What is peer-to-peer lending?

Disclaimer: The below article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please check with your adviser or accountant to obtain the correct advice for your situation.

Fluctuating equities and property market conditions have put many investors on the hunt for investments that can provide stable income to their portfolios. Traditionally this meant investing in fixed income products such as government or corporate bonds, however more recently investors have seen peer-to-peer lending emerge as an alternative.

Prior to the arrival of peer-to-peer lending in Australia, consumer credit was a closed asset class, one which retail investors could only access indirectly via bank deposits or equity investments in the banks themselves. But with the arrival of peer-to-peer lending, this increasingly popular option is opening up consumer credit (and it’s attractive risk/return profile) to a much broader audience.

So, what exactly is peer-to-peer lending?

What is peer-to-peer lending?

Broadly speaking, peer-to-peer lending uses technology to create an online marketplace that matches borrowers with investors.

The platform operator acts as an intermediary and makes an assessment on the creditworthiness of loan applicants - however it’s important to note this methodology by reading the PDS for each platform as it can differ between peer-to-peer lenders, nor is it the same as an external credit agency rating. For example, RateSetter evaluates a borrower’s credit history, employment status, and credit score. The platform operator will also manage the loan lifecycle including establishing loan contracts, facilitating payments between borrowers and investors and managing each investor’s portfolio.

Investors using peer-to-peer lending platforms receive the borrower payments of principal and interest on loans each month, but may also suffer losses if a borrower to whom their funds are matched fail to make timely repayments or default on their loan. Some peer-to-peer lending platforms, such as RateSetter, may offer a form of protection against losses, through a ‘Provision Fund’. This is a pool of funds that may be available to compensate investors in the event of borrower late payment or default - It’s important to note that these funds are not insurance and investors should understand how any compensation fund may or may not cover them should such an event arise by reading the PDS.

ASIC regulates peer-to-peer or what is termed ‘marketplace lenders’. Under Australia's financial services and credit laws, providers of marketplace lending products and related services will generally need to hold an Australian Financial Services (AFS) licence, and an Australian credit licence where the loans made through the platform are consumer loans (e.g. loans to individuals for domestic, personal or household purposes).

As the holder of an AFS licence, peer-to-peer lenders must have in place a complaints handling procedure that is explained in the PDS - and are required to respond to any complaints. Should their response not sufficiently resolve the issue, there are additional avenues to escalate including taking the matter to the external dispute resolution (EDR) scheme the platform belongs to listed in the PDS, as well as contacting ASIC directly.

Where do peer-to-peer loans fit in?

The way you use peer-to-peer loans will depend on your needs as an investor as well as your appetite for risk. Investing in a portfolio of peer-to-peer loans can be compared to some other investments such as corporate bonds or hybrids.

Fixed interest investments have traditionally been an attractive option for investors who are looking for a steady income stream. There are many types to choose from - each with varying risks and benefits:

-

Government bonds have long been a mainstay for fixed interest investors, thanks to the attraction of their high security and government guarantee of return of your principal. However, they offer modest returns.

-

Corporate bonds bear some similarity with government bonds in that they involve lending money, (in this case to a company), at an agreed interest over a set term, but there are important differences. Bonds can vary greatly in the amount of capital security they offer. Generally speaking, corporate bonds are less risky than buying shares in a company, but their ability to pay interest and to pay back your capital at maturity can be compromised if the company goes out of business.

-

Mortgage schemes are a type of managed fund that lends to borrowers to buy property or to undertake property development projects. On the surface these may seem safe and have attractive interest rates, but there are potentially higher risks. Mortgage schemes may be used to raise capital by developers who may not be able to secure loans from banks, due to the higher risks of borrowers defaulting or a property development project going bust.

-

The term ‘hybrid security’ is a catch-all name that covers a range of investments with odd sounding names, such as ‘capital notes’, ‘convertible preference shares’ and ‘subordinated notes’. These can be highly complex investments that are issued by institutions like banks, but this doesn’t mean that they offer the level of security that you would normally associate with bank investments (such as term deposits). Rates can be attractive but in certain circumstances your investment could be converted to shares in the bank and leave you with less capital than you initially invested.

In short, peer-to-peer lending may play a role alongside other fixed income securities like bonds and bank hybrids.

If you want to start investing with RateSetter you can register here.

How to track peer-to-peer loans in Sharesight?

