How to handle the Afterpay and Touchcorp merger

In February 2017, ASX-listed payments fintech Afterpay (AFY) announced a proposed merger with the payments firm, Touchcorp (TCH). Both firms had enjoyed a close and productive relationship, with Touchcorp developing the technology behind Afterpay’s highly successful ‘Buy Now, Pay Later’ offering. The merger was described as a ‘natural evolution’ of the existing relationship between the two companies, allowing the new business, Afterpay Touch Group, to take advantage of revenue opportunities, through a more integrated combination of Afterpay’s growing retail network and Touchcorp’s strong technology offering.

As part of the merger, eligible Afterpay shareholders received 1 share in the Afterpay Touch Group, for every 1 Afterpay share they held. For Touchcorp shareholders, they received 0.64 Afterpay Touch Group shares for every 1 Touchcorp share they held.

How to handle the Afterpay-Touchcorp merger in Sharesight

If you held either Afterpay (AFY.ASX) or Touchcorp (TCH.ASX) shares, and have now received shares in the new Afterpay Touch Group (APT.ASX), Sharesight makes it easy to handle corporate actions, track subsequent performance and account for any potential capital gain or loss.

From all accounts, this merger is eligible for rollover relief, although specifics are subject to the release of an official ATO class ruling. We will update this post accordingly, if any changes are required!

If you held Afterpay (AFY.ASX) shares:

- Sign up for a FREE Sharesight account and add your Afterpay holding.

- From the ‘Holdings’ tab, use the search bar to locate your Afterpay holding. You can also find this on the ‘’Overview’ page.

