The unlisted property trust investing essential guide

There are a number of ways to invest in commercial property, ranging from direct investment, private syndicates, ASX-listed real estate investment trusts (REITs), to the focus of this article, unlisted property trusts.

Benefits of investing in a trust structure

There are several key benefits investors gain from using trusts, including:

-

Investors’ funds are pooled, providing access to assets they could not otherwise purchase individually, such as large office buildings or major shopping centres;

-

Protection via professional management of trust;

-

Internal gearing is non-recourse to investors, which means if there is a default, the issuer of the debt (usually a bank) can seize the collateral but cannot seek out the investor for any further compensation. This reduces the risk to each investor and makes them suitable for SMSFs;

-

Regular income stream, with distributions ranging from monthly to six-monthly payments;

-

Investors share in any capital growth, proportionate to their holding in the trust;

-

Potential for tax-deferred income, increasing after-tax returns;

-

Professional management, covering due diligence, debt, property and tenant management;

-

Liquidity (dependent on the structure used); and

-

Only a small investment is required, allowing investors to diversify across properties and managers.

How does an unlisted property trust work?

Unlisted property trusts provide an investment with characteristics most like a direct purchase of a commercial property, with the added benefit of professional management.

As unlisted property trusts are generally priced based on the underlying valuation of their property assets, the value of the investment is primarily influenced by movements in the commercial property market rather than by the broader share market. This can mean less volatility in the investment.

There are two types of unlisted property trusts, open-ended property funds and fixed-term, closed-end property trusts (often referred to as syndicates).

Open-end property funds

Open-end funds don’t have a maturity date or a finite number of units. Instead, they can continue to issue units so long as they raise money, using the new funds to purchase additional properties.

As there is no specific maturity date, to allow investors to exit the investment they must offer some other method of liquidity. Liquidity is usually provided by holding a portion of the fund’s assets in cash, using new investors’ funds to pay out existing investors, or selling assets if necessary. This allows investors to exit at regular intervals.

These funds tend to hold a number of assets to increase diversification, but it is at the manager’s discretion to buy or sell assets, so investors must have confidence in their ability to do so successfully.

Fixed-term, closed-end property trusts

Syndicates contain one or more properties that will be held for a specified period of time, usually five to ten years. At the end of the specified time, investors will vote on the future of the trust, with the default outcome usually that the property be sold, the trust wound up and investors paid out.

Syndicates should be considered illiquid investments and you need to have an expectation that you will remain in the investment for the full term. They are generally fairly easy to understand and you know for certain which property (or properties) are owned. Therefore, if you don’t like the property in question, you simply don’t have to invest.

Single property syndicates don’t necessarily provide diversification on their own, but because the minimum investment is generally as low as $10,000, investments in a number of syndicates can be made to provide diversification by property, location, sector, maturity date and manager.

Property Management

A key reason for using an unlisted property trust is gaining the expertise of a professional property manager. The best property fund managers have an internal property management division which looks after the buildings in the trusts it manages. Having this function in-house avoids the use of third party agents, and ensures an alignment of interests between the manager and investor.

Property management includes leasing, ongoing maintenance of buildings, building concierge services, fire safety and other compliance requirements and, most importantly for investors, making sure the rent is collected!

