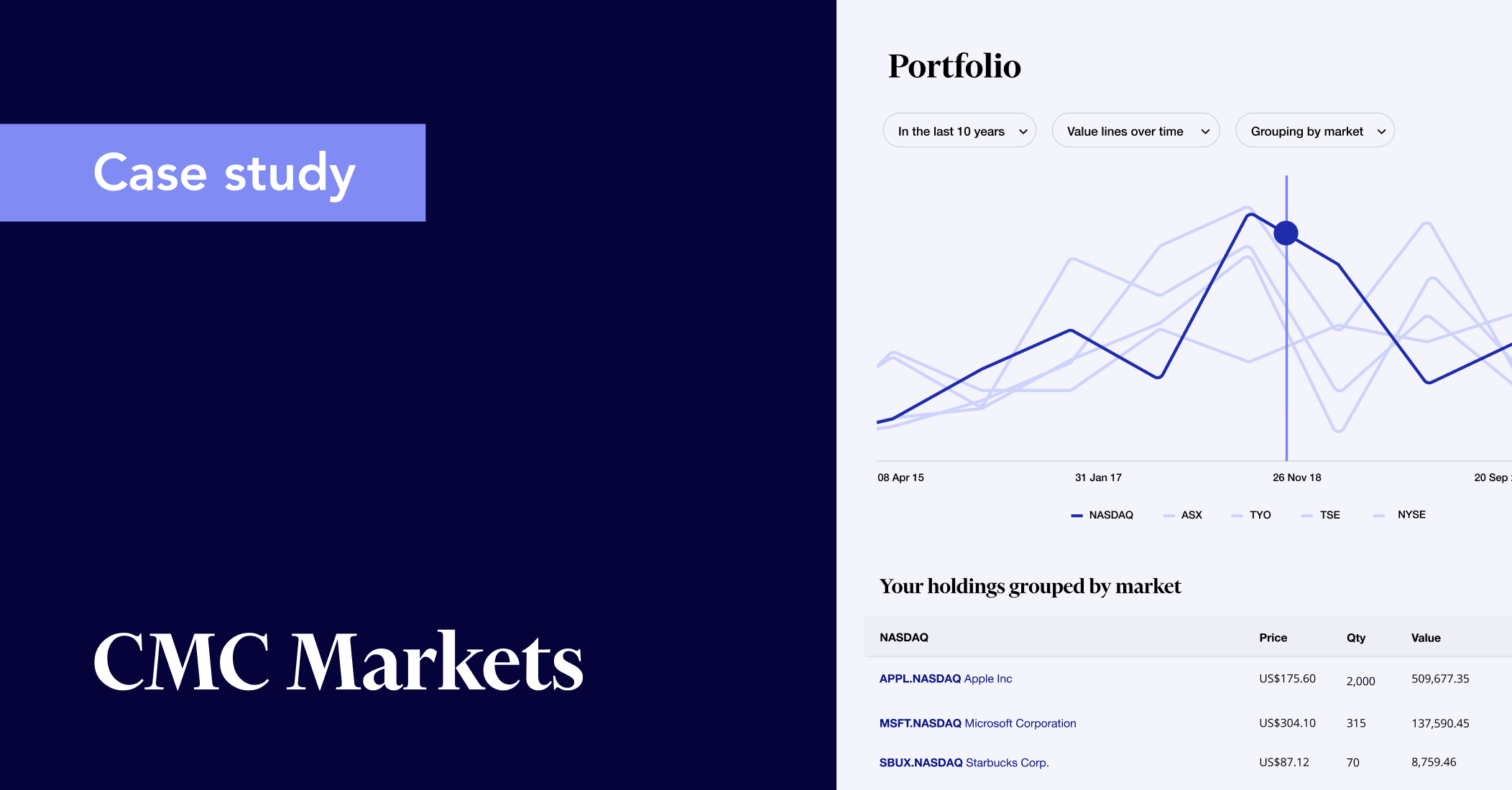

How CMC Markets uses Sharesight to deliver tax and portfolio reporting

Partner snapshot

- Company: CMC Markets

- Partner type: API broker partner

- Since: Sharesight partner since 2012

- Partner Program Tier: ‘Preferred’ partner

The need

-

Find a tax and portfolio solution to handle a broad range of instruments

-

Improve tax and portfolio reporting for customers and their advisors

-

Overcome barriers to entry for prospects.

The process

-

Integrate tax and portfolio reporting within the CMC Markets platform

-

Create a single sign-on for customers

-

Set-up integration with Xero.

The results

-

15% of CMC customers are using Sharesight

-

10.6% of customers have upgraded to Sharesight’s paid plans

-

Reliable, real-time tax and portfolio reporting that covers ASX and the 15 international markets we offer.

The number of retail investors trading online has more than doubled in the past decade. This has led to the availability of more online trading platforms, creating a competitive environment where platforms need to adapt fast to changing market conditions to succeed. And it is something Sharesight partner CMC Markets, Australia’s second-largest online broker, has experienced firsthand.

"When we first began working with Sharesight in 2012, our platform had just over 2,000 listed instruments. We now have over 40,000 listed instruments and have added another 15 countries as part of our global reach," says Andy Rogers, Director of Stockbroking at CMC Markets.

"We’re always trying to evolve our user experience and meet changing customer needs, so we needed to have the capability to make changes fast. The API makes it easy to bring Sharesight features onto our platform and as a result, we can move quickly to enhance our customer's experience."

Tackling barriers to entry

Andy explains why tax and portfolio reporting is a particularly difficult challenge for online brokers.

"When clients transfer their shares to CMC Markets Invest, we don’t know the cost bases of those shares because they weren’t purchased on our platform," he says.

"Without that information, it makes tax and portfolio reporting near impossible. So, for customers wanting to switch brokers, this can be a real roadblock."

Many third party tax and portfolio providers deal with this challenge by using screen scraping technology of contract notes that have been uploaded by customers. This process can work well, but any formatting or branding changes can quickly lead to issues and errors.

With Sharesight, CMC Markets customers can import details of their contract notes and easily confirm details before they are stored in the system. After that, there is no reconciling of events as Sharesight keeps track of the historical cost base and what dividends have been paid since.

"There’s no magical solution for brokers to work out what the cost base is. But with Sharesight, customers can easily input this data in a really intuitive way – and they only have to do it once."

— Andy Rogers, Director of Stockbroking, CMC Markets

Putting customer experience first in a fast-changing landscape

While Sharesight has helped overcome challenges for new clients, it also helps deliver attractive benefits as they go on to use the platform. This includes:

One login to access both platforms

The first development within the partnership was to develop a single sign-on so customers could log in to the CMC Markets Invest platform and launch Sharesight from there. The API allows all trades to be linked from CMC Markets to Sharesight in real-time, so there is a low margin for error and the information is reliable.

"We did this because we had some sizeable goals to grow the product quite rapidly," says Andy.

"We didn’t want to slow down this evolution, so by incorporating it into our platform, customers could access the latest feature as soon as it was available."

International share coverage

International instruments were introduced in 2017, and the customer requests for tax and portfolio reporting for these holdings quickly followed. CMC Markets made the necessary changes with ease, helping them respond to their customers fast.

"We’ve always had a good relationship with Sharesight and their lead developer. It means we can get our tech teams to work well together and just get it done."

— Andy Rogers, Director of Stockbroking, CMC Markets

Integration with Xero

Sharesight offers a direct connection to leading online accounting software, Xero. For CMC Markets customers, this means their financial advisers can easily access the data they need from both the CMC Markets platform and Sharesight. It makes life easier for not only the customer, but also their adviser.

CMC customers take advantage of tax and portfolio reporting

Fully integrated tax and portfolio reporting has now become an integral part of the CMC Markets Invest and CMC Markets Flow platforms. CMC customers have the opportunity to use the Sharesight platform for free with the flexibility to upgrade to the higher value paid plans as their investment journey progresses. For example, 15% of customers are currently using Sharesight to track their portfolios, with 10.6% of these customers having upgraded to paid plans.

"The best thing about this partnership is that the customer gets the best of both worlds. The software just works, it’s robust, and it adds real value for our customers."

— Andy Rogers, Director of Stockbroking, CMC Markets

Evolution built into the pipeline

The decade-long partnership between Sharesight and CMC Markets is set to continue, with several plans in place for evolving the platform. This includes adding new asset classes (including digital assets) in 2023, as well as enhancing its most popular pages, such as the investor profit and loss page.

"It’s been a great partnership – the Sharesight team are easy to work with, turnaround time is quick, and they’re agile. So, when we need to expand our platform, we don’t need to do that much to incorporate Sharesight into our offering."

— Andy Rogers, Director of Stockbroking, CMC Markets

Track your investment performance and tax with CMC and Sharesight

If you trade with CMC Markets Invest, it’s easy to link your CMC and Sharesight accounts – allowing you to automatically sync all your historical and ongoing CMC trades to Sharesight.

Or if you’re not already using Sharesight, simply login to your CMC Markets account and follow the instructions under Tax & Portfolio Reporting to get started tracking your performance (and tax) with Sharesight.

FURTHER READING

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.