Importing your portfolio just got easier

We know from the feedback that we get that the biggest challenge for many new customers is getting their historic portfolio set up Sharesight. One of our goals is to make it as easy as possible for you to get your data into (and out of) Sharesight. Last week we released some improvements to our file importer to make it compatible with a much broader range of spreadsheet files.

The first step is getting a list of all of your trades into a spreadsheet. Thankfully this is easier than it sounds as most online brokers allow you to export a copy of your trading history in a form that can be opened up in a spreadsheet program such as Microsoft Excel.

Provided that your spreadsheet contains one row per trade and one column per attribute (price, quantity, date etc) it is now much easier to import this data into Sharesight.

Importing your data in two easy steps:

1. Save your file in CSV format

Once you have the data in a spreadsheet, you need to choose ‘Save As’ and save the file as a CSV file. CSV stands for ‘comma separated values’ and is basically just a plain text file without any extraneous formatting information.

2. Upload to Sharesight

To access the file importer, click ‘Add New Security’ then click ‘Bulk Import’ and click on the ‘Import CSV’ button.

Once you have selected your file to upload you may need to specify what piece of information is contained in each of the columns you want to import.

You have the chance to add, modify, or delete any data before it is finally imported into your portfolio. Sharesight won’t let you import invalid data, but if there are any problems they will be clearly highlighted so that you can fix them up.

FURTHER READING

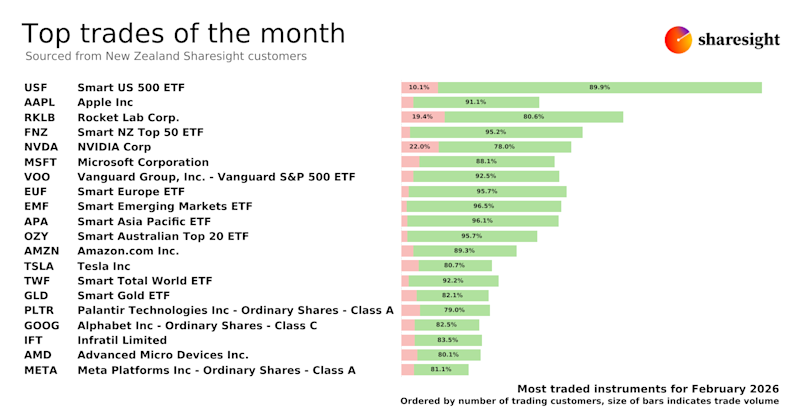

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

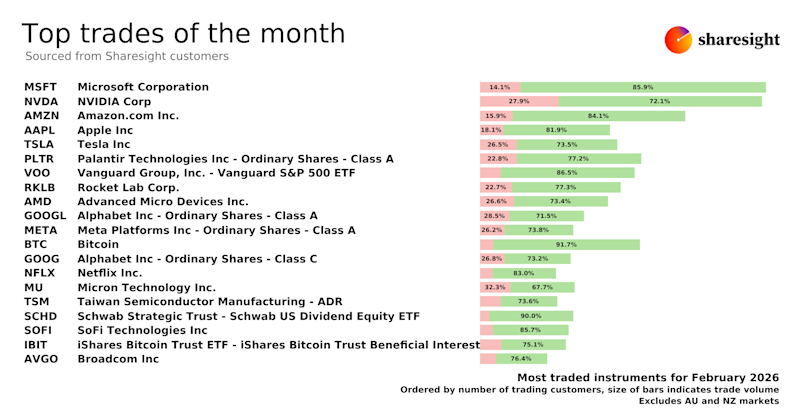

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

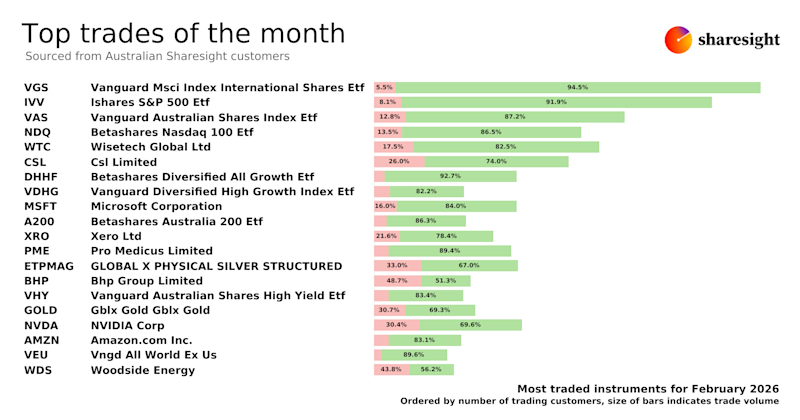

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.