Distributions

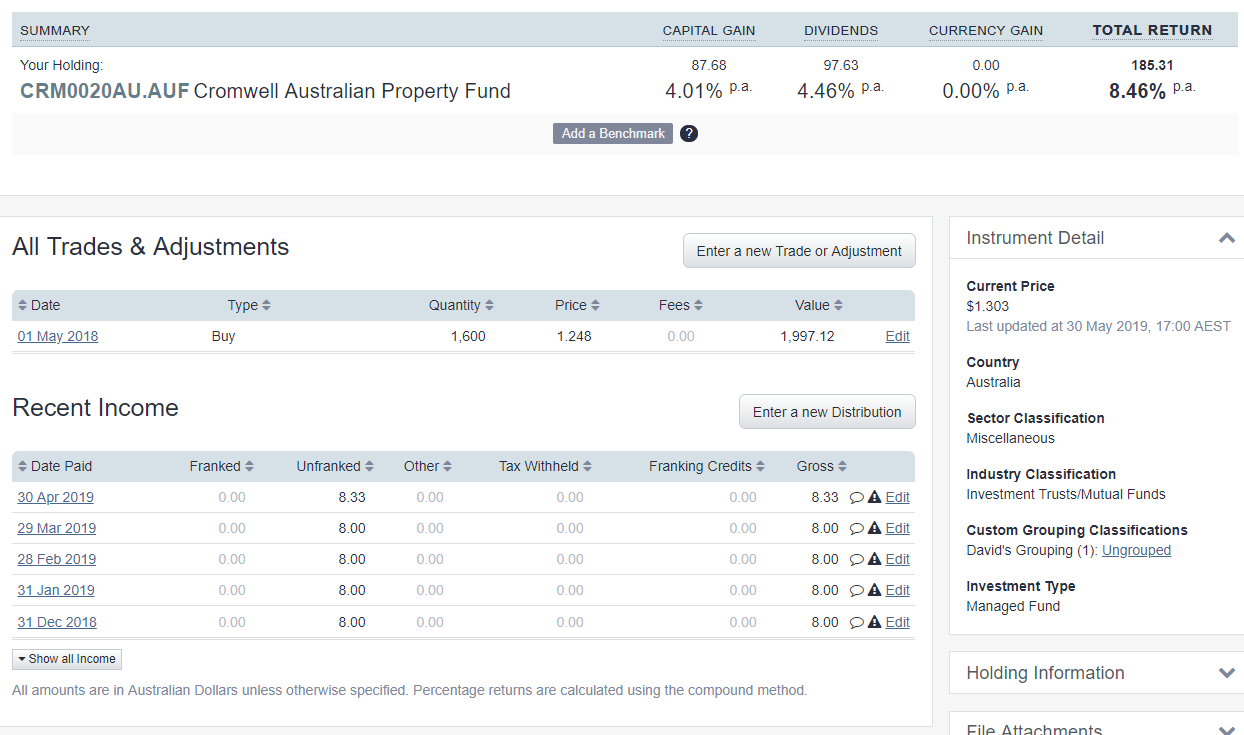

The trust will receive rental payments from tenants and this is passed on, less the relevant aforementioned expenses, to unitholders as distributions on a regular basis. Depending on the trust, distributions may be paid monthly, quarterly or six-monthly. Here are the distributions paid by the Cromwell Australian Property Fund, as tracked in Sharesight:

Costs and fees

The trust will generally be charged acquisition fees, ongoing management fees, property management fees and various other fees by the manager depending on the individual trust, its assets and structure. The trust is also likely to pay stamp duty for the acquisition of properties plus legal and other costs.

Any returns forecast will take these fees and costs into account. The Australian Securities and Investments Commission (ASIC) requires all managers to display their fees and costs in a consistent format in the Product Disclosure Statement (PDS), which makes it easy to compare the fees between trusts.

Liquidity

Fixed-term trusts

These are essentially illiquid throughout their term. At the end of the trust’s term, the property is sold, the trust wound up and investors paid out proportionately to the units they hold.

Open-end funds

Each open-end property fund will have a different liquidity mechanism, but as the underlying property assets are illiquid, the ability to exit the fund will have limitations. Common ways of providing some liquidity is to hold some of the fund’s assets in cash, using cash from incoming investors or, if demand is high and market conditions allow, selling assets.

Reviewing an unlisted property trust

The manager of an unlisted trust will provide you with a lot of information about the trust and its assets in the PDS, so it is important to read and understand it – particularly the ‘Risks’ section.

This section will include details on the manager, distribution yield, property assets – inclusive of all the considerations within, such as location, building quality, growth, tenants, lease and green credentials – the trust structure, fees, borrowing and more.

Tracking unlisted property funds with Sharesight

Sharesight’s investment database includes the latest unit price and distribution information for the majority of retail unlisted property funds in Australia, with information updated daily from the world’s largest and most trusted provider of managed fund data: Morningstar. Using the same unlisted property fund from earlier, we can see the performance of the investment in Sharesight:

![]()

How to track unlisted property funds with Sharesight:

-

Sign-up for a FREE Sharesight account

-

Add your holdings to your portfolio(s) by searching for either the:

a. Name of the unlisted property fund – in the screenshot above we’ve added the "Cromwell Australian Property Fund" mentioned earlier

b. APIR code (CRM0020AU in the above)

-

Watch as Sharesight automatically updates unit prices daily, plus distributions paid as soon as they are available from our data provider, Morningstar

Embedded content: https://www.youtube.com/embed/kcvc1KaZFFI?rel=0

Sharesight is one of the only platforms that provides historical unlisted property fund unit price and distribution data freely to investors in Australia. So, if you invest in unlisted property funds – Sign-up for a free Sharesight account and start tracking your investment performance today.

Disclaimer: This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions. To the extent that any general financial product advice is provided in this article, it is provided by Cromwell Funds Management Limited ABN 63 114 782 777, AFSL 333214. Cromwell Funds Management Limited and its related bodies corporate, and their associates, will not receive any remuneration or benefits in connection with that advice.

FURTHER READING

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.