Red flags: When should you avoid investing in an asset?

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Investing is a great tool for building wealth, and one that we should all be utilising to the best of our ability, regardless of our financial position or stage of life. There are many ways to do this, from stocks, ETFs and bonds to hedge funds, real estate, angel investing and so much more. And because we all have different financial situations, risk profiles and preferred investing strategies, there is no one “right way to invest”. Any of these asset classes could potentially produce good returns, provided you make an educated investment.

In making an educated investment, there are many factors you may wish to consider — fundamental, technical or otherwise. These are all useful, but it can be overwhelming to keep track of this laundry list of requirements, especially if you are a frequent investor or you’re in a situation where you need to make quick decisions.

Sometimes it can be useful to consider things from the opposite perspective. Rather than thinking about what makes a good investment, instead consider what makes a bad investment. With that in mind, this blog explores some of the “red flags” to look out for when considering an investment.

1. It doesn’t add diversity to your portfolio

Warren Buffet once famously declared, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

If you’ve worked with investing in a professional capacity then this may make sense for you. But for those of us who lack the time or expertise, diversification is simply a smart way to hedge our bets against unpredictable economic and market events.

So if you’re an expert on commodities for example, then you may find focusing solely on raw materials to be the simplest and most profitable investing strategy for you. But for many of us, a better choice would be to invest in a range of assets that add diversity to our portfolio, or even an ETF that provides exposure to multiple assets in a particular index or industry.

2. It lacks liquidity

Private investments like real estate, venture capital, hedge funds and angel investing can be a great addition to your overall portfolio. However, it should be noted that these are rather illiquid investments, meaning that it could take months to sell them off and get your money back, should you choose to do so.

Investments like publicly traded stocks, ETFs or mutual/managed funds are much more liquid by comparison, with the ability to get your money back within a few days (typically). Of course, whether or not this is important to you is entirely dependent on your financial situation and your reason for investing. If the liquidity premium is anything to go by, it could even be more profitable to invest in more illiquid assets. Whether you want to take that risk however, is up to you.

3. It’s expensive to acquire and own

Real estate is a prime example of this. The details are contingent on your country of residence, but potentially you’re looking at legal and conveyancing costs, stamp duty, transfer costs, interest fees (if you’re on a mortgage), ongoing repair costs and so much more.

And depending on the market, you may not always have consistent rental income, which complicates things even further. That being said, many people choose to get into the real estate market despite these additional costs because once again, the returns have the potential to be higher.

Managed/mutual funds are another good example. All funds come with a management fee, typically an annual fee of around 1% of the average funds under management. However, there are many funds whose fees are 2% and higher. As you can imagine, investing in these more expensive funds can really add up.

For example, if you had $50,000 in a fund with an annual management fee of 2%, this would equate to $1,000 in fees each year. That’s $1,000 that could be potentially better invested elsewhere, and this figure will only compound over time as your returns grow.

Essentially, if you’re going to invest in a fund with high fees, you will need higher returns to justify this. And higher fees don’t necessarily mean better fund performance, so be sure to do your research and consider the impact of fees before getting into any managed investments.

4. It lacks transparency

When you buy shares in a publicly traded company, that company is required to provide quarterly financial reports to stakeholders, and their financial records must comply with legally defined accounting standards. In that way, there is a certain level of transparency that you can expect when you invest in assets on the share market.

Private markets and alternative investments aren’t necessarily held to the same standards, which can make it harder to make informed decisions about investing in these assets. So if you do wish to invest in these assets, ponder how important it is to have access to these transparent financial records, and whether you are prepared to do your own research.

5. You don’t understand the asset you’re investing in

This is perhaps the biggest investing red flag. It doesn’t matter how well-performing an asset seems to be — there is no ‘sure thing’ in investing. Take the recent ‘buy-now-pay-later’ stock bubble as an example, or the spectacular rise and fall of Bitcoin. What goes up will inevitably come down at some point, and you should only invest in assets that you understand and can see the value in, not just whatever is the subject of the latest investing hype.

That’s not to say that you should avoid these assets, but you should always do your research, consider how these assets fit with the rest of your portfolio and whether they align with your investing strategy. It’s easy to get caught up in the ‘noise’ in the market and end up making decisions with emotion rather than logic. To avoid this, before you make an investment, ask yourself: ‘What unique value does this asset bring to my portfolio?’ and ‘Do I understand the asset (and its market) well enough to evaluate it going forward?’

