The top brokers and markets for UK investors in 2025

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

With the ever-growing number of stockbrokers available to UK investors, many are left wondering which is the best broker to suit their needs. Priorities differ depending on the individual investor; for example, are they a frequent trader or more of a long-term investor? Do they prefer stocks of ETFs? And do they invest locally or globally? With some of these questions in mind, we take a look at the most popular brokers among British Sharesight users in April 2024 - March 2025.

What drove UK investor behaviour in 2024-2025

Between April 2024 and March 2025, UK markets showed resilience despite ongoing global economic uncertainty. The FTSE 100 and FTSE 250 both delivered strong performances, outpacing major international indices and renewing investor interest in UK assets. This momentum was supported by a stronger pound, easing energy prices and growing expectations of interest rate cuts from the Bank of England as inflation pressures began to subside.

Investor sentiment gradually improved as the economy showed signs of stability, with modest growth in both GDP and retail activity. The UK’s service-heavy economy and relatively low export exposure also helped cushion the impact of global trade disruptions. Overall, the period was defined by cautious optimism, with favourable economic signals and a more supportive policy environment contributing to renewed confidence in UK markets.

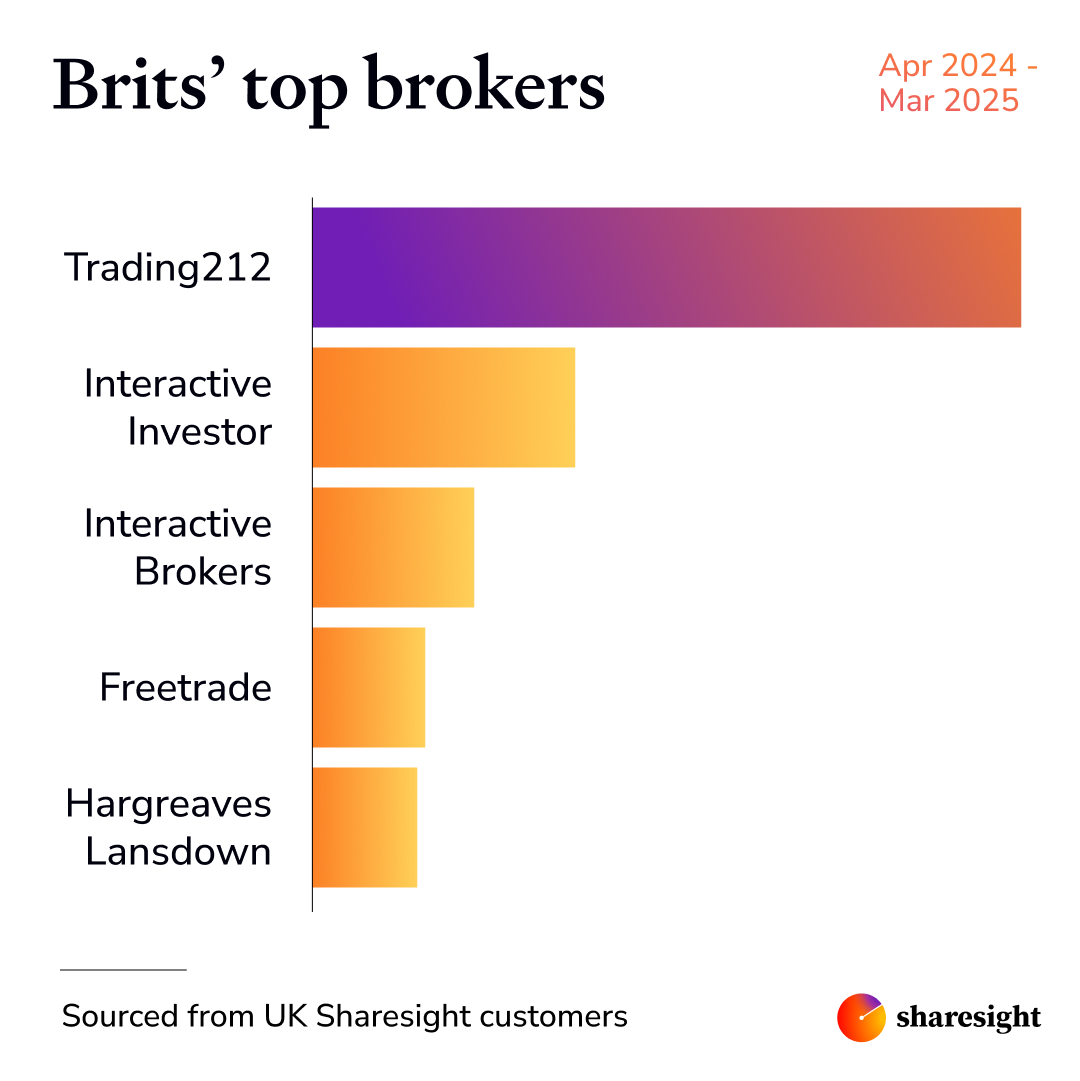

Most popular brokers for UK investors

Looking at the most popular broker among our UK userbase during this period, Trading212 was the clear winner, followed by Interactive Investor and Interactive Brokers.

What makes Trading212 such a popular choice for UK investors? Trading212 offers commission-free trading, plus access to stocks and ETFs on a range of leading global

exchanges. It also allows investors to open a Stocks and Shares ISA account to invest tax-free. For the investors using both Trading212 and Sharesight, it’s easy to import Trading212 trades to a Sharesight portfolio using a spreadsheet or automatic trade confirmation email forwarding, helping them stay on top of their portfolio with minimal effort.

Interactive Investor came in second place, likely due to its flat-fee pricing, broad access to UK and international markets, and support for ISA, SIPP and Junior ISA accounts. For investors using Sharesight, it’s simple to keep their portfolio up to date by uploading a spreadsheet of trades or manually forwarding trade confirmation emails, making Interactive Investor another convenient choice for those who want powerful portfolio tracking alongside their investing.

