Morningstar Individual Investor Conference 2020: Event wrap-up

This year’s Morningstar Individual Investor Conference had one major theme: How is Covid-19 impacting markets and what should investors do to safeguard their wealth? The US election was another key focus, along with much discussion around the valuation of Australian equities.

The 2020 investor conference was the first to be held entirely online, spanning two days and 13 presentations. This included a session between Sharesight CEO Doug Morris and Morningstar’s Senior Product Manager Mark LaMonica, showing how investors can take advantage of the integration between Morningstar and Sharesight when tracking their portfolio.

To find out some of the key takeaways from our picks of the top sessions from the 2020 Morningstar Individual Investor Conference, keep reading.

The Cost of Covid: The Long-Term Impact on Markets and Economies

Diana Mousina - AMP Capital

The current state of the economy

-

Financial markets are still about 15% lower than pre-Covid levels.

-

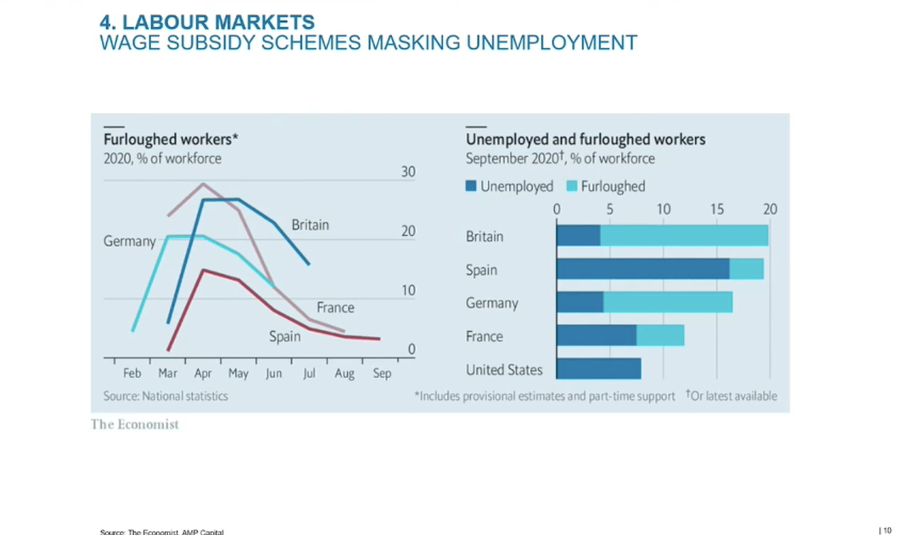

Wage subsidy programs are masking the true level of unemployment, which is about 9% globally.

- In this recession, females have been hit much harder than males due to the decline of the service industry and part-time roles. Female participation still has not recovered as much as male participation, with childcare arrangements also being a factor.

Medium to long-term

-

Australia’s budget deficit will move to about 11% of GDP - the highest level since WW2. Other countries’ deficit will be close to 100% of GDP.

-

Local manufacturing will not return to Australia because we are not competitive in the manufacturing space; our high cost base is unlikely to change. The US however, may bring some production back onshore.

-

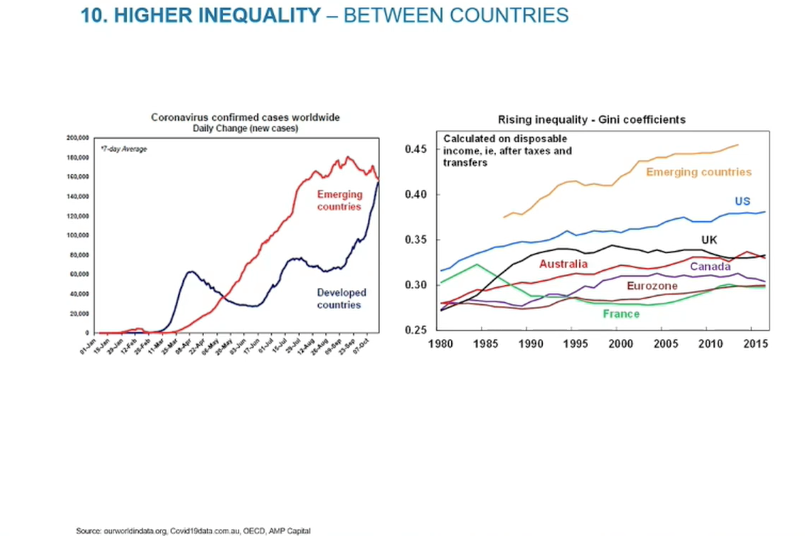

Inequality will increase between countries and within countries.

