Portfolio setup tip #1: opening balances (manual entry) are your best friend

New Year’s resolutions never stick. Don’t believe us? Go to the gym this week and count the empty treadmills. Psychologically, we think this sort of absolutism is a fool’s errand, evidenced by years of our own broken resolutions: caffeine, alcohol, fitness, avoiding blogs, leveraged ETFs, you name it. The best changes in life, including investing and app development come from manageable step-wise processes.

Sharesight clients love that we don’t force them into using our app by going whole-hog with a massive all or nothing setup effort of purchasing process. For the newly initiated (or those with less than 10 holdings) Sharesight Free Plan will always be free, and we’ll never deactivate your account due to inactivity, number of holdings, or portfolio value. If you choose to purchase one of our plans, we won't force you into an annual commitment either. Simply pay as you go monthly if you prefer. But, the best part is all of your data will be automatically updated at the close of each day’s trading, whether you’ve logged in or not.

Regardless of what type of Sharesight plan you use, our goal is to offer the best portfolio product on the market. This means getting a portfolio set up should be simple and by no means an all-or-nothing exercise. With our approach you can combine our setup processes and edit your data at any time so your portfolio is updated based on your schedule and the information you have available.

So as you make New Year’s resolutions to invest as wisely as Warren Buffett or be on top of your portfolio admin like a German fund manager, Sharesight has you covered should you find yourself retreating a bit from your bold 2014 proclamations.

Over the next week or so we’ll be posting some tips to help get you started and get your portfolios on track. The first tip is arguably the most important: opening balances (a.k.a. just pick a date and get on with life).

Portfolio Setup Tip #1: Opening Balances (Manual Entry) Are Your Best Friend

Whilst Sharesight has historical data stretching back decades that you can use to recreate complete transaction histories (more on this later), you don’t need to go back to day one of your first investment to make sure your portfolio is accurate. Most people we work with don’t have records stretching back to their first buys and sells. Systems change, balances are transferred, and records get lost, we get it!

So, we’ve created a way for investors and the Pros who serve them to put a stake in the ground and begin from a specific portfolio opening balance date. This is no less accurate than having access to trade histories, but you are creating a portfolio start date, before which no data will be recorded and after which, all data should be pristine. This is your personally crafted “In the beginning, God created a portfolio” moment. Enjoy it.

Chances are you’ll have access to an accurate opening balance date as at the portfolio’s last tax lodgement or some other official statement period. We advise clients to pick the oldest possible date at which your portfolio data is reliable. This way you’ll have access to some history too. From a compliance perspective, though, choosing an opening balance date immediately following the previous tax year (e.g. 1 July 2013) is the safest way to go.

If the portfolio has less than 20 holdings, our recommendation is to key in the opening balances for each holding. This should take about 20 seconds per holding. All you need is your cost base and the number of shares. Once this is input, we’ll work out the rest for you, including all subsequent gains, losses, dividends, and corporate actions. Remember, you can always go back and edit these holdings later. If you do make a change, all of the performance data will be updated accordingly and automatically.

On the Add Holding page, just make sure you've selected "Opening Balance" and Sharesight will show you the required fields. Once your opening balances are entered, your portfolio will carry on from that point forward automatically. All performance gains/losses, dividends, and corporate actions will now affect your portfolio. It's a good idea to go into each holding and check and confirm things like dividends and splits.

It’s important to understand, however; if you want to layer on or backfill buy and sell transactions you can do so at any time between your portfolio’s opening balance date and today. You can do this by forwarding Trade Confirmation Emails to Sharesight or by manually entering buy or sell transactions. More on both of these processes later in this series.

Here’s a link to our help page on setting up your holdings for more info.

Next up: Portfolio Setup Tip #2: Opening Balances (Bulk Upload) Are Also Your Best Friend

FURTHER READING

Sharesight's top 10 investing blogs of 2025

We look back on your favourite Sharesight blogs, from Sharesight feature explainers to users' favourite brokers, a compilation of world's best blogs and more.

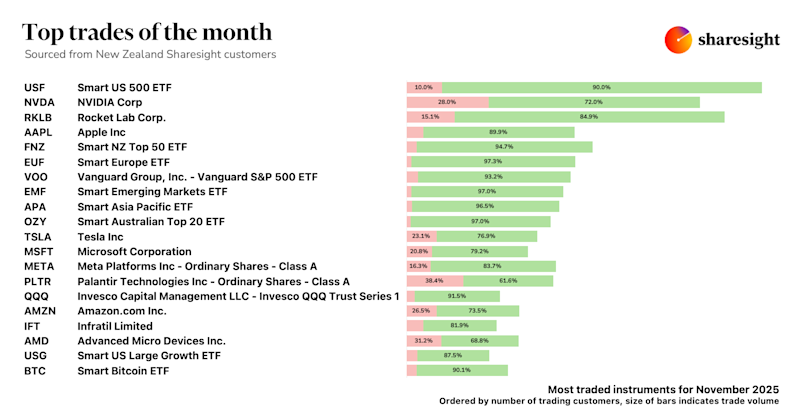

Top trades by New Zealand Sharesight users — November 2025

Welcome to the November 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — November 2025

Welcome to the November 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.