Division 296 tax: Essential strategies for SMSF trustees and advisors

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Last month, we hosted a webinar with Meg Heffron, managing director and co-founder of Heffron, a company that specialises in SMSF services and administration.

In this webinar, Meg discusses the details of the proposed Division 296 tax, answering common questions and modelling different scenarios for tax reduction. (More information about the tax is also available on the Heffron website.)

For those who could not attend, we provide the full video below, as well as a short summary of some of the key points.

What is Division 296 tax?

Division 296 tax is a proposed additional tax that would apply to individuals with superannuation balances exceeding $3 million. Set to begin in the 2025-26 financial year, this tax is designed to impose an extra 15% tax on part of the super earnings allocated to individuals who are above the $3 million threshold.

“It's only paid if you've got $3 million at the end of the year,” notes Meg.

“What you had during the year can be anything. So someone who has exactly $3 million at the end of the year, no tax to pay, no matter how big their balance was during the year.”

She also notes that this is an individual tax, meaning that even couples in the same fund are not grouped together. In this case, a couple with total super balances of $4 million, $2 million each, would not be subject to Division 296 tax.

Another common question is whether the $3 million threshold will change in the future.

According to Meg, the proposed law doesn't include any automatic indexation. For now, we can consider it like personal tax brackets — it will only go up if the Government decides to increase it.

How can SMSF members reduce their tax liability?

Of course the most common question is what SMSF trustees can do to avoid this new tax, and whether it makes more sense to leave their money in their super account or to take some of it out.

“The real problem with Division 296 tax is that tax on unrealised gains,” says Meg.

“And that's got a really big problem with it in that it brings tax forward. It means if your share portfolio is steadily going up, you're paying what is effectively a capital gains tax all the way along, even though you haven't actually sold the assets.

“You've got to think not only about what happens as your portfolio is growing, but also what will happen when you sell something at the end? And at that point, being in super is awesome because super funds pay capital gains tax at 15%, but they only pay it on two thirds of the gain. So effectively it's 10%. And if you've got a pension in your super fund, it's a little bit lower.

"Outside super though, if you think about how capital gains are taxed, when you eventually sell things, if you're a top marginal rate payer, you'll pay the top marginal rate, 45%. You’ll often only pay tax on half the gain but you’ll also have to pay the Medicare Levy – effectively the tax rate works out to be 23.5%.

“So that makes it tricky, right? We've got this problem. Division 296 tax is going to make us pay more tax early, but less tax later, and super funds pay less tax at the end. So how do they stack up? Which one is better overall? And this is a classic superannuation person answer — it depends. There are actually lots of different factors.”

Meg goes on to delve deeper into the potential strategies trustees can use to reduce their tax, using the typical Heffron client as an example. See the full webinar below:

About Meg Heffron

Heffron Managing Director Meg Heffron, has been working exclusively in SMSFs since 1998. She is one of the few actuaries to work in all areas of SMSF practice. Her passion is turning technical knowledge about SMSFs into practical solutions that accountants and advisers can use to help their clients and grow their businesses.

She is a sought-after speaker at events for industry professionals and their clients, a regular contributor to the Australian Financial Review, The Australian and SMSF trade publications and a trusted source in the development and implementation of superannuation policy via government and regulators.

