ASX financial sector trades due to Banking Royal Commission

The much awaited and anticipated Banking Royal Commission report was released on 4 February 2019 around 4:45 PM. If you have read the recommendations in the report, chances are your response fall in one of two categories, either: "that’s the way to go" or “is that it?”, with seemingly more people in the latter camp!

We have a reasonable sample of retail investors tracking their investments with Sharesight. So let’s gauge what their reaction to the Banking Royal Commission report was by looking at the trades made in finance stocks, both before and after the report’s release.

ASX financial sector trades and Banking Royal Commission

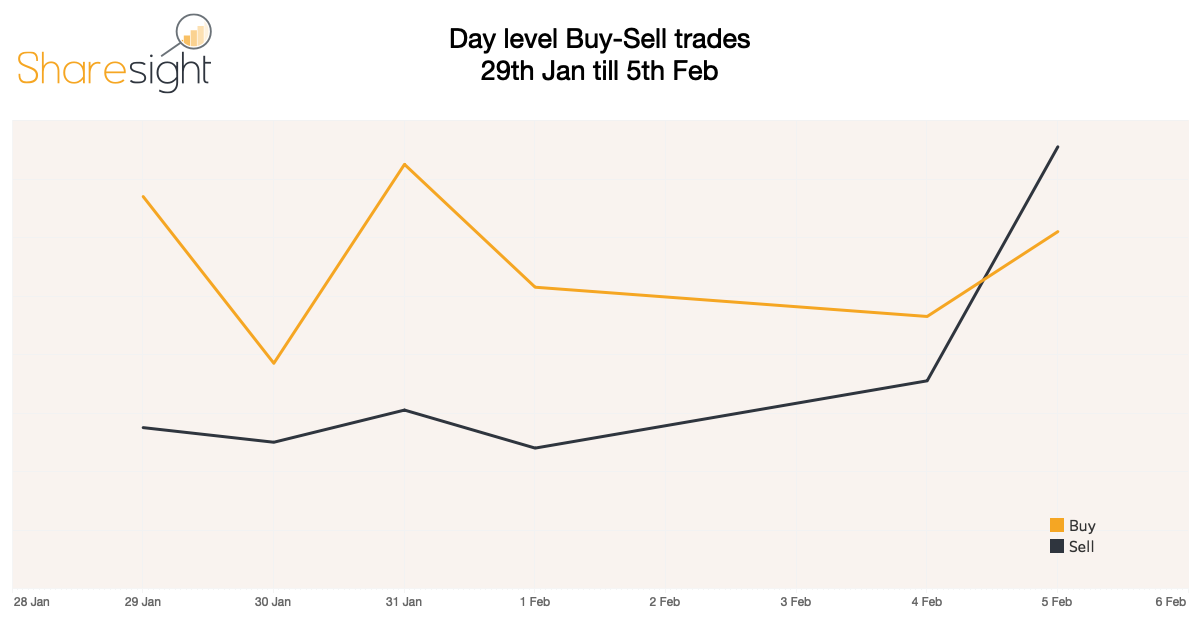

Before the announcement, we see that the buying activity outpaces the sell activity (which is typical for Sharesight users on average), but on 5 February after the report was released, selling activity outpaces buy trades by our user base.