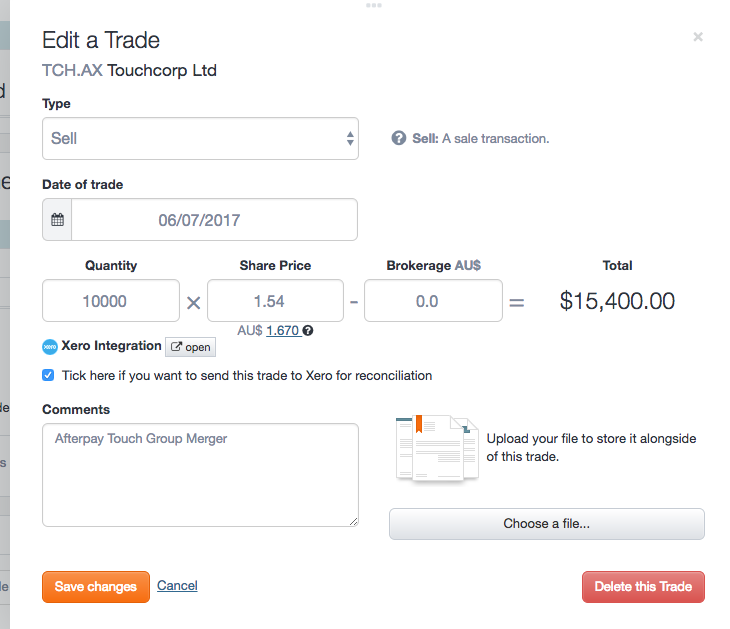

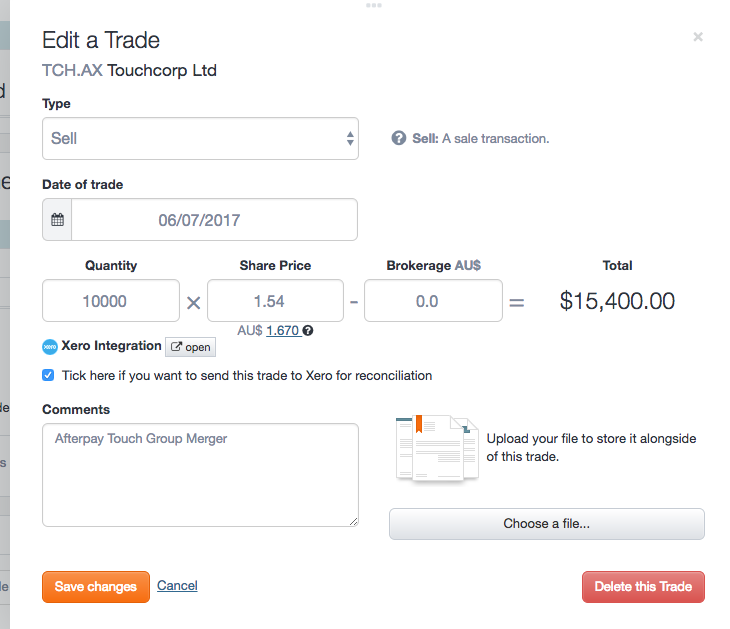

- Once on the ‘Holdings’ page for your Afterpay holding, click on the ‘Enter a New Trade or Adjustment’ button. From the transaction type drop-down list, choose ‘Sell’. The date we are using is the ‘Implementation Date’, 6th July 2017 (06/07/2017).