Track your SMSF with Sharesight

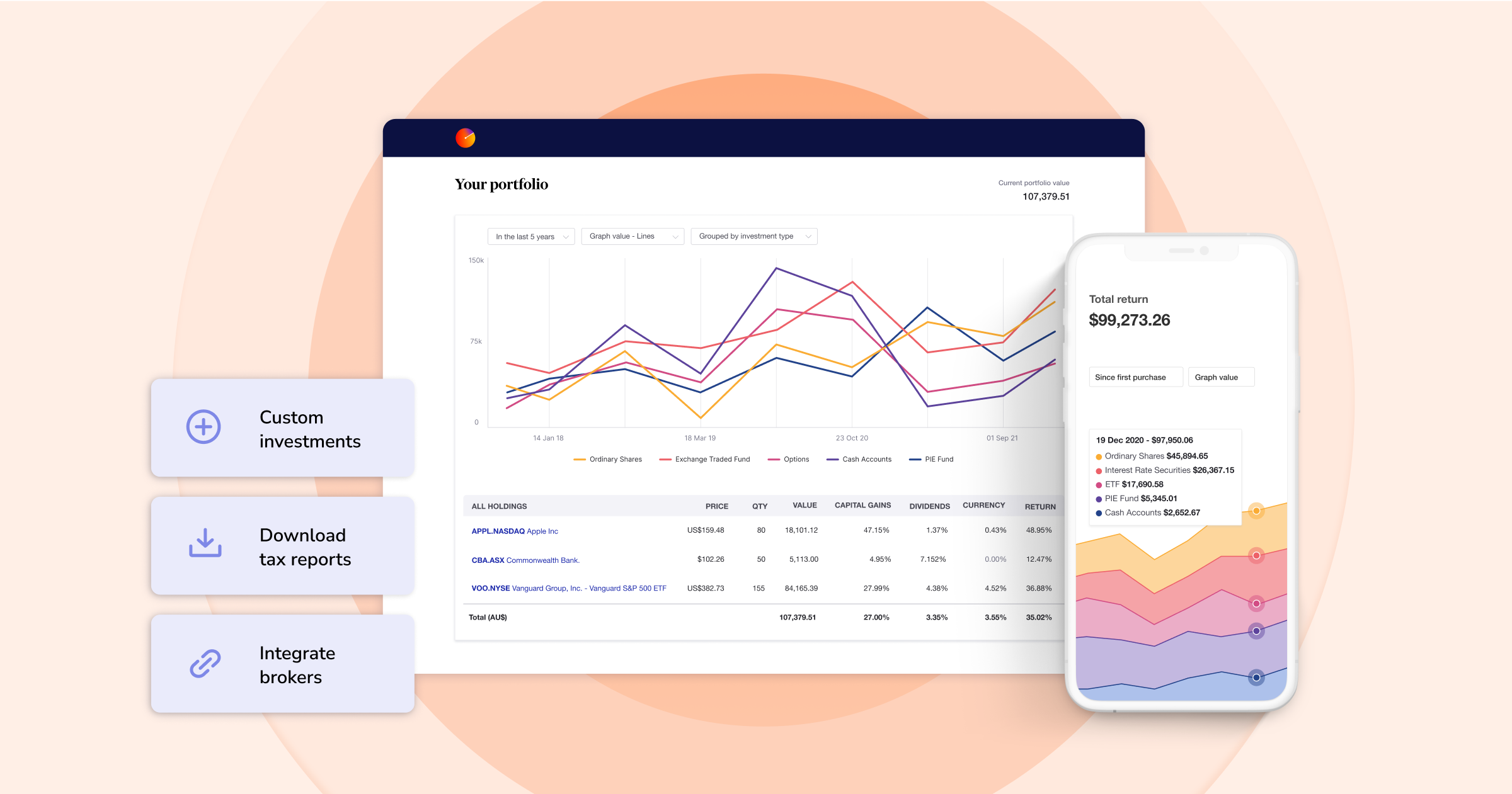

Join over hundreds of thousands of investors tracking their investments with Sharesight. Built for the needs of SMSF trustees, with Sharesight you can:

- Organise holdings according to your documented SMSF asset allocation and investment strategy, providing valuable insights throughout the year

- Easily share SMSF portfolios with accountants or financial professionals to make admin and tax compliance a breeze

- Track SMSF investment performance with prices, dividends and currency fluctuations updated automatically

- Run powerful tax reports built for Australian investors, including capital gains tax, unrealised capital gains tax, and taxable income (dividend income)

Sign up for a free Sharesight account and get started tracking your SMSF investments today.

FURTHER READING

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.