Sharesight goes global

Today we launch Sharesight International, a version of our platform to fulfil the demand we're seeing from investors worldwide.

As more people gain access to more global investment options, they're realising the need to track holdings from various markets, different brokers, different asset managers, and in different currencies.

Sharesight International is different from our Australian and New Zealand localised editions. Investors can now select their home currency, choose from approximately 200 global share markets, and we've stripped away Aussie and Kiwi nuances. The paid plans will be billed in USD.

Soon user-driven capital gains tax reporting and an internationalised version of our taxable income report will be available. Our long term plan is to maintain a flexible, country-agnostic edition of Sharesight, while also building localised versions for big markets such as the US, the UK, and Canada.

The knock on our door to build a flexible, non-local offering has been steadily growing for months. And because Sharesight was born in New Zealand, we've always understood the need to jump to new markets, which we did for Australia in 2011.

To put this in perspective, New Zealand has a population of 4.5M, and the NZX is worth roughly $94B. Bill Gates' could buy 53% of the entire market. Compare that to the US with a population of 319M and the NYSE and NASDAQ worth a combined $24.6T (that's T for trillion). Furthermore, nearly 80% of our original Kiwi clients own overseas shares - they realised the overseas potential and so do we.

Our mission has always been to build a world-class portfolio application. We just happened to be from New Zealand.

It's a big world out there. Time to renew our passports!

FURTHER READING

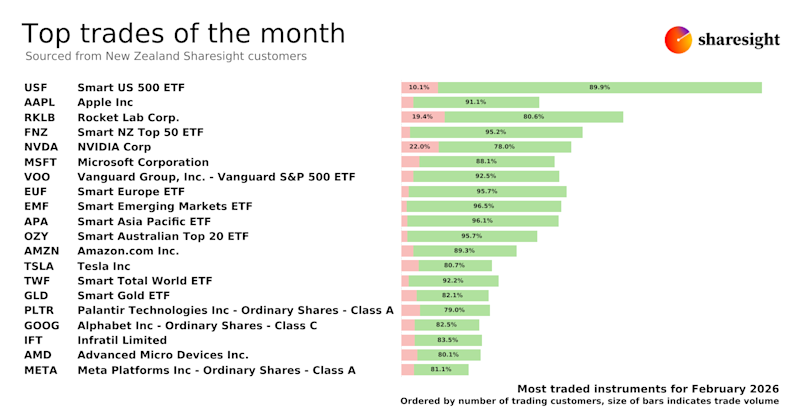

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

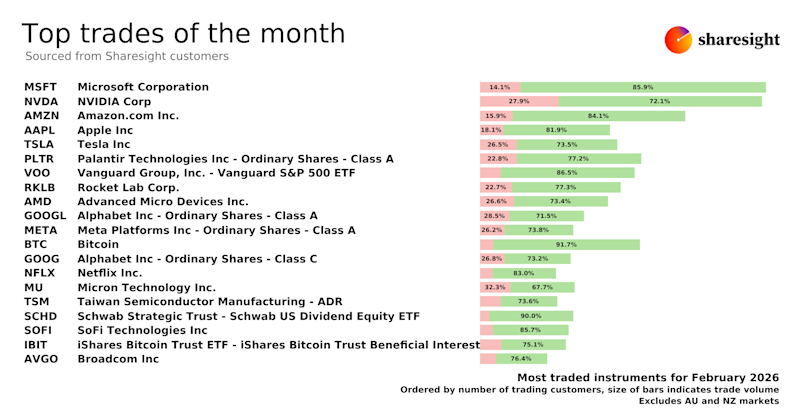

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

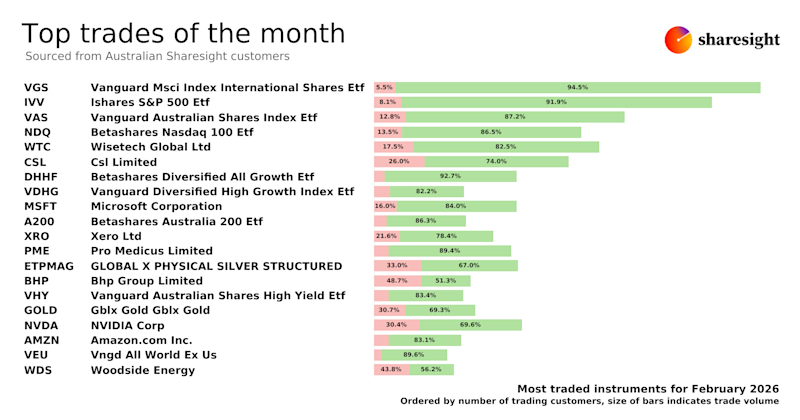

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.