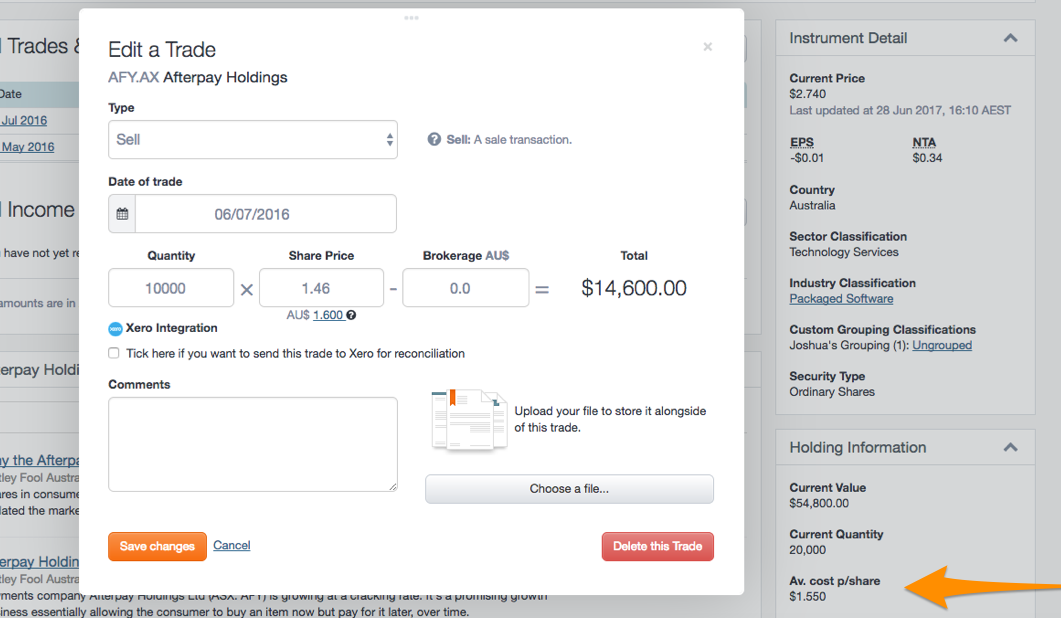

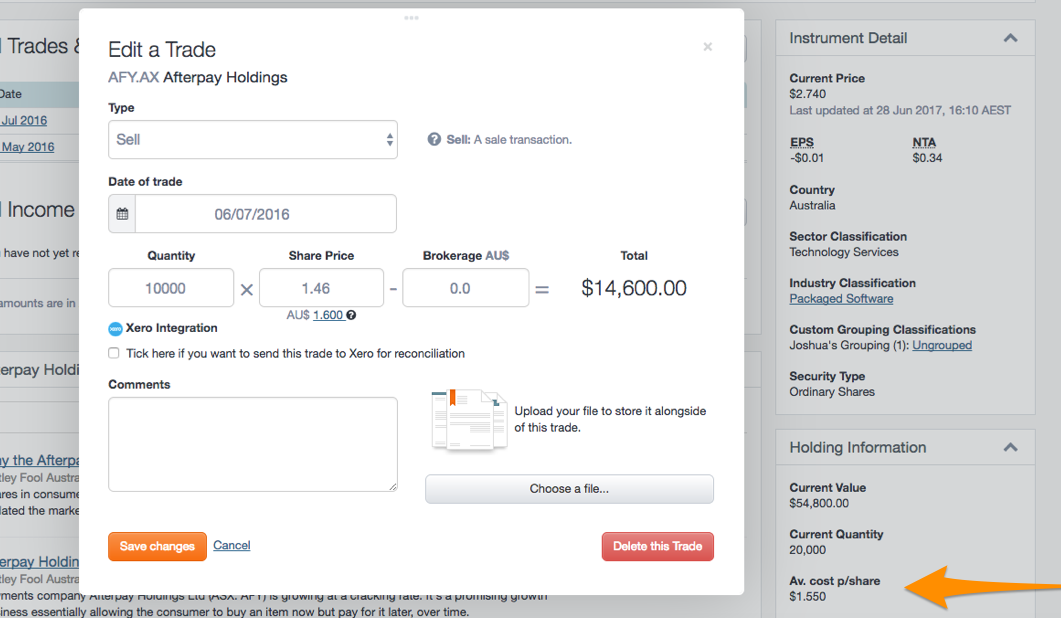

- Enter your full Afterpay quantity, e.g. 10,000. If rollover relief is chosen, the ‘Price’ should reflect your existing Afterpay cost-base, e.g . To find your cost-base per share, look for the ‘Holding Information’ tab on the right-hand side of the ‘Holdings’ page per the below screenshot. If you have purchased Afterpay in more than one parcel and/or have sold some shares, it is best to obtain your cost base information from the Historical Cost Report. Look for the ‘Closing Balance’ and divide that figure by the ‘Closing Quantity’.

Entering the ‘Sell’ at your original cost price will ensure that no capital gain is recorded against your original Afterpay holding. Note: Write down the ‘Total’ figure, as this will be used when adding the new Afterpay Touch Group holding!

