Snapshot of a global fintech

This post is part of Sharesight’s 10 year anniversary series. Scroll down to the Further Reading section for every post in the series or read Sharesight’s 10 year fintech journey post to get started.

Since Sharesight was born 10 years ago, we’ve become quite an international company! Between the team, we work from 3 different countries, speak 11 languages (not including the dozens of languages our developers use to build Sharesight), and come from 8 different countries. We might actually hold more passports than Jason Bourne!

Our clients are from all but one continent

And our clients? We are so proud to have a userbase covering 61 different countries and spanning all continents with the exception of Antarctica. Funny enough, our very first clients outside of Australia and New Zealand signed up on the exact same day in June 2015 and they were from France and Singapore. That month, we also welcomed our first clients from 10 other countries. I’m sure it’s no coincidence because that’s when we began supporting Global Markets. Anguilla was the 61st country added to the list in February this year.

Sharesight userbase coloured in orange

Sharesight userbase coloured in orange

The international Sharesight team

Sharesight staff work from 3 different locations: Wellington, New Zealand; Sydney, Australia and Barcelona, Spain. We come from 8 different countries:

- Australia

- Brazil

- Canada

- Germany

- Malaysia

- New Zealand

- United Kingdom

- United States of America

We speak 10 languages:

- Cantonese

- English

- French

- German

- Italian

- Malay

- Mandarin

- Makaton (sign language)

- Portuguese

- Spanish

Our global stock exchanges

So far we are supporting 16 stock exchanges around the globe:

- Australian Stock Exchange (ASX)

- Bolsa de Madrid (BME)

- Borsa Italiana Milan (BIT)

- Börse Frankfurt (FRA)

- Canadian Stock Exchanges (CSNX, TSE, CVE)

- EURONEXT (Paris, Lisbon, Brussels, Amsterdam)

- Hong Kong Stock Exchange (HKG)

- Johannesburg Stock Exchange (JSE)

- Indian Stock Exchanges (BSE & NSE)

- London Stock Exchange (LSE)

- NASDAQ

- New Zealand Stock Exchange (NZX)

- NYSE

- Singapore Exchange (SGX)

- SIX Swiss Exchange (SWX)

- Tokyo Stock Exchange (TYO)

If you don’t see your preferred market, leave a message on our community forum and we’ll add it based on client demand.

We look forward to the next decade and growing the Sharesight team, and our global userbase of DIY investors and Sharesight's professional plan. If you happen to be in Antarctica, please sign up so we can say we have clients on every continent!

FURTHER READING

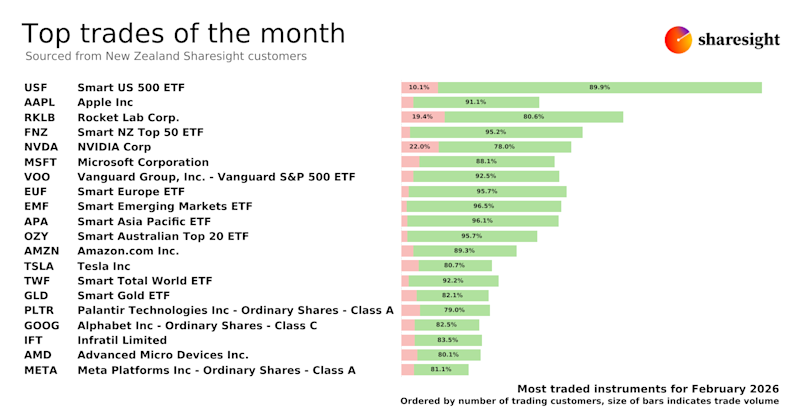

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

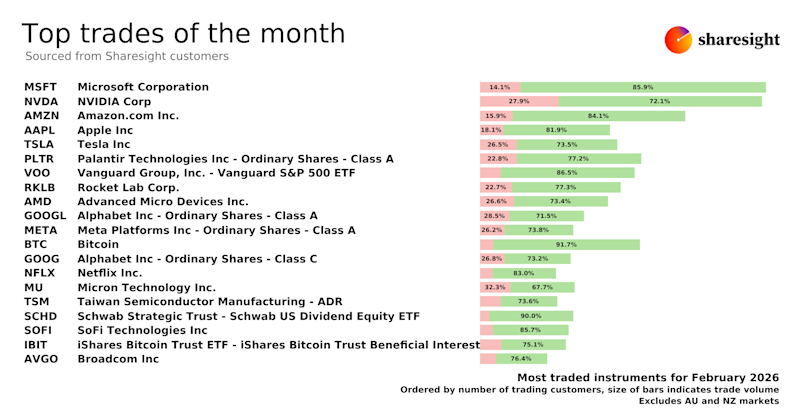

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

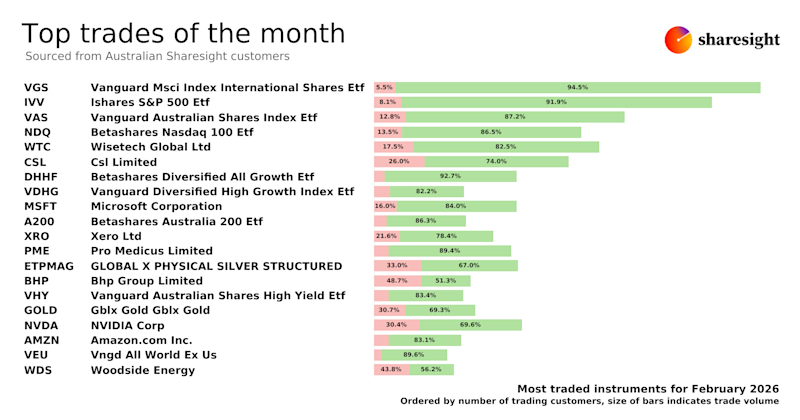

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.