Sharesight release notes – April 2023

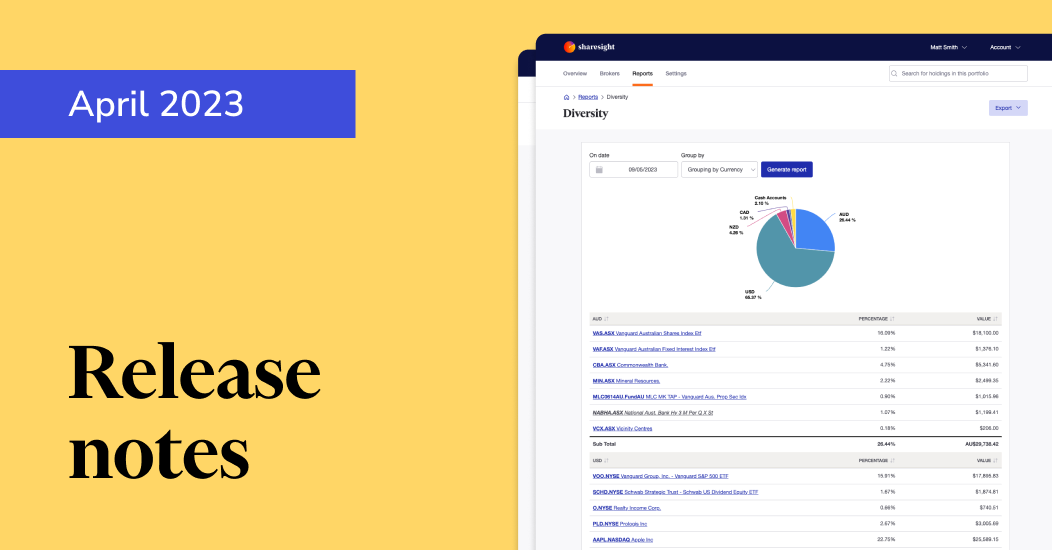

In April we rolled out the new-look diversity report to our beta users on the Investor, Expert and Professional plans. We will introduce this renewed report to the rest of our Investor and Expert users in the coming weeks.

As I touched on last month, apart from the refreshed look and feel of the diversity report, the real benefit of this re-architectured reporting function is that the report will no longer hit timeouts with larger portfolios. We intend to roll out this new approach to all fifteen of our reports, completely removing the long-running issue of timeouts from our system.

New functionality / Enhancements

-

We released our revamped diversity report.

-

We introduced a new staff permission for our Professional users to allow for specific authorisation around the management of account level custom investments. We will continue to streamline our custom investment feature set as we expand beyond our core focus on share market investments into alternatives, property and the like.

-

We introduced support for 28,000 Irish investment funds.

UX / Usability improvements

-

We’ve streamlined aspects of our Macquarie cash account feature, specifically around the addition and deletion of new Macquarie connections.

-

We’ve improved the way we refer to NZ bonds to make them easier to discover and reference when on the overview, holdings, trade and payout forms.

-

We have completed the rollout of our new payouts functionality with support for payouts synced to Xero and other edge cases.

FURTHER READING

Key takeaways from SIAA 2025: Trends, insights & industry highlights

We summarise the key takeaways from the 2025 SIAA conference in Sydney, covering industry insights, market trends and the future of financial advice.

5 ways Sharesight keeps your data safe

Here at Sharesight, we maintain constant vigilance around cyber security. In this blog, we discuss five ways Sharesight keeps your data safe.

The investor's guide to IPOs: Risks, rewards and strategies

Discover when to invest in IPOs, how to approach them strategically, and how Sharesight helps you track and optimise your performance.