Australian Equities: The Valuation Conundrum

Anton Tagliaferro, Investors Mutual Limited & Kate Howitt, Fidelity International

Anton

-

We are seeing upgrade-downgrade mania: Little changes in company earnings making huge share price changes. The market also tends to be focused on daily information flow; a short-term focus.

-

Long-term focus is valuation driven, not momentum driven. Focus is on quality, not upgrade-downgrade mania, and in-depth research rather than daily information flow.

-

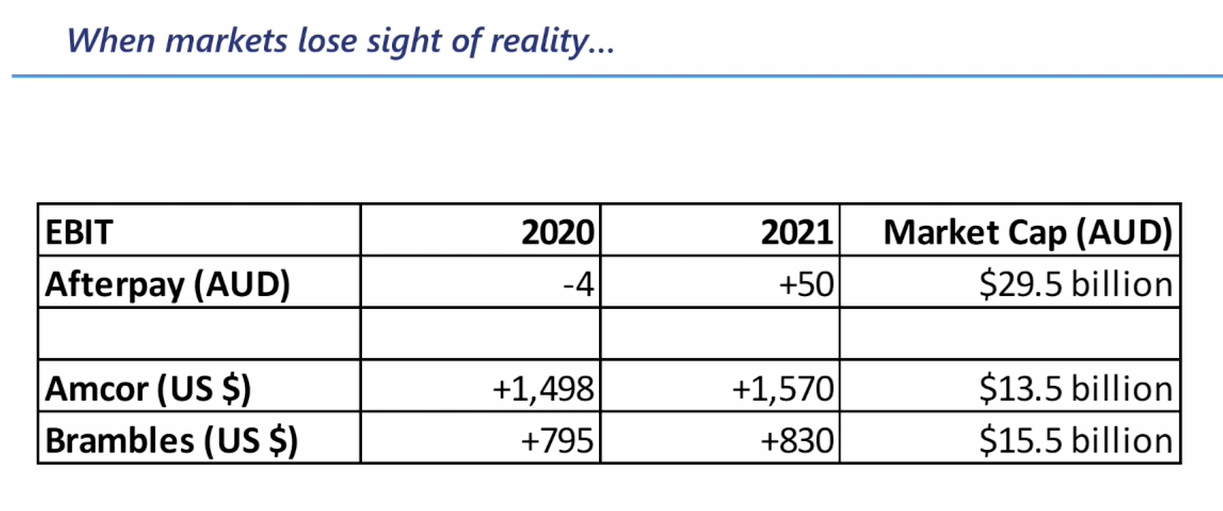

People should be risk averse right now but instead of movement into safe value stocks people are buying tech stocks on enormous valuations. At some point this has to adjust.

-

There are many companies that pay good dividends but are not doing that well in the current stock market: Amcor, Brambles, Aurizon and Telstra. Not too expensive, sustainable dividends, good balance sheets, good operations, recurring cash flow and not cyclical like gold.

Kate

-

There is a case for investing in companies with a higher growth profile. The mistake is to assume all high growth companies are on the same trajectory when tech companies, for example, could be disrupted in 3-5 years.

-

Quantitative easing tries to make long duration assets look unattractive, causing investors to look to more speculative assets.

-

Investors are being forced out of the bond market and they are bidding up prices in equities.

-

We will soon move from government handouts to encouraging investments in businesses. Things will get rocky domestically but compared to other countries we have had a better run with the virus and we started off with a great sovereign balance sheet.

