How to calculate your 2017 FIF income

NOTE: There is a newer version of this article. See How to calculate your NZ FIF income for more information.

When it comes to investing, tax reporting can be a real hassle. This is especially true for New Zealand residents with offshore holdings. That’s because there are special tax requirements for investors with certain types of overseas investments -- also known as foreign investment funds.

What is a foreign investment fund (FIF)?

As stated by the New Zealand Inland Revenue Department (IRD), a foreign investment fund (FIF) is an offshore investment held by a New Zealand-resident taxpayer who holds:

- less than 10% of the shares in a foreign company

- less than 10% of the units in a foreign unit trust

- between 10% and 40% of the shares in a foreign company which is not a CFC

- an interest in a life insurance policy where a FIF is the insurer and the policy is not offered or entered into in New Zealand

It does not include interest earned from term deposits, bonds, debentures or money lent.

Calculate your 2017 FIF income

As a result of these IRD rules, investors who have certain types of overseas investments may have FIF income. And while the IRD has an online tool that lets you check if you are required to do anything under the FIF rules, if you determine that you do, the actual calculations can get quite complicated.

The good news is that investors on a Sharesight NZ Expert or Sharesight NZ's professional plan plan can run their own FIF Report in just a few clicks. This lets you:

1. Determine which of your holdings are subject to FIF

Before we go any further, here’s a bit of background information:

- In previous years, the IRD published an Australian share exemption lists -- also known as the IR871.

- The list indicated whether an Australian company listed on the ASX (excluding listed investment companies) was exempt from the FIF rules for that financial year.

- Due to copyright restrictions, the IRD can no longer publish this list.

- Instead, the IRD has provided the Australian share exemption list 2017 calculator.

