Quickly view the performance of any asset with the share checker

Sharesight’s share checker is the perfect tool for investors who need a quick, easy way to view the price and performance of over 700,000 global stocks, ETFs and managed/mutual funds tracked by Sharesight. While it is possible to look up stocks through your broker, you’re only getting half the information you need. With the share checker you can view a stock’s performance over the time period of your choice, inclusive of dividends and other key performance metrics that other platforms omit from their calculations.

Why the share checker is a useful tool for investors

Using the share checker, you can look up the price of stocks in over 60 major global markets to see how a hypothetical investment of $10,000 would have performed in your portfolio over a range of different time periods. This can be a very useful research tool for DIY investors who evaluate buying opportunities by researching stocks’ past performance.

The share checker provides the following information at a glance:

-

A historical price chart, including corporate actions such as share splits and dividends

-

The country in which the stock is domiciled

-

Sector, industry and custom grouping classifications

-

The investment type (stock, ETF, managed/mutual fund, etc.)

-

The EPS, NTA and P/E ratio (for stocks on the ASX and NZX).

And as with all performance calculations in Sharesight, the share checker displays the stock’s total annualised return, including the impact of capital gains or losses, dividends and foreign exchange rates — key metrics that can have a significant impact on returns.

This can be clearly seen in the screenshot example below, which shows the performance of Apple in a non-US portfolio over the past year. For instance, under these conditions the stock would have a -2.31% return, with capital losses contributing -5.41%, dividends contributing 0.47% and currency gain contributing 2.64%.

If you'd like to see a stock’s dividend history, clicking on the ‘Dividends’ tab will bring up a list of paid dividends during the chosen period, including information such as franking credits, TFN withholding tax, non-resident withholding tax, tax credits and deductions, and exchange rates, depending on the tax residency of the portfolio. The screenshot below for example, shows the dividend history of Apple over the past year from the perspective of an Australian portfolio.

For more information on a stock’s performance, you can also access tabs showing corporate actions and related news.

How to use Sharesight’s share checker

-

If you’re not using Sharesight yet, sign up for a FREE account to get started.

-

Click the Share checker button at the top of the Overview page.

-

Access the dropdown menu on the far left to choose the market of your stock, then type in the stock ticker code. Next to the stock code, there is also a dropdown menu with options to view performance in percentage points (compounded or simple) or monetary values.

-

Access the dropdown menu on the far right to choose from a wide variety of time periods for calculating the performance of your chosen stock.

-

Press go for detailed information at a glance on the performance of your chosen stock, with the ability to look up unlimited stocks from over 60 major global markets.

For more help using Sharesight’s share checker function, you can also watch our guide on YouTube:

Try Sharesight today and make better investment decisions tomorrow

Join thousands of other self-directed investors who are empowering themselves to make better investment decisions with Sharesight’s award-winning performance, dividend tracking and tax reporting features. With Sharesight you can:

-

Track all your investments in one place, including stocks in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-currency valuation, multi-period, risk, exposure and future income (upcoming dividends)

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a free account today to start tracking your investment performance (and tax) with Sharesight.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

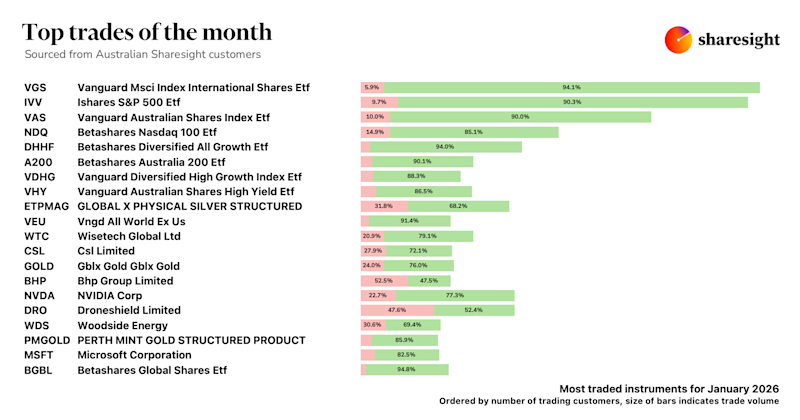

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.