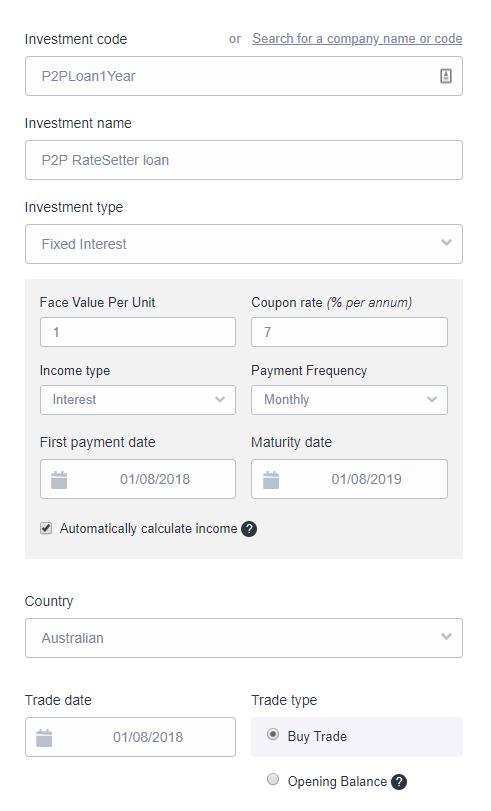

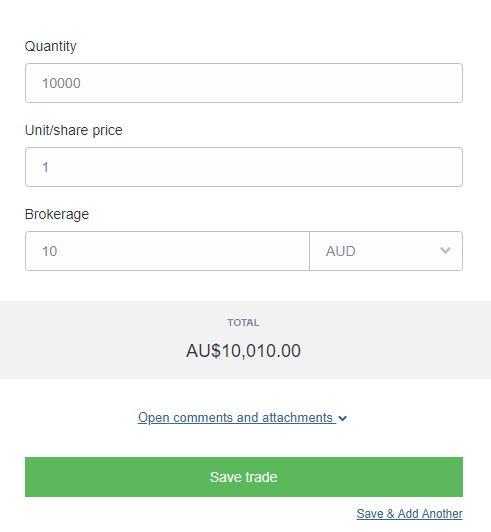

In order to record peer-to-peer loan investments in Sharesight, create a custom investment, fixed interest. You can enter interest rate, payment frequency or just record the interest payments manually as you receive them. Make sure that the quantity is the value of the loan, set price and face value to 1.

For example, if you have invested $10,000 with RateSetter, add this holding as a custom investment of type "Fixed interest". Enter the coupon rate or the interest rate that is promised as part of the investment.

Once the investment is in Sharesight, you can view the holding page to see the interest payments on a monthly basis. You can enter any manual adjustments to the investment as necessary for tracking it properly.

Track your fixed income investments with Sharesight

Tracking your investments in fixed income products like peer-to-peer lending is easy with Sharesight. With Sharesight you can:

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Automatically track your daily price & currency fluctuations, as well as handle corporate actions such as dividends and share splits

- Run powerful tax reports built for investors, including Capital Gains Tax (Australia and Canada), Unrealised Capital Gains, (Australia) and Taxable Income (All regions)

The best way to understand what Sharesight is all about is to sign up and try Sharesight for yourself. We’re confident that you’ll agree that it’s the best portfolio tracker for investors.

Disclaimer: * The Provision Fund is not insurance or a guarantee. Read the Product Disclosure Statement before investing. Past performance is not a reliable indicator of future performance. Capital is at risk This information does not constitute financial advice and you should consider whether it is appropriate to your circumstances before you act in reliance on it. Any opinions, forecasts or recommendations reflect the judgement and assumptions of RateSetter as at the date of publication and may later change without notice.

RateSetter Australia RE Limited ABN 57 166 646 635 holds Australian Financial Services Licence 449176 and Australian Credit Licence 449176 and is a member of the Australian Financial Complaints Authority (AFCA).

How Sharesight helps advisors track net worth and simplify compliance

We talk to Ryan Jones, Partner, Accountant and Financial Advisor at Jones Louros, about how he uses Sharesight to manage his clients’ investment trusts.

Automatically track Swissquote trades with Sharesight

If you trade using Swiss broker Swissquote, you can automatically import your trading data to your Sharesight portfolio.

Dividends vs. share buybacks: Which is better for investors?

We take a look at dividends and share buybacks, discussing the pros and cons of each, the tax implications and which one is more beneficial for investors.