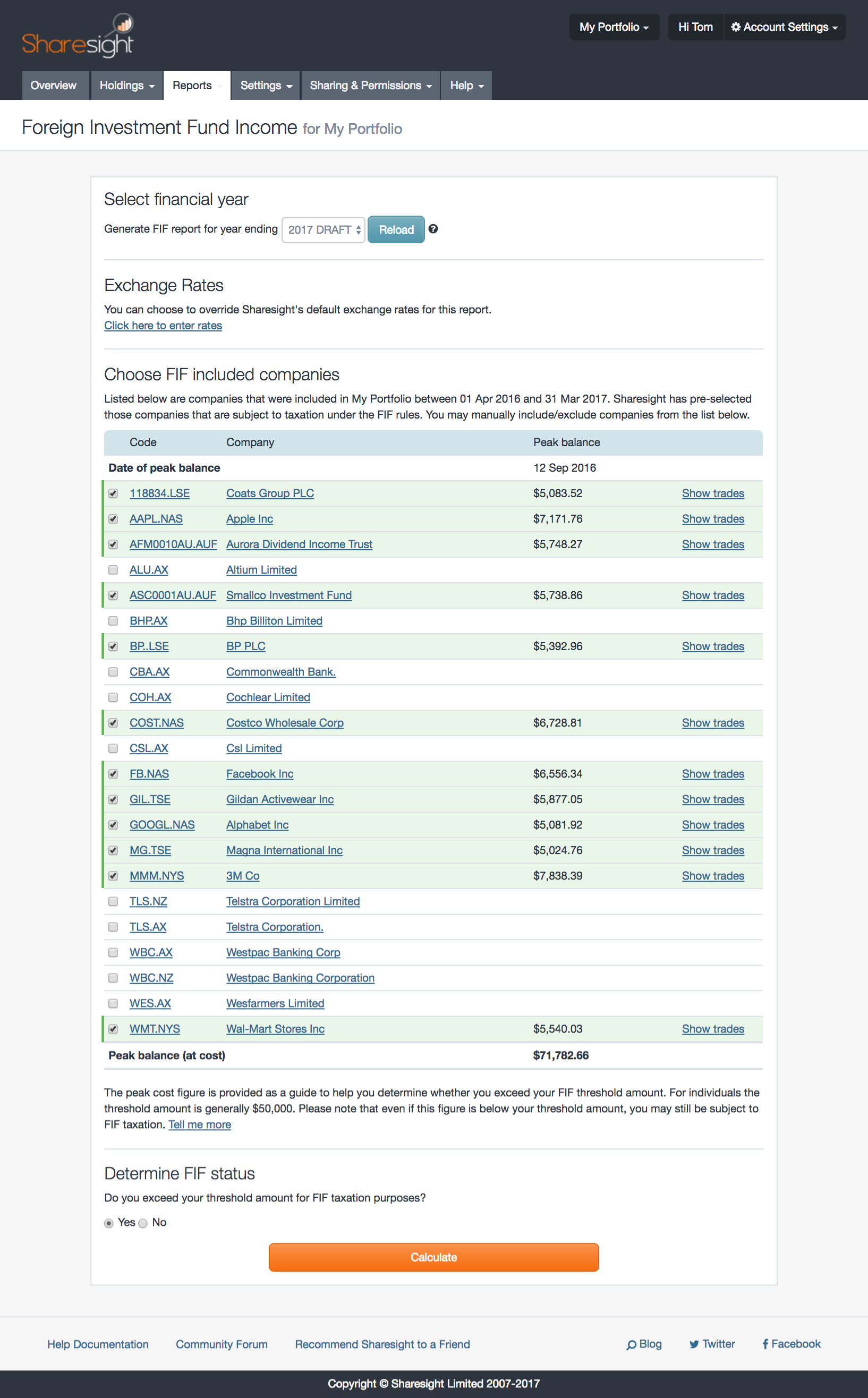

To simplify this process, Sharesight automatically excludes any holdings within your portfolio which were included in the Australian share exemption list 2016 IR871:

NOTE: We recommend double-checking your FIF included companies against the IRD calculator. If you notice any holdings that are not automatically included/excluded, please leave a message on our dedicated forum topic: NZ investors: calculate your 2017 FIF income.

2. Calculate your 'peak holding balance'

This determines whether you exceed the FIF threshold ($50,000 for individuals). Based on the example above, the answer is "yes" because the peak balance is $71,782.66.

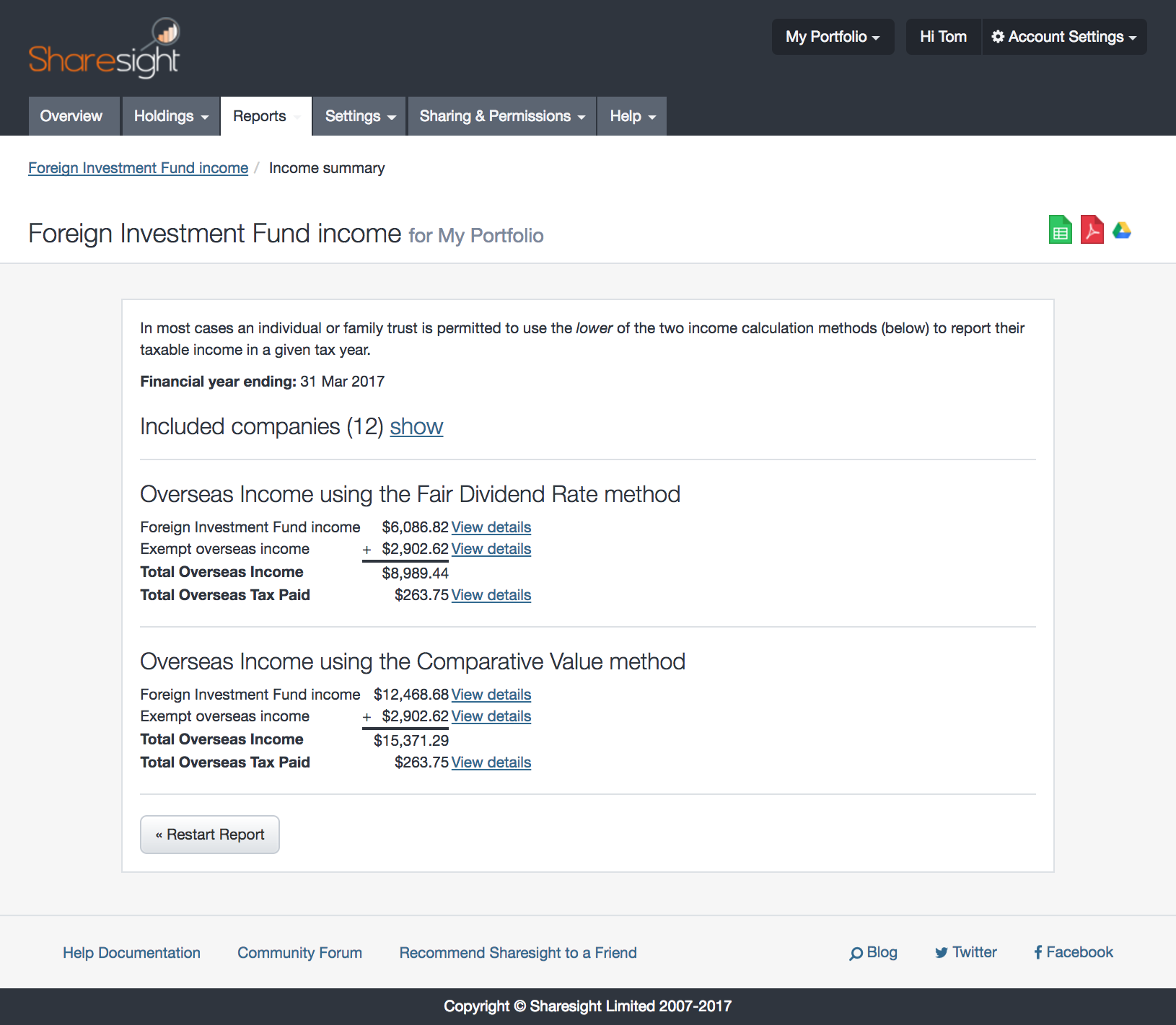

3. Calculate your FIF income

If you determine that you exceed the FIF threshold, clicking the "Calculate" button will automatically calculate your FIF income under both the Fair Dividend Rate Method and Comparative Value Method (generally you are permitted to use either methodology, but check with your accountant if you are unsure as there are some exceptions):

Get your FIF Report today

By compiling all your portfolio data in one place, Sharesight eliminates the paper-chase and headaches normally associated with performance and tax reporting. To get started, simply signup for a FREE Sharesight account and add your holdings. From there you can upgrade to an NZ Expert plan for only $39/month to get INSTANT access to your FIF Report, as well as other advanced features including:

- Traders Tax Report

- Diversity Report

- Benchmarking

- FREE email support

Why struggle with maths equations and complicated tax rules when Sharesight can calculate your FIF income for you, in just a few clicks? Our Expert and Pro plan clients agree:

I used the FIF reports for the first time and it greatly assisted the preparation of 2013/14 years tax returns. Sent copies of report to IRD with the returns and it was no problem. Well done Sharesight and well worth upgrading to include this reporting facility.

RICHARD MADDREN — SHARESIGHT CLIENT SINCE 2008

We have been using this great app for several years. It makes it easy to review portfolio performance, keep track of income and manage those awful FIF calculations at tax time. The subscription is easily recovered in time savings at year end...

MARGARET HOLMES — SHARESIGHT CLIENT SINCE 2010

MORE INFO

- Forum -- NZ investors: calculate your 2017 FIF income

- Help -- FIF Report

FURTHER READING

- 7 reasons why Sharesight is better than a spreadsheet

- How much money can Sharesight save you?

- How your broker’s performance numbers mislead you

Important Disclaimer: We do not provide tax advice. Make sure you seek appropriate tax advice before implementing the ideas in this post.

Announcing the Sharesight Fintech Scholarship's 2024 winner

We are pleased to announce the 2024 winner of the Sharesight Fintech Scholarship, Temiremi Egwuenu, who is studying Applied Finance at Macquarie University.

Effortlessly track clients’ trades with Sharesight and Desktop Broker

Sharesight has integrated with Desktop Broker, allowing advisers to have their clients’ trading data automatically synced to Sharesight’s portfolio tracker.

Red flags: When should you avoid investing in an asset?

This article explores some of the “red flags” you should look out for when considering an investment for your portfolio.