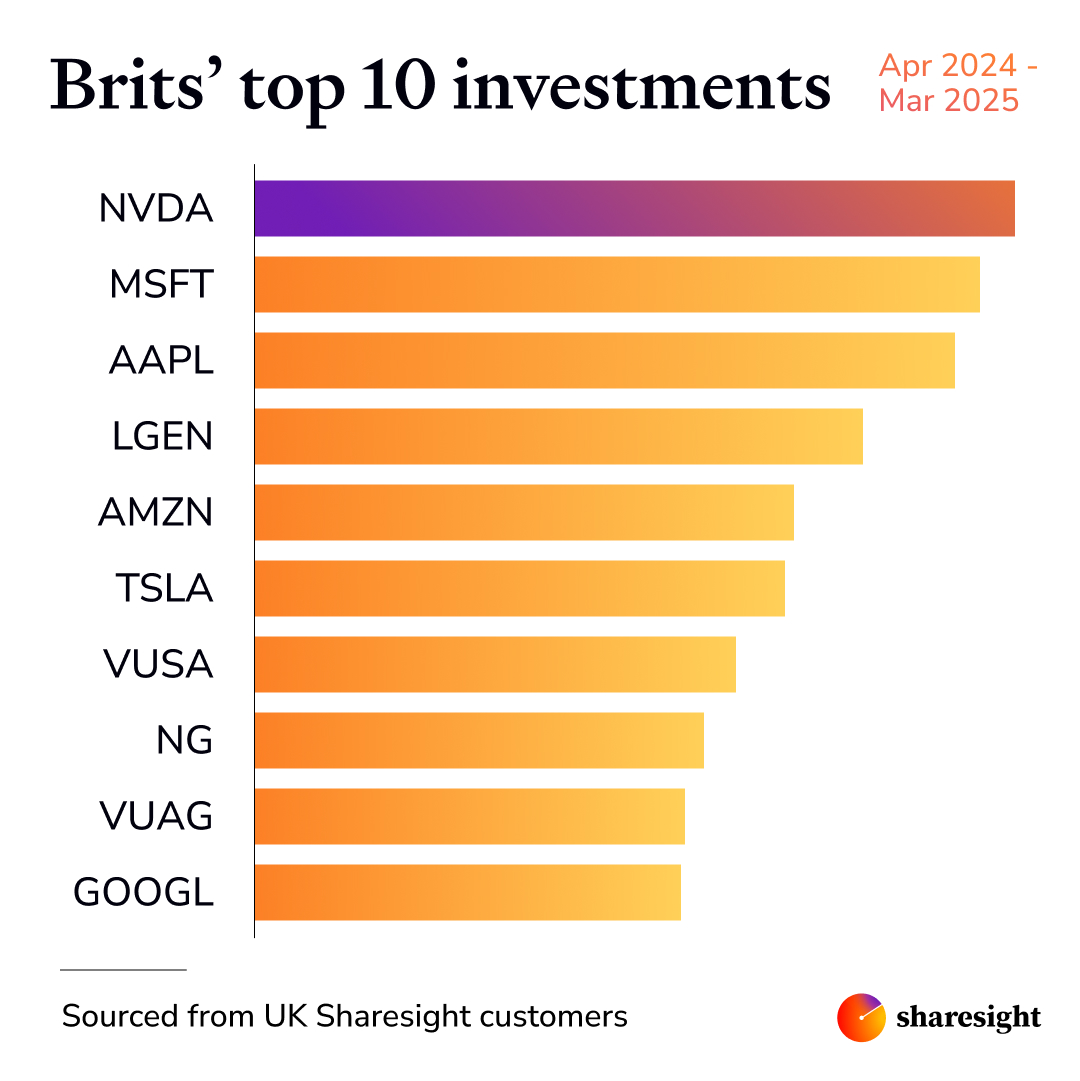

Top trades for UK investors

As can be seen from the chart below, UK investors’ top trade over the April 2024 - March 2025 period was NVIDIA (NASDAQ: NVDA). This US tech company experienced extreme volatility over the period, including record-breaking highs and brief surges in valuation, as well as sharp sell-offs driven by market sentiment and AI sector concerns. The top trades were followed by Microsoft (NASDAQ: MSFT), which faced growing concerns from shareholders as it made major AI investments but struggled with slowing cloud growth, rising costs and market pressures. Coming in third place, Apple (NASDAQ: AAPL) had mixed results, with brief share price highs driven by AI hype, but ongoing struggles with declining iPhone demand and regulatory hurdles abroad.

Most popular countries for UK investors

Unsurprisingly, the UK topped the list as the most popular destination for UK investors, reaffirming the home bias often seen among retail and self-directed investors. The US came in as a strong second choice, reflecting its dominant market performance and the global appeal of major American companies. Broader Europe and Germany followed, rounding out the top regions of interest. This trend aligns with expectations, given the strength and stability of US markets, combined with the fact that most UK brokers offer easy access to UK, US and key European exchanges. These preferences suggest that UK investors are taking a practical approach, focusing on familiar, well-performing markets with easy accessibility.

