Australian CGT calculator

Estimate your capital gains tax with Sharesight’s CGT calculator.

Estimated net taxable gains

$490.00

Capital gains | $1,980.00 |

Taxable gains | $990.00 |

Net taxable gains | $490.00 |

Estimated tax payable | $159.25 |

Purchase price of asset | $8,000.00 |

Sold price of asset | $10,000.00 |

Incidental costs | $20.00 |

Long term | Yes |

Marginal tax rate | 32.5% |

Carry forward loss | $500.00 |

CGT discount | 50% |

Incidental costs

Any additional cost incurred as part of buying or holding the asset, such as brokerage fees, spreads or taxes.

Holding period

Enter the holding period to determine if the asset qualifies for short-term (less than 12 months) or long-term (over 12 months) capital gains.

Marginal tax rate

Select the appropriate tax rate based on your total taxable income in accordance with the Australian Taxation Office (ATO) rules.

Carry over losses

Enter any capital losses from the sale of investments from the previous year/s that you wish to use to offset your capital gains tax.

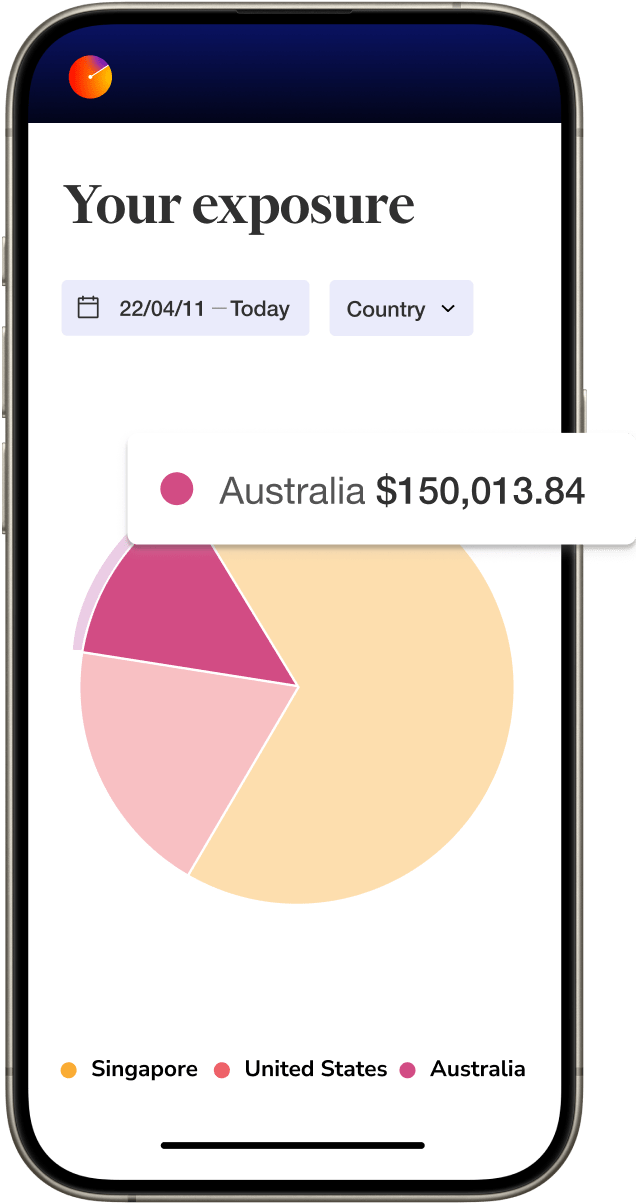

Calculate your capital gains tax with Sharesight

Calculate the CGT on your portfolio (including foreign shares) with Sharesight’s CGT report. You can also model different sales allocation methods for assets in your portfolio, which could potentially help reduce your capital gains tax.

Sign up for free

We work with all your favourite brokers and apps

Sharesight integrates with hundreds of brokers and finance apps, including CommSec, CMC Markets and Selfwealth.

View our partners

500

k+

700

k+

200

Plans & Pricing

Start by tracking up to 10 holdings for free! Then upgrade to a premium plan at any time to track additional holdings or portfolios, and unlock advanced features. And as a bonus, your Sharesight subscription may be tax deductible. *

Free

$0

Forever

Starter

$19

AUD per month

billed annually

$25.33 AUD billed monthly

Investor

$29

AUD per month

billed annually

$38.67 AUD billed monthly

Expert

$49

AUD per month

billed annually

$65.33 AUD billed monthly

Don't just take our word for it

Over 500,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

Frequently Asked Questions about CGT and Sharesight

We understand that Capital Gains Tax (CGT) can be complex, especially when dealing with investments like shares. Here are some frequently asked questions to help you understand CGT and how Sharesight can simplify the process: