How to get the most out of Sharesight’s tracking features

Sharesight allows investors around the world to track their portfolio performance and help calculate the tax implications of investing. But with so many features, where do investors start? For most, their journey begins with Sharesight’s Portfolio Overview page, but there’s so much more.

Here are the Sharesight portfolio performance tracking features investors need to know about:

Sharesight’s Portfolio Overview page

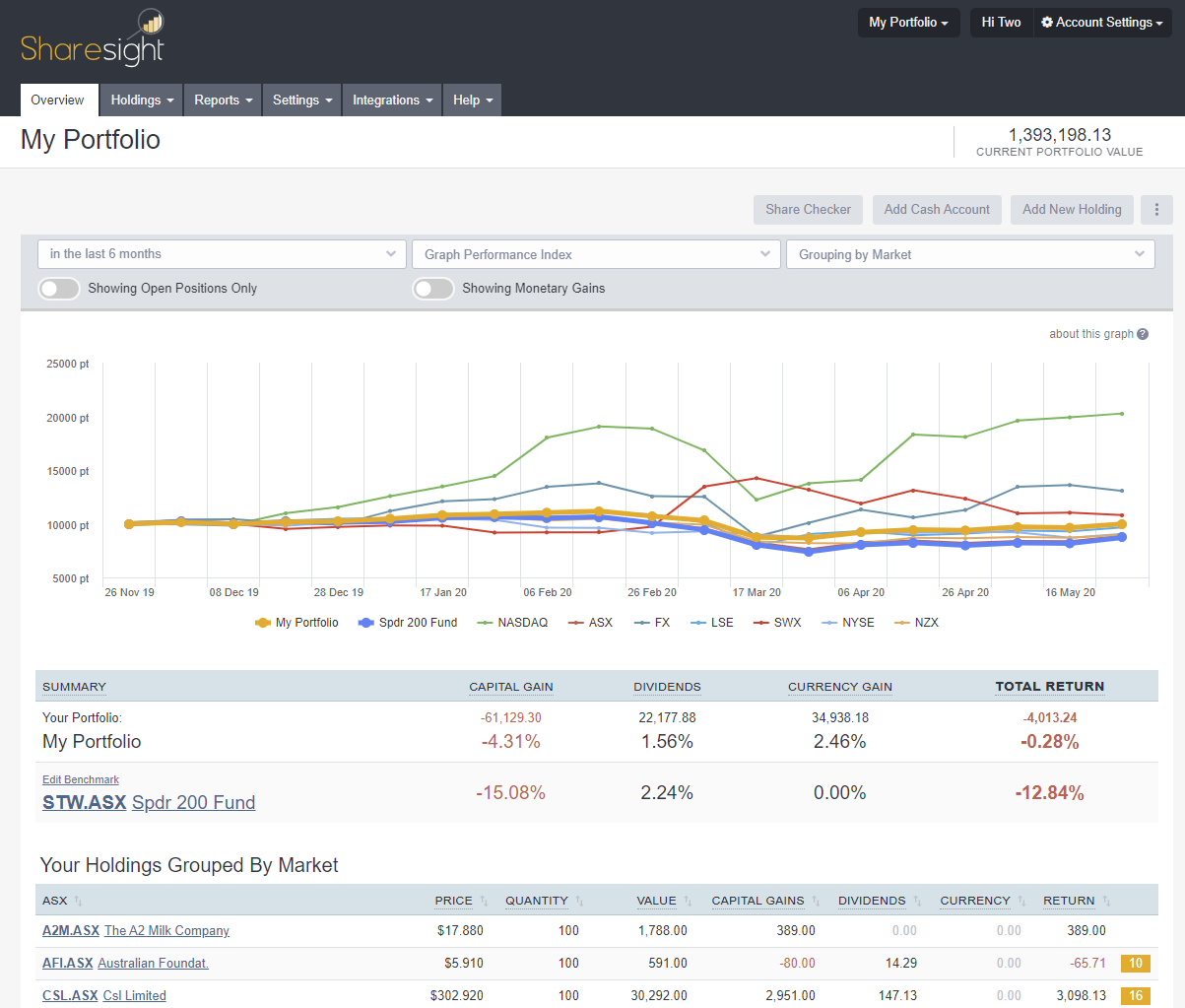

One of the first things most investors see when they log into Sharesight is the Portfolio Overview Page, and unsurprisingly this page is the most viewed as it provides an ‘at a glance’ look at portfolio performance.

