Portfolio sharing is caring

We work with DIY investors every day through Sharesight, our original application, and with accountants and financial advisers through Sharesight's professional plan. A feature that receives little fanfare, but a lot of use is our “share access” feature, which is where our two client bases come together.

So much of financial services is vertically integrated and walled-off from the end client, you the investors, the depositor, the small business owner. Getting hold of your investment data is akin to rocking up at the Google office asking to reorder their search results. As such, one of the original tenants behind Sharesight was to facilitate information flow between investors and the professionals who serve them. We wanted to increase productivity and accountability.

As an DIY investor on the Investor or Expert Plan, you can share access with anyone you’d like. Want to keep your accountant in the loop during the tax year and need a bit of extra guidance on how to treat those partially franked dividends? Go ahead and allow Read & Write access. Want to keep your spouse up to date on your (naturally genius) share picks? Read-Only access would probably be the safest way to go, a.k.a. “marriage preservation mode.”

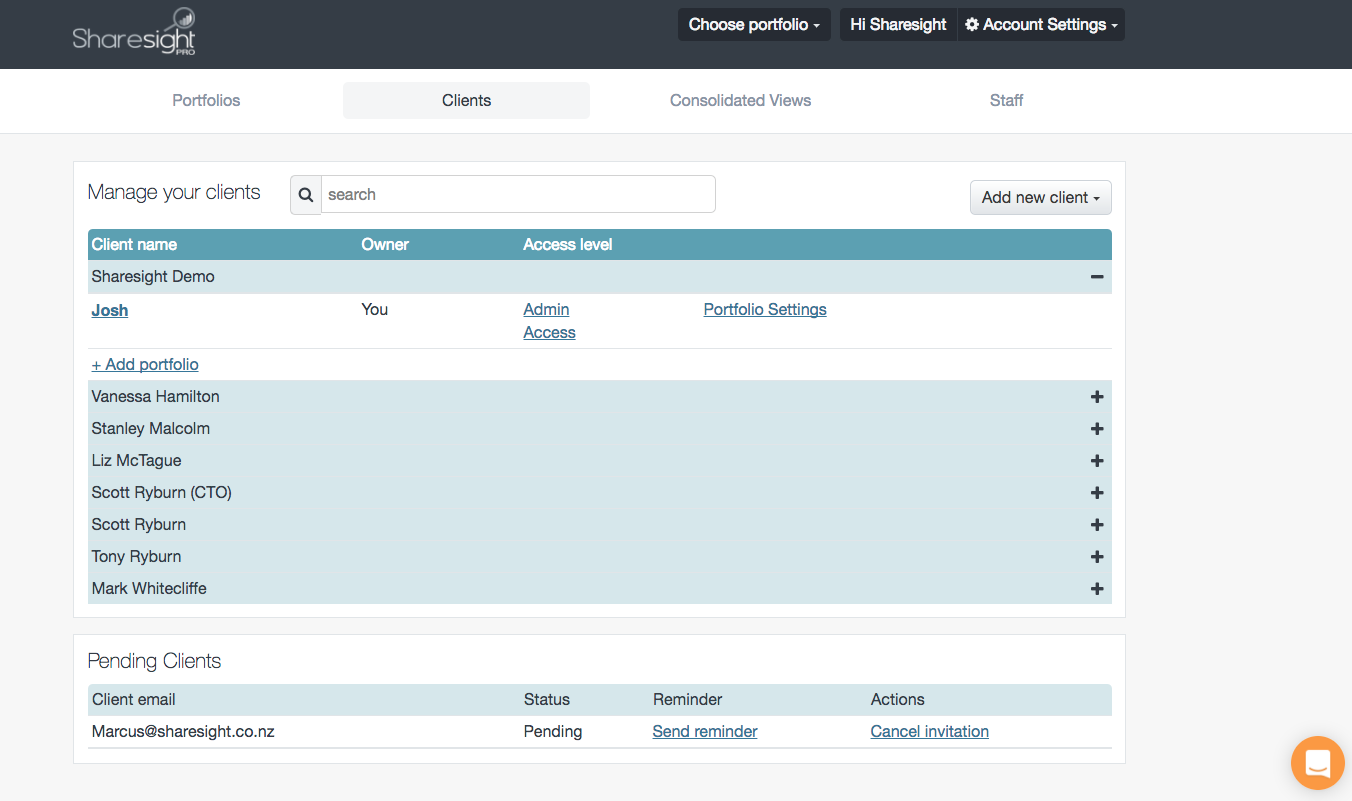

If you’re an accountant or financial adviser on Sharesight's professional plan, not only can you share Read Only or Read & Write access with your clients, but you can set them up to receive portfolio alert emails too. Plus, you create as many staff logins as you’d like for no extra charge.

When we first launched Sharesight's professional plan, we helped early adopters realise the time savings Sharesight afforded. Once client portfolios were set up, everything just ticked forward automatically. Accountants and advisers began to realise that with more time on their hands and with Sharesight as a sales weapon, they could market their services proactively to clients seeking investment accounting help, both the DIY investing crowd and of course, SMSF trustees.

We also discovered that all of a sudden Sharesight's professional plan partners had a few more billable hours to fill, while putting a stop to write-downs caused by the dreaded shoe box full of client trading data.

LEARN MORE

- Help -- Sharing your portfolio

- Help -- Sharing a portfolio with a client

NOTE: Screenshots have been updated to reflect current interface (2019-02-14)

FURTHER READING

Sharesight nominated for 2025 Wealth Tech Innovator of the Year

Sharesight has been chosen as a finalist in the 2025 Australian Wealth Management Awards, in the Wealth Tech Innovator of the Year category.

Prepare your annual accounts with our historical cost report

Sharesight's historical cost report is a powerful tool for investors who need to prepare annual accounts or financial statements with mark-to-market accounting.

Sharesight product updates – July 2025

This month's focus was on rolling out predictive income forecasting, as well as improved cash account syncing across different brokers and currencies.