Being an Engaged Investor in the Time of Covid-19

John Cowling, Australian Shareholders’ Association

Risking your capital

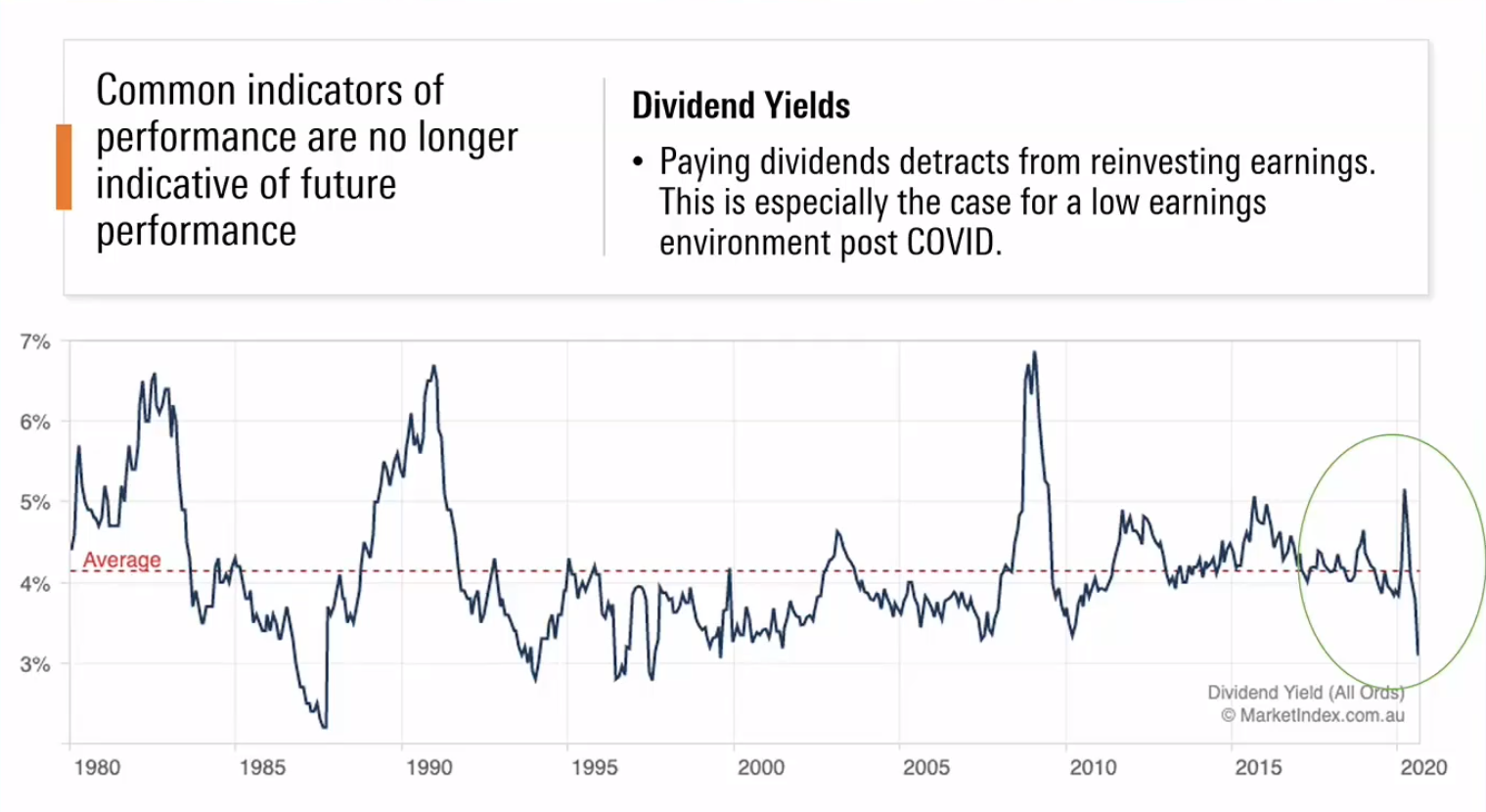

- Dividend yield is low right now and you’re not getting an adequate return on capital.

- Brokers are all telling us to buy - less than 10% recommend to sell.

Looking long-term

-

Long-term, you should be looking for sustainable business practices, a strong social license and great customer relationships.

-

The new generation of investors cares much more about ESG investing than older generations

-

Australian companies are ahead of the world on ESG scores.

-

To find investments with a strong social license, look to Taskforce on Climate-related Financial Disclosure (TCFD) framework; arabesque s-ray tool, responsible returns and net promoter score.

ESG and profit

-

Australian equities responsible share funds outperform the S&P/ASX 300 over 5 and 10 year horizons.

-

ESG leaders are more resilient

-

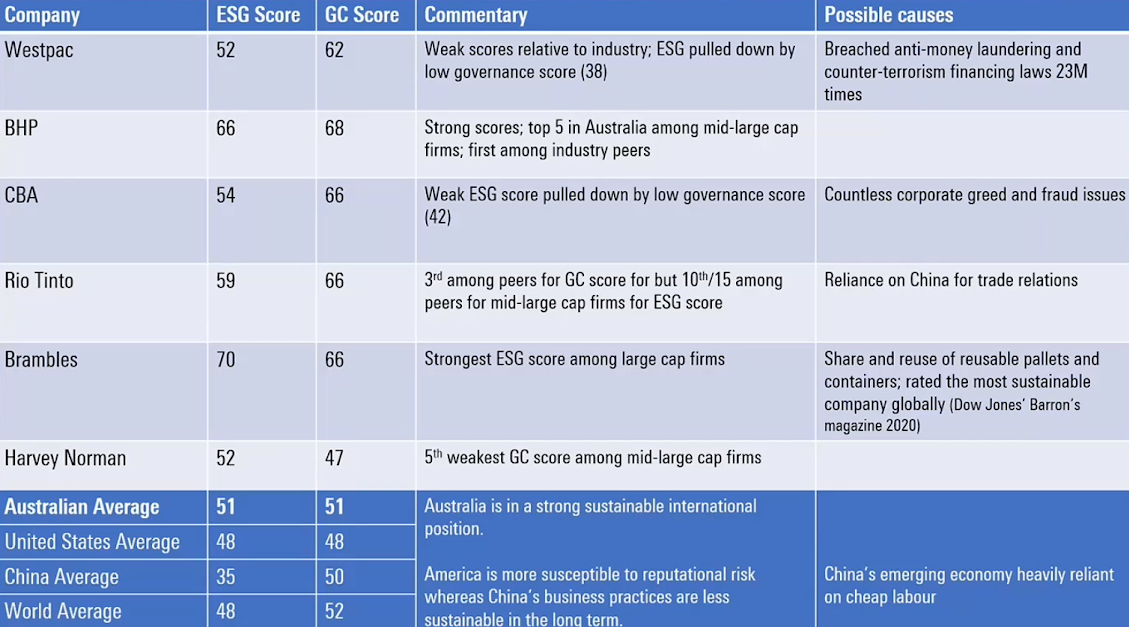

ESG ratings on some of Australia’s biggest companies:

The US Election and Your Portfolio

Hamish Douglass, Magellan Financial Group

Does it matter who wins?

-

It does matter and we will have a different world depending on who wins.

-

It comes down to what happens in the Senate. For example, if Biden wins the house but not the Senate.

-

If the Republicans keep the Senate, there will be little change with the Republicans acting as a check and balance on the Democrats.

-

If the Democrats take the Senate, it depends on the filibuster. If the Democrats remove the filibuster this could really spook markets.

-

Potential risks around Democrat plans to increase company tax rate to 28% and increased regulation of the tech industry.

State of the US economy

-

Things in the US depend on how they handle the pandemic. With hospitals at or near capacity they will need to shut down their economy again, which will require large support from governments.

-

The $1,200 stimulus cheques were very effective.

-

The composition of the market has changed. Instead of banks, which are capital intensive, there has been a switch to large tech companies, which skew valuations as they are less capital intensive.

-

Bond rates have been a strong driver of excess market returns, especially since 2008/9.

-

If inflation emerges and interest rates go up that is very negative for asset prices. Not necessarily a risk in the next 5 years, but with increased government borrowing it will have to create inflation at some point. This is the biggest threat out there for equity investors and needs to be planned for today.

Individual investors love Sharesight

Built for the needs of individual investors, with Sharesight you can:

-

Track all of your investments in one place, including stocks, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed Funds

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis and Future Income

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

If you’re not already using Sharesight, sign up for a free Sharesight account and start tracking your investments today.

FURTHER READING

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.