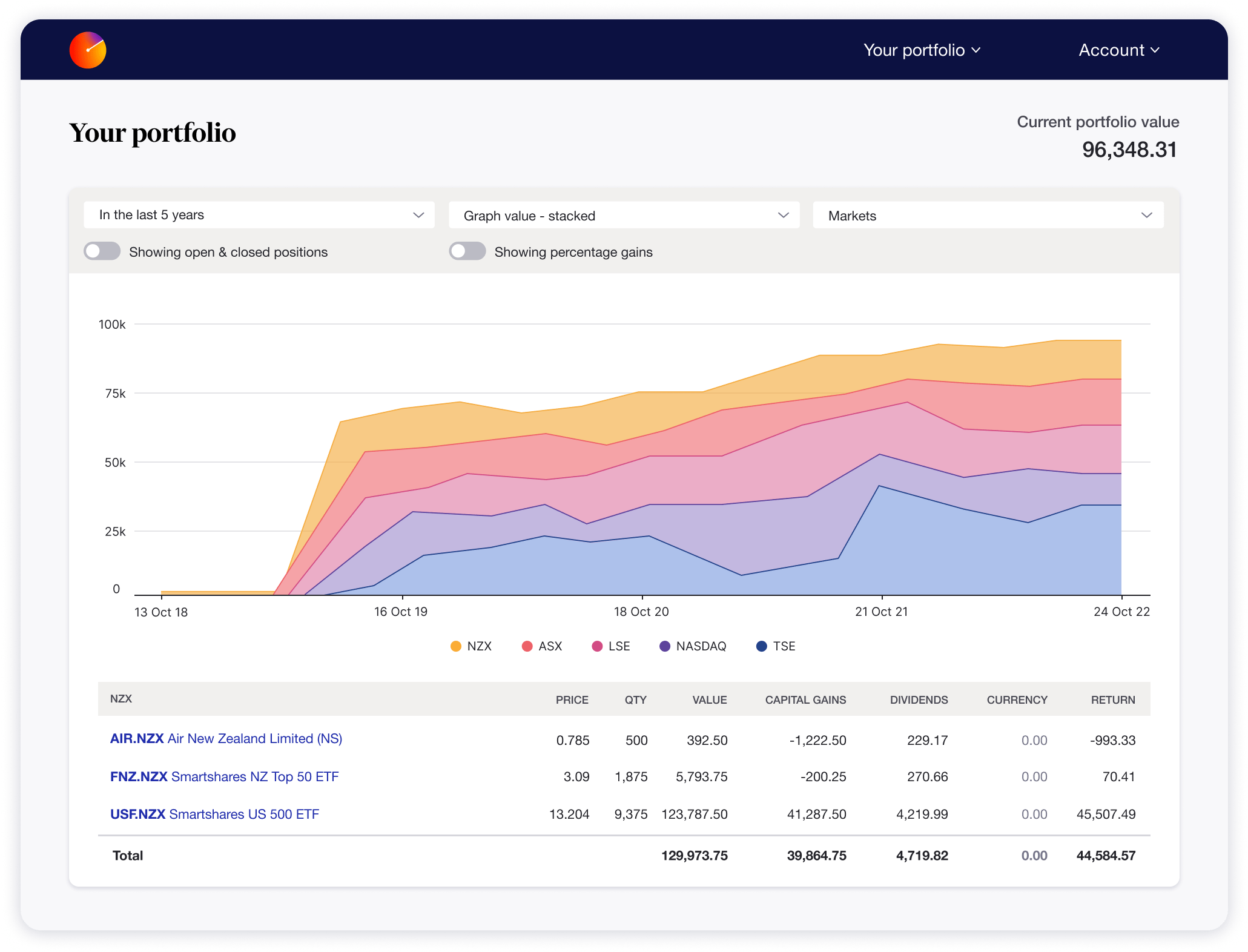

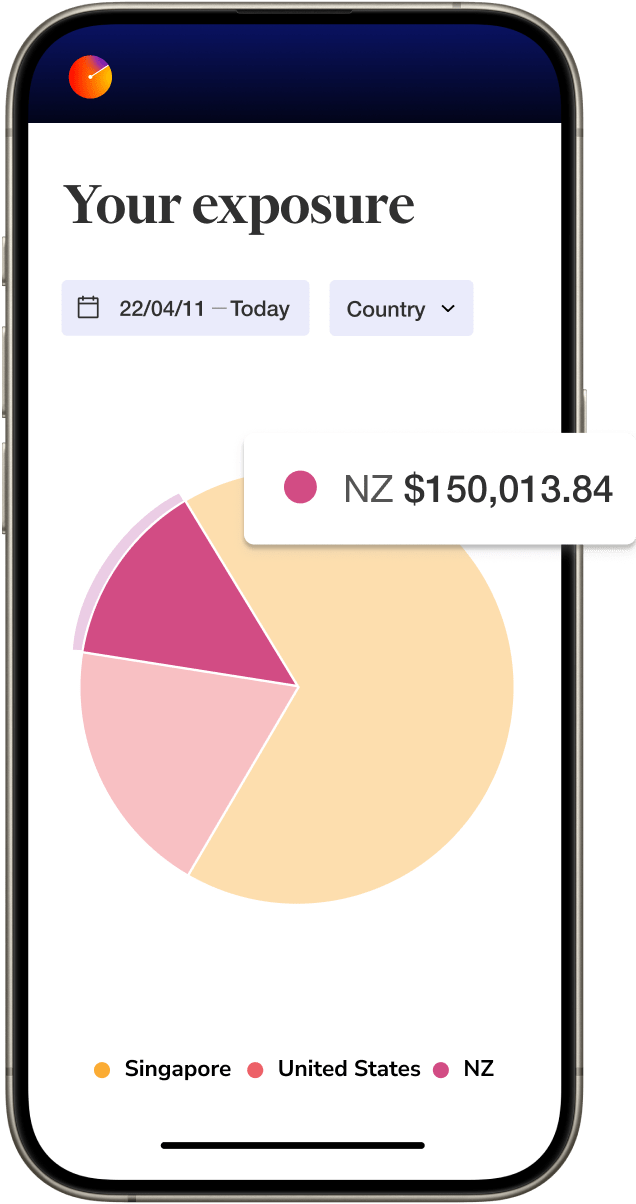

Be the smarter investor

Powerful portfolio tracking software that lets you check your investments in one place with award-winning performance, dividend tracking and tax reporting.

Sign up for free

We work with all your favourite brokers and apps

Sharesight integrates with hundreds of brokers and finance apps, including Sharesies, Hatch and Jarden Direct.

View our partners

500

k+

700

k+

200

Plans & Pricing

Start by tracking up to 10 holdings for free! Then upgrade to a premium plan at any time to track additional holdings or portfolios, and unlock advanced features. And as a bonus, your Sharesight subscription may be tax deductible. *

Free

$0

Forever

Starter

$12

NZD per month

billed annually

$16 NZD billed monthly

Investor

$29

NZD per month

billed annually

$38.67 NZD billed monthly

Expert

$49

NZD per month

billed annually

$65.33 NZD billed monthly

No fuss, free sign up.

No credit card needed

The only way to see true performance is to see it in context. Sign up for free without any commitment.

Sign up for free

Don't just take our word for it

Over 500,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

Featured in

Start tracking your performance for free

Track up to 10 holdings.

No credit card needed.

Sign up for free