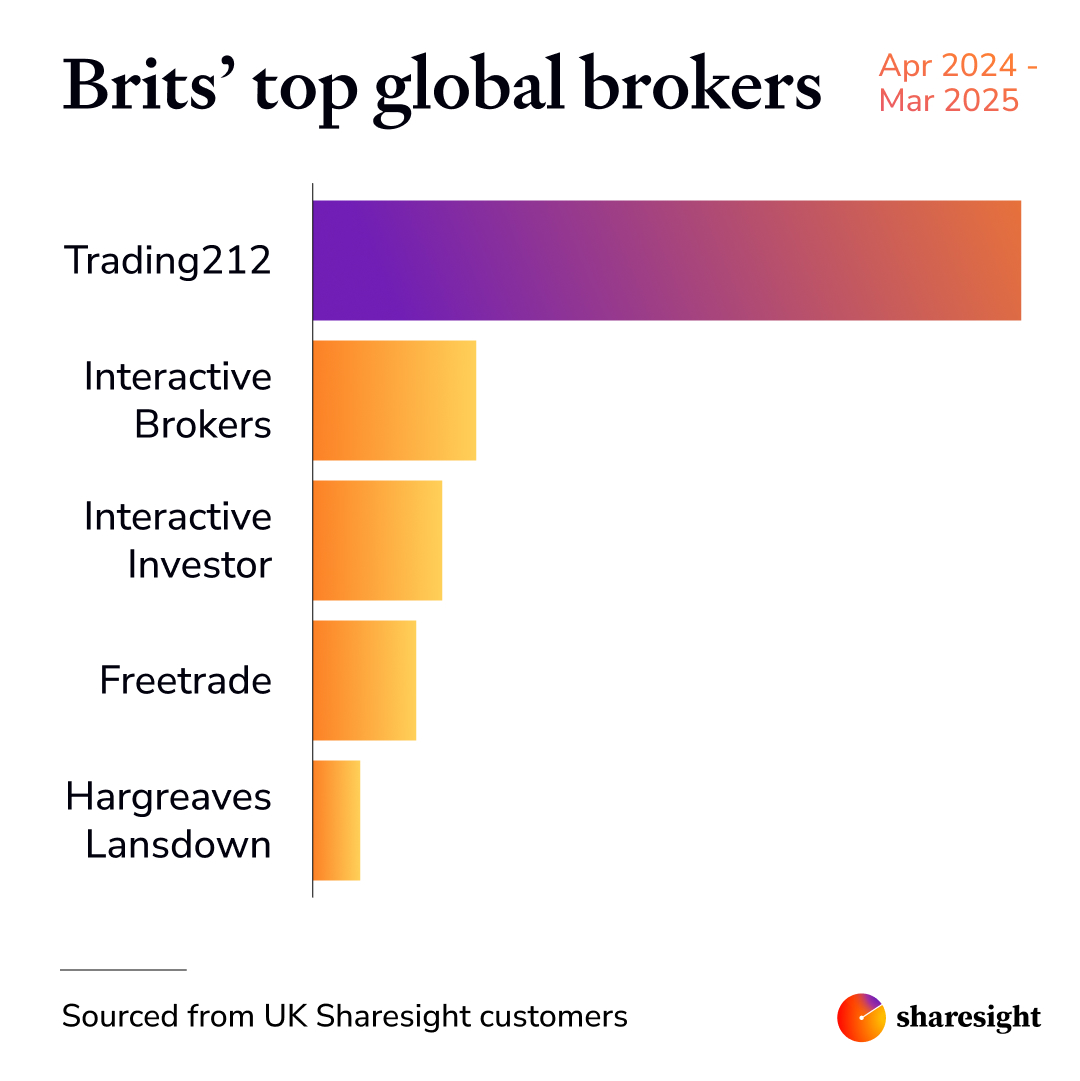

Most popular broker for global trades

Looking at UK investors’ most popular brokers for international trades, Trading212 was also a clear winner. This is also not surprising, given the fact that it gives investors access to commission-free trades on stocks and ETFs from major US and European exchanges. The broker’s fractional shares and low minimum investment requirements also make it especially appealing to newer investors who want to diversify beyond the UK market without high costs or complicated processes.

Interactive Brokers came in second place, likely due to its low-cost trading fees and extensive international market support. The broker offers access to over 150 markets in more than 30 countries, all from a single multi-currency account. With competitive pricing and support for tax-efficient accounts like ISAs and SIPPs, it appeals to both experienced investors and those looking to build globally diversified portfolios.

Track all your investments in one place with Sharesight

Thousands of investors like you are already using Sharesight to track the performance of their UK investments — along with the rest of their portfolio — all in one place. If you’re not already using Sharesight, what are you waiting for? Sign up and:

- Track all of your investments in one place, including global stocks, ETFs, mutual/managed funds, property and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, future income, exposure, drawdown risk, multi-period and multi-currency valuation

- See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.