When it comes to tracking portfolio performance, the Overview Page has a number of key features:

Date Filters

Date range options to filter performance using a list of common date ranges such as "since first purchase" or “in the last 6 months”.

Performance graphs

A number of different portfolio performance graphs including:

Graph Growth: Dollar gains by sub-period.

Graph Value -- Stacked: Portfolio value over time, stacked by report grouping eg: market, sector, industry or even your own Custom Groups.

Graph Value -- Lines: Portfolio value for each report grouping.

Graph Performance Index**:** Performance of opened and closed positions indexed to the start of the period specified in the date filter.

Portfolio performance

See portfolio performance broken down by capital gain, dividend/distribution income, currency gain and total return.

Portfolio benchmarking

Benchmark portfolio performance against any of the 37,000 stocks, ETFs, mutual/managed funds or unit trusts that Sharesight tracks.

For example, the image below shows the performance of a Sharesight portfolio versus an ASX200 index-tracking ETF (STW.ASX), when selected this benchmark will also appear in the performance graphs above (where relevant).

For more insights on how to get the most of the Portfolio Overview page watch this webinar recording where Sharesight’s Emily Grunberg takes you through all of the options available to you.

Embedded content: https://www.youtube.com/embed/6Xa8phjSVhM

Performance Report

Sharesight’s Performance Report allows investors to calculate portfolio performance over any date range, opening up additional possibilities over the preset date range filters available on the Portfolio Overview page.

Additionally with the Performance Report it’s possible to specify whether to include only open, or open and closed (sold) positions, view performance broken down by Sharesight groupings (or Custom Groups), as well as filter the report using labels.

Here the Performance Report shows the advanced custom date filters available as well as the performance of a portfolio broken down by sector classification.

Embedded content: https://www.youtube.com/embed/fw5fzIX8q3s Watch this video for a deeper dive into the Sharesight Performance Report

Diversity Report

Sharesight’s Diversity Report allows investors to track portfolio diversity as at any date (in the past, or present).

When running the report, it’s possible to view portfolio diversity using any of the six industry classification groupings: market, sector, industry, investment type, country or no grouping at all. Additionally investors can classify investments using Sharesight’s Custom Groups feature based on any criteria specified.

Custom Groups showing an example custom allocation groupings for use in the Diversity Report.

By specifying Custom Groups like the above, investors can assess how a portfolio is tracking against an asset allocation target by running the Diversity Report, then take action and rebalance the portfolio to meet the target.

Sharesight’s Diversity Report, organised by the Custom Groups shown above.

Make sure to read our guide on ‘How to track your asset allocation strategy in Sharesight’ to make the most of the Diversity Report.

Contribution Analysis Report

The Diversity Report gives investors an insight into how a portfolio is tracking towards a specific asset allocation, but with Sharesight’s Contribution Analysis Report it’s possible to track which asset classes are contributing the most towards a portfolio’s performance.

Like the Performance Report, the Contribution Analysis Report can calculate portfolio performance over any date range, as well as break down performance across any of the Sharesight groupings or Custom Groups selected.

Sharesight’s Contribution Analysis Report, broken down by market.

Export any Sharesight report

All of Sharesight’s reports can be exported to Excel, Google Sheets or in Adobe PDF format to perform additional calculations or as part of an investor’s record keeping requirements.

This is as simple as clicking on the icon of the desired format to export on the upper right-hand side of any report in Sharesight.

How Sharesight’s CEO tracks his portfolio performance

The above tools are only a subset of the many features Sharesight offers investors to track their performance.

For even more tips, watch Sharesight CEO Doug Morris walk through how he uses Sharesight reports to track his own portfolio’s performance in the following webinar recording.

Embedded content: https://www.youtube.com/embed/CLPsXBVfFMk

Join over 100,000 investors tracking their performance with Sharesight

If you’re not already a Sharesight user, what are you waiting for? Sign up now it’s free to join, and with Sharesight you’ll get access to:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis and Future Income (upcoming dividends)

-

Run tax reports including Taxable Income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.