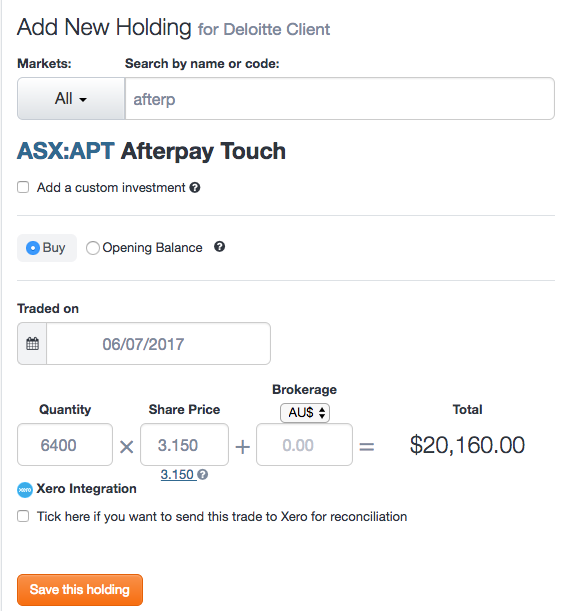

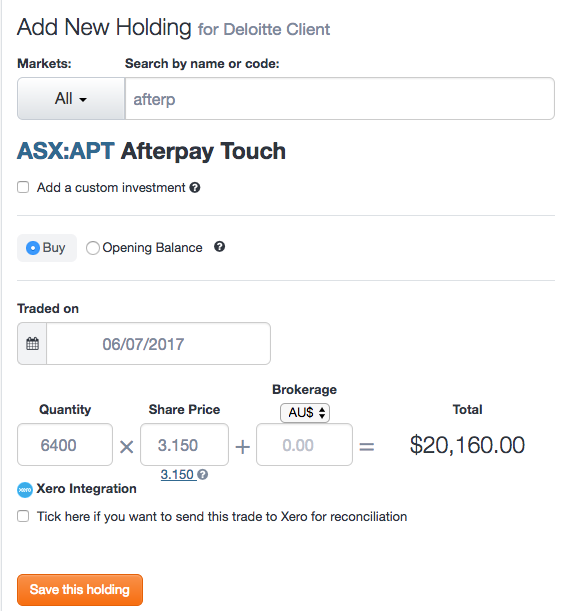

Entering the ‘Sell’ at your original cost price will ensure that no capital gain is recorded against your original Afterpay holding. Note: Write down the ‘Total’ figure, as this will be used when adding the new Afterpay Touch Group holding! - Once you’ve done this, from the top of the page, click the ‘Add or Import Holdings’ button. You’ll be taken to a new page, from which you’ll be able to enter the details of your new Afterpay Touch Group holding. To start, we suggest using an ‘Opening Balance’ transaction. This allows you to enter a cost-base for tax purposes, as well as a market value for the Implementation Date, allowing you to correctly track performance for your holding in the new company.

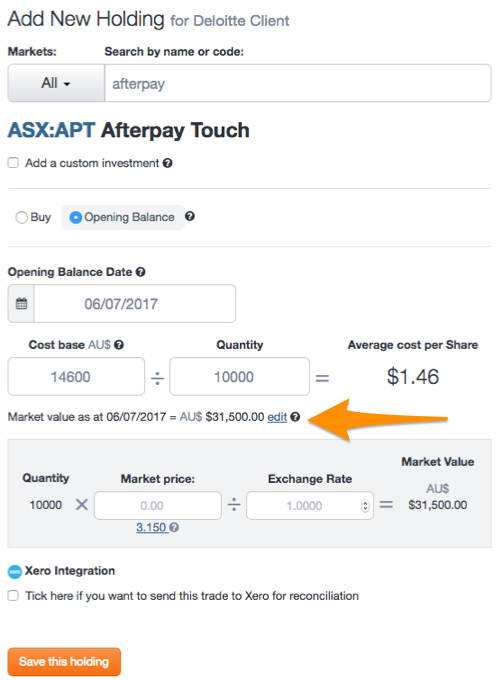

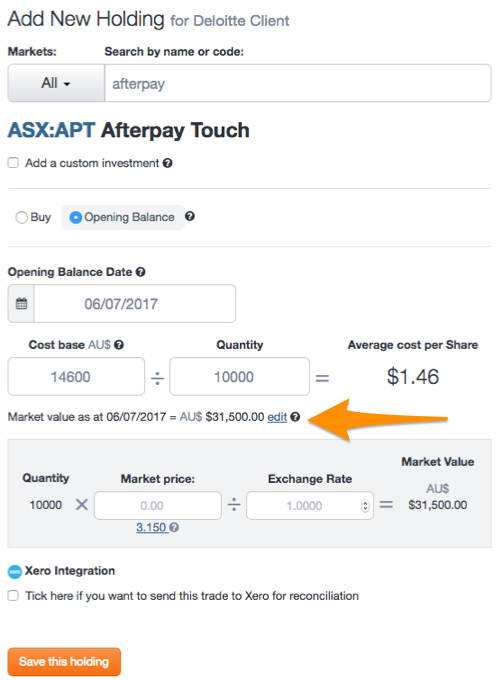

- For the ‘Opening Balance’ date, use the ‘Implementation Date’, 06/07/2017. The ‘Cost Base’ should be the ‘Total’ you have noted from Step 3, and the Quantity the same as your original Afterpay holding. Just below the ‘Cost Base’ and ‘Quantity’ fields, you’ll see details regarding ‘Market Value’. Click the ‘Edit’ button - in the new ‘Market Price’ field, you can use the price Sharesight provides, $3.15, or a market price specified by Afterpay. We’ve used the closing price for Afterpay Touch Group on 06/07/2017, $3.15. Once you’ve filled in these details, click ‘Save This Holding’:

If you held Touchcorp (TCH.ASX) shares:

- Sign up for a FREE Sharesight account and add your Touchcorp holding.

- Repeat the same steps, 1 - 4, as seen in the Afterpay holders section above, for your Touchcorp shares instead. Remember to make a note of the ‘Total’ figure when entering the ‘Sell’ transaction for Touchcorp. This will become your cost base.