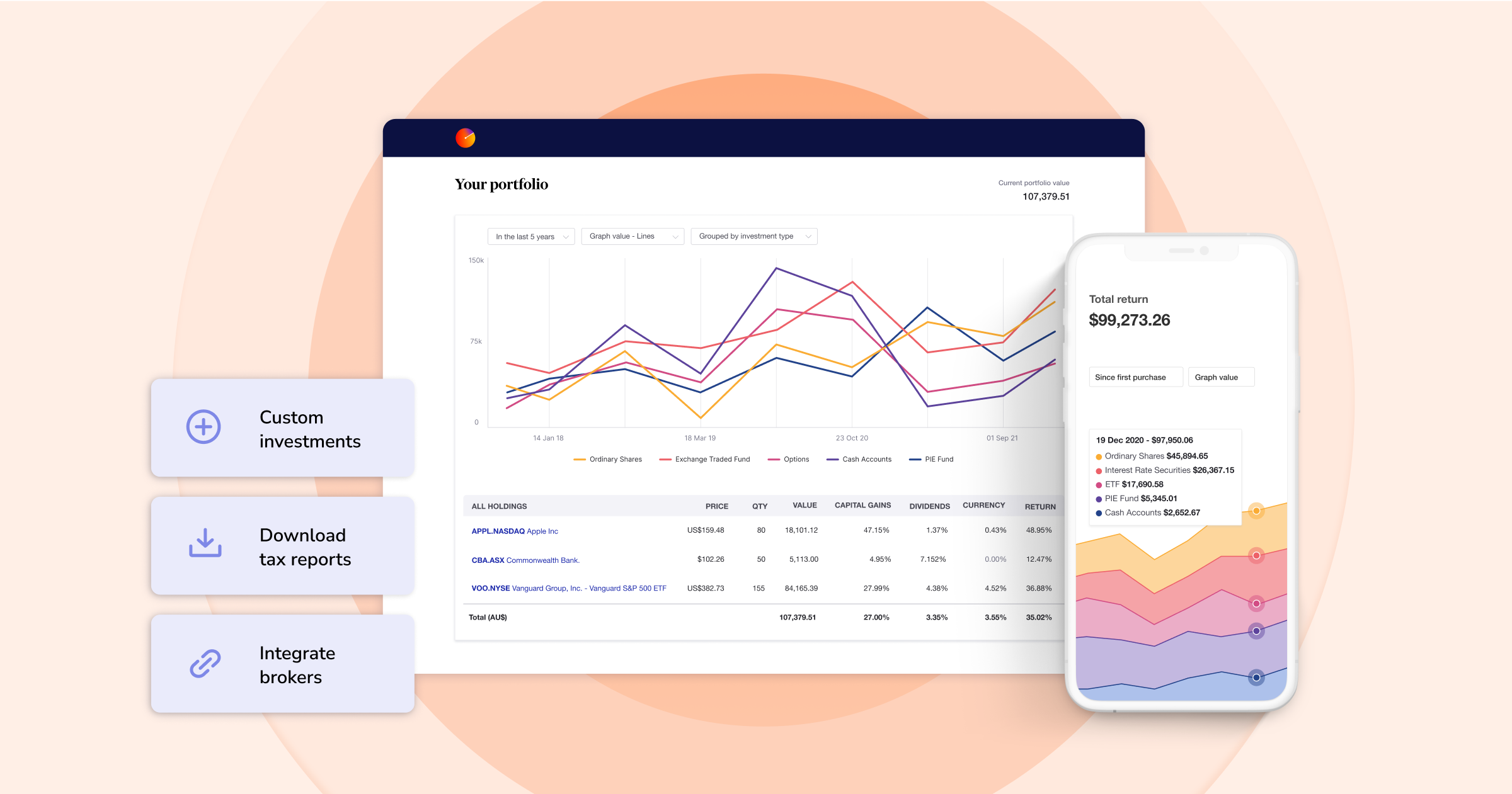

Become a smarter investor with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to track their portfolio and make smarter investment decisions. Sign up today so you can:

- Track all your investments in one place, including stocks in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

- Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight product updates – May 2024

This month's focus was on expanding our broker support and streamlining the customer onboarding journey, as well as additional reporting and holding functions.

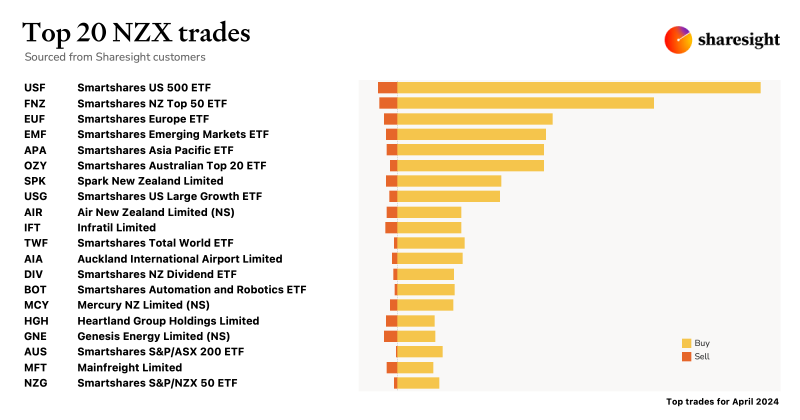

Top 20 NZX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX.

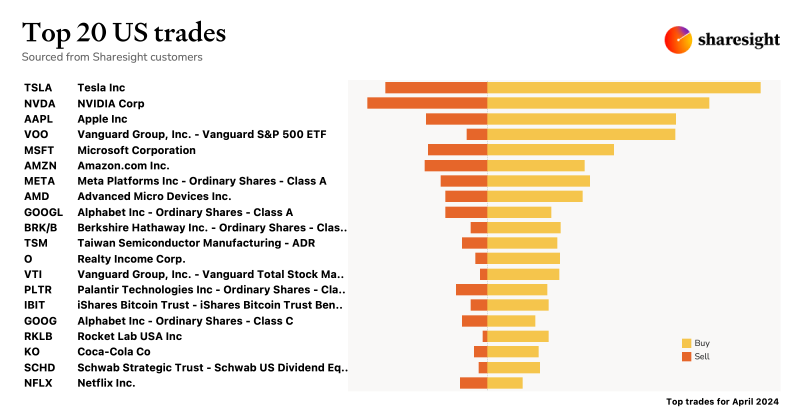

Top 20 trades in US stocks by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks.