Sharesight product updates – June 2024

This month saw us deploy the new holdings page to all users by default. While some work continues in this area, our attention is now shifting toward the new features we have long wanted to introduce to this key page. We have also continued to focus on expanded broker support while delivering on improvements to our trade and reporting feature set as set out below.

New functionality / enhancements

- Increased the maximum allowable decimal places on the unit/share price and cost base fields from 6 to 10 and the market price field (used on opening balances) from 4 to 10 decimal places, helping to improve the accuracy of trade creation

- Migrated the historical cost report onto our new reporting architecture, removing timeouts from this report. Work is ongoing to improve the table format of this updated report

- We now display the new holdings page to all users by default, rather than just to beta users. Users will continue to have access to the old holdings page while we tie up the remaining loose ends on this development

- Introduced benchmarking to the performance report, including a benchmark chart that provides a quick visual as to whether a holding or group of holdings has out-performed or under-performed the benchmark.

Broker import functionality

- Added support for Independent Reserve trade file imports

- Added support for St. George bank trade file imports

- Added support for FinecoBank trade file imports

- Added support for English trade file imports from XTB

- Added support for Swedish trade file imports from Nordnet

FURTHER READING

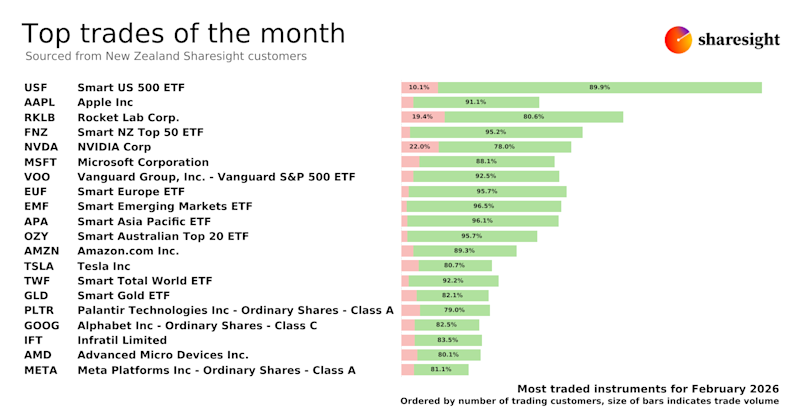

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

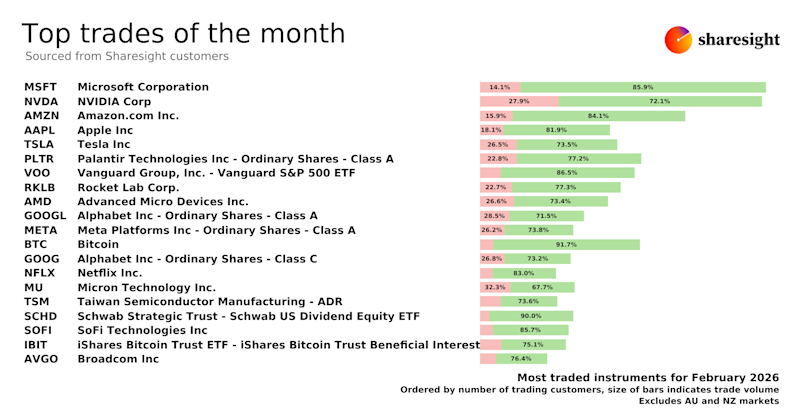

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

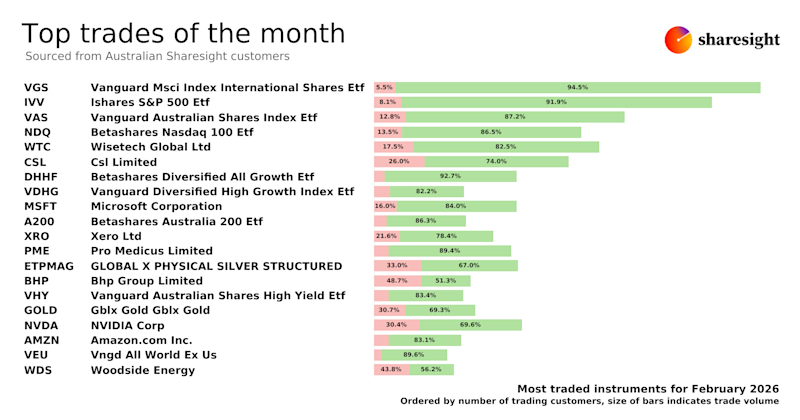

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.