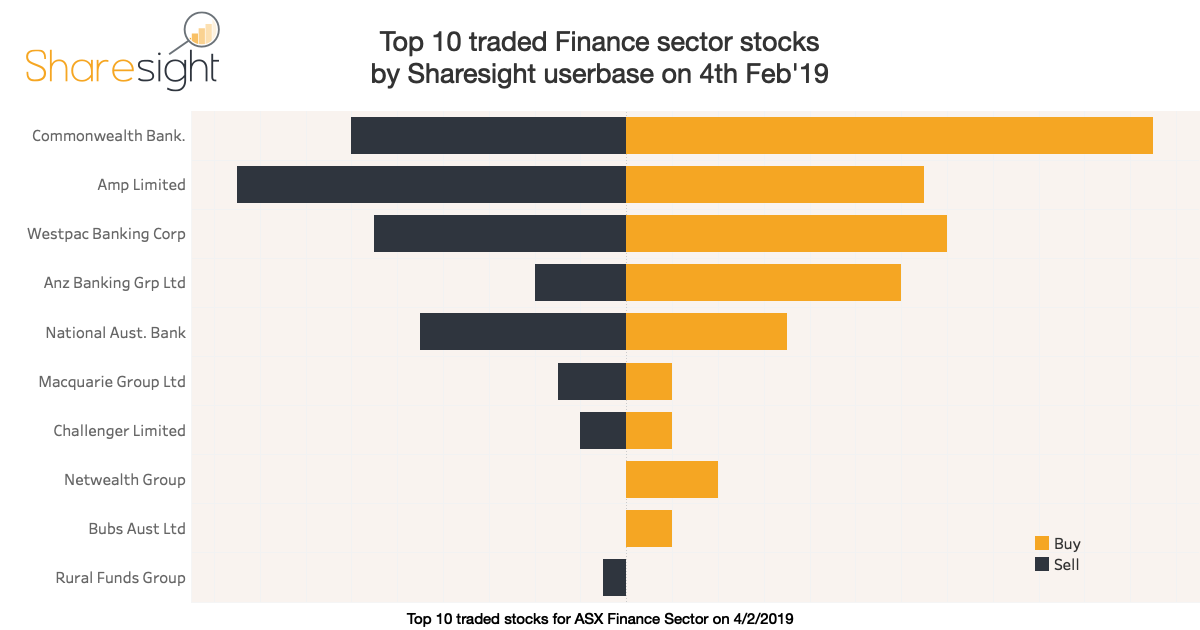

ASX financial sector trades before the Banking Royal Commission report

On the day leading up to the Banking Royal Commission’s report disclosure, Commonwealth Bank, Westpac and ANZ had more buy trades, but AMP and NAB had more sell trades and these made up the 5 most-traded financial stocks by the Sharesight user base.

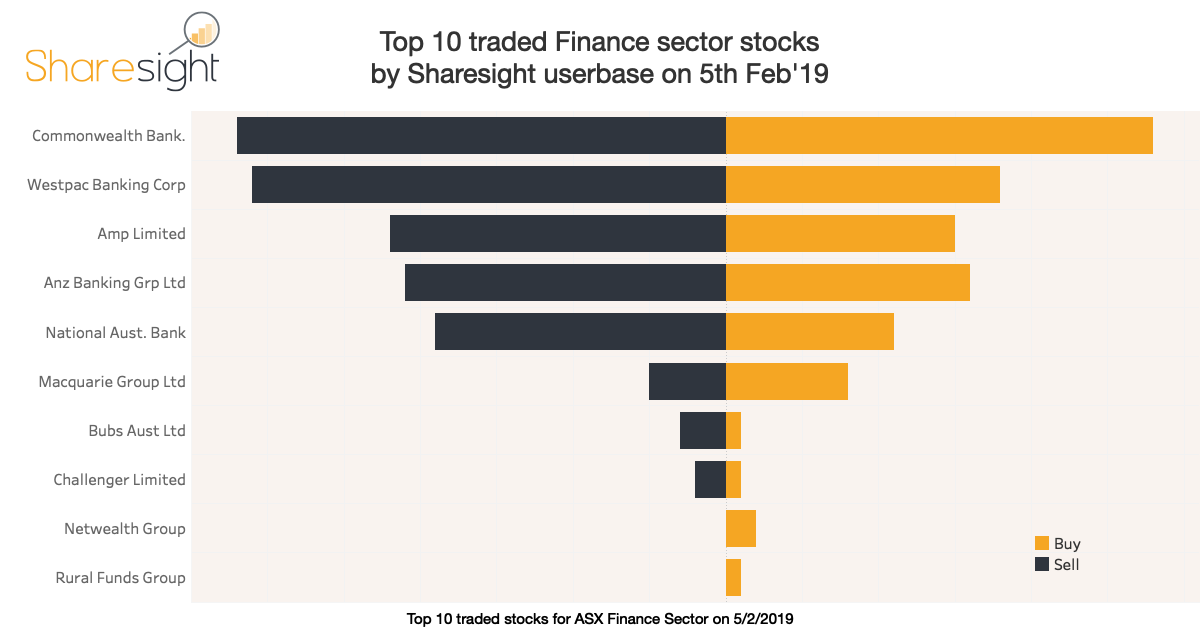

ASX financial sector trades after the Banking Royal Commission report

Stock prices by end of day on 5 February went up for all of the big four banks: with ANZ 6.5%, CBA 4.69%, WBC 7.36%, NAB 3.91% and for AMP by 9.95%. Once again, these stocks made the top 5 most-traded financial stocks for the Sharesight user base on that day, but with more sell trades seen than usual, with investors possibly locking-in these strong gains based on the report’s findings.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.