- Once you’ve clicked on the ‘Add or Import Holdings’ button, and have selected the ‘Opening Balance’ transaction type, enter the ‘Total’ that you’ve noted, in the cost base field. When entering the ‘Quantity’, remember that Touchcorp shareholders received 0.64 Afterpay Touch Group shares for every 1 Touchcorp share. For example, if you held 10,000 Touchcorp shares, you would have received 6,400 Touchcorp shares. The cost base figure will remain the same as your ‘Total’ though.

Again, remember to enter a ‘Market Price’, so that Sharesight can correctly track performance of your holding in the new company, from the Implementation Date going forward. Click ‘Save This Holding’.

Again, remember to enter a ‘Market Price’, so that Sharesight can correctly track performance of your holding in the new company, from the Implementation Date going forward. Click ‘Save This Holding’.

All done! You’ve now accounted for the Afterpay and Touchcorp merger. As mentioned above, these steps are applicable if you’ve opted for rollover relief.

Note using this approach means that your CGT Report will not account for any CGT discount if you choose to sell your newly acquired Afterpay Touch Group shares in the next 12 Months. For tax purposes, you may consider backdating the opening balance date as required when you run a CGT report, or downloading the CGT report into Excel format and making a manual adjustment.

No Rollover Relief?

If you will not be opting for rollover relief in the treatment of your Afterpay or Touchcorp shares, concerning this merger, there are a couple of different steps to take.

Firstly, when entering a ‘Sell’ trade for your Afterpay shares, the ‘Sell’ price will need to reflect the ‘Market Price’ of your new Afterpay Touch Group shares, as at the Implementation Date. At the time of writing, there has been no official indication of what price to be used, so we suggest using the closing price for the 6th of July, 2017, which was $3.15. If you held Touchcorp shares, you will need to enter a ‘Sell’ price that is proportionate to the ratio that determined your new Afterpay Touch Group quantity - our suggestion is: Price = 0.64 x $3.15 = $2.016.

This will allow you to correctly reflect the proceeds received for your Touchcorp shares, which is the value of your new shares. Any capital gain or loss, as a result of this transaction, will be reflected in the Capital Gains Tax report.

The second difference, if not opting for rollover relief, is that when entering the new Afterpay Touch Group holding, the cost base should reflect the ‘Market Value’. You can actually use a Buy transaction in this instance, using your new quantity in Afterpay Touch Group, and the market price of $3.15 (closing price on 06/07/2017).

This will allow you to correctly reflect the proceeds received for your Touchcorp shares, which is the value of your new shares. Any capital gain or loss, as a result of this transaction, will be reflected in the Capital Gains Tax report.

The second difference, if not opting for rollover relief, is that when entering the new Afterpay Touch Group holding, the cost base should reflect the ‘Market Value’. You can actually use a Buy transaction in this instance, using your new quantity in Afterpay Touch Group, and the market price of $3.15 (closing price on 06/07/2017).

Please note that we always advise you to consult your financial advisor or accountant regarding corporate actions, especially for tax purposes, as we are not authorised to provide financial advice. For further information regarding this merger and information on the tax implications, please refer to:

- Official Afterpay Scheme Booklet [pdf]

- Official Touchcorp Scheme Booklet [pdf]

SHARESIGHT HELP

- Help -- Corporate Actions

FURTHER READING

Sharesight nominated for 2025 Wealth Tech Innovator of the Year

Sharesight has been chosen as a finalist in the 2025 Australian Wealth Management Awards, in the Wealth Tech Innovator of the Year category.

Prepare your annual accounts with our historical cost report

Sharesight's historical cost report is a powerful tool for investors who need to prepare annual accounts or financial statements with mark-to-market accounting.

Sharesight product updates – July 2025

This month's focus was on rolling out predictive income forecasting, as well as improved cash account syncing across different brokers and currencies.

Entering the ‘Sell’ at your original cost price will ensure that no capital gain is recorded against your original Afterpay holding. Note: Write down the ‘Total’ figure, as this will be used when adding the new Afterpay Touch Group holding!

Entering the ‘Sell’ at your original cost price will ensure that no capital gain is recorded against your original Afterpay holding. Note: Write down the ‘Total’ figure, as this will be used when adding the new Afterpay Touch Group holding!