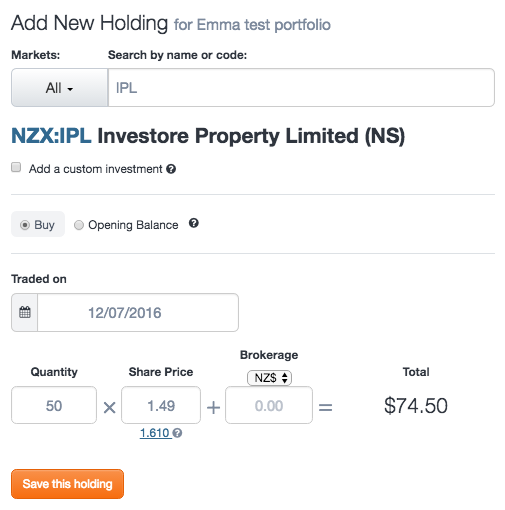

- Calculate how many shares you’re entitled to:

To reflect your new Investore (IPL) shareholding, first calculate how many shares you’re entitled to based on the officially announced ratio of 1 Investore share for every 4 Stride Property Limited share.

- Record a buy transaction for IPL at the issue price:

Record a buy transaction for IPL at the issue price of $1.49. Use 12 July 2016 as the trade date.

For most investors these corporate actions can be time consuming and confusing. Sharesight provides you with the tools and technology to help keep your portfolio up-to-date.

Please note that we always advise you to consult your financial advisor or accountant regarding corporate actions, especially for tax purposes, as we are not authorised to provide financial advice. The information above, including the dates is subject to change. We encourage you to review the official Stride Investore restructure document for full details.

GET HELP

- Help -- Corporate Actions

FURTHER READING

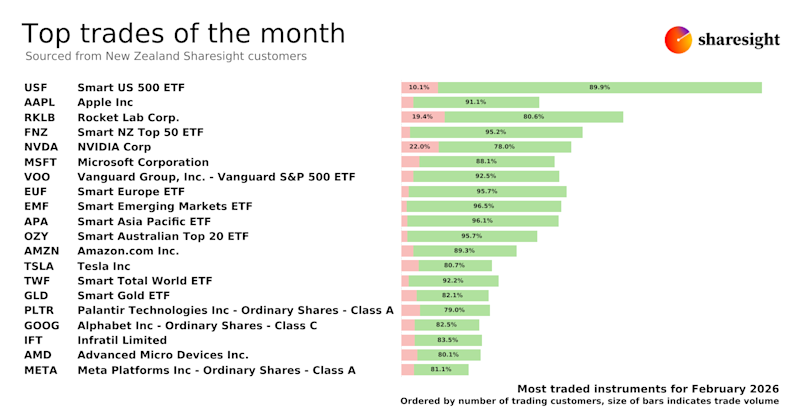

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

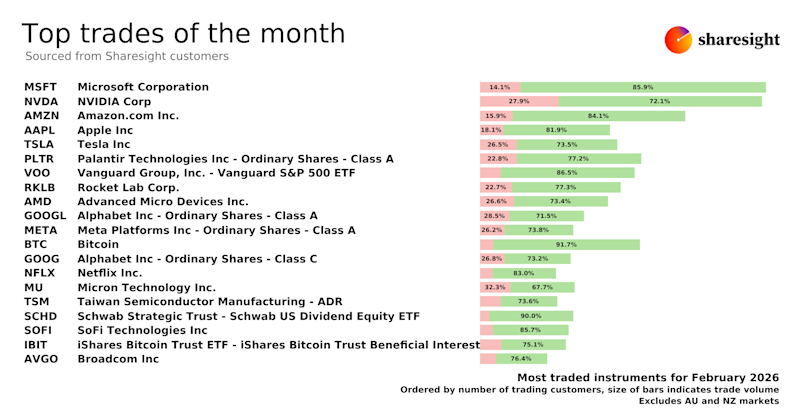

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

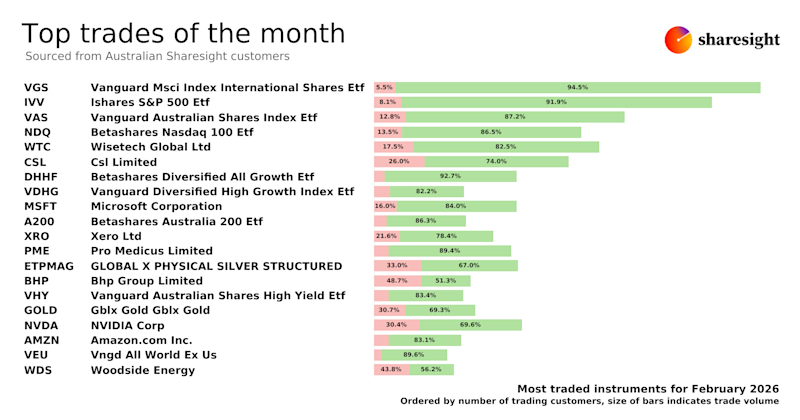

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.