Top trades by Australian Sharesight users — October 2025

Welcome to the October 2025 edition of Sharesight’s monthly trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users. Below we will look at the top trades overall, plus the top trades in individual stocks, which allows us to observe the broader investment trends by Australian Sharesight users, while also giving us an opportunity to zoom into the most popular stocks and the market-moving news behind them.

Top trades in October 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month, the top trades were strongly led by Vanguard’s Australian Shares Index (ASX: VAS) and MSCI Index International Shares (ASX: VGS) ETFs, followed by the iShares S&P 500 (ASX: IVV) ETF. It was an ETF-heavy month overall, with 9 of the top 20 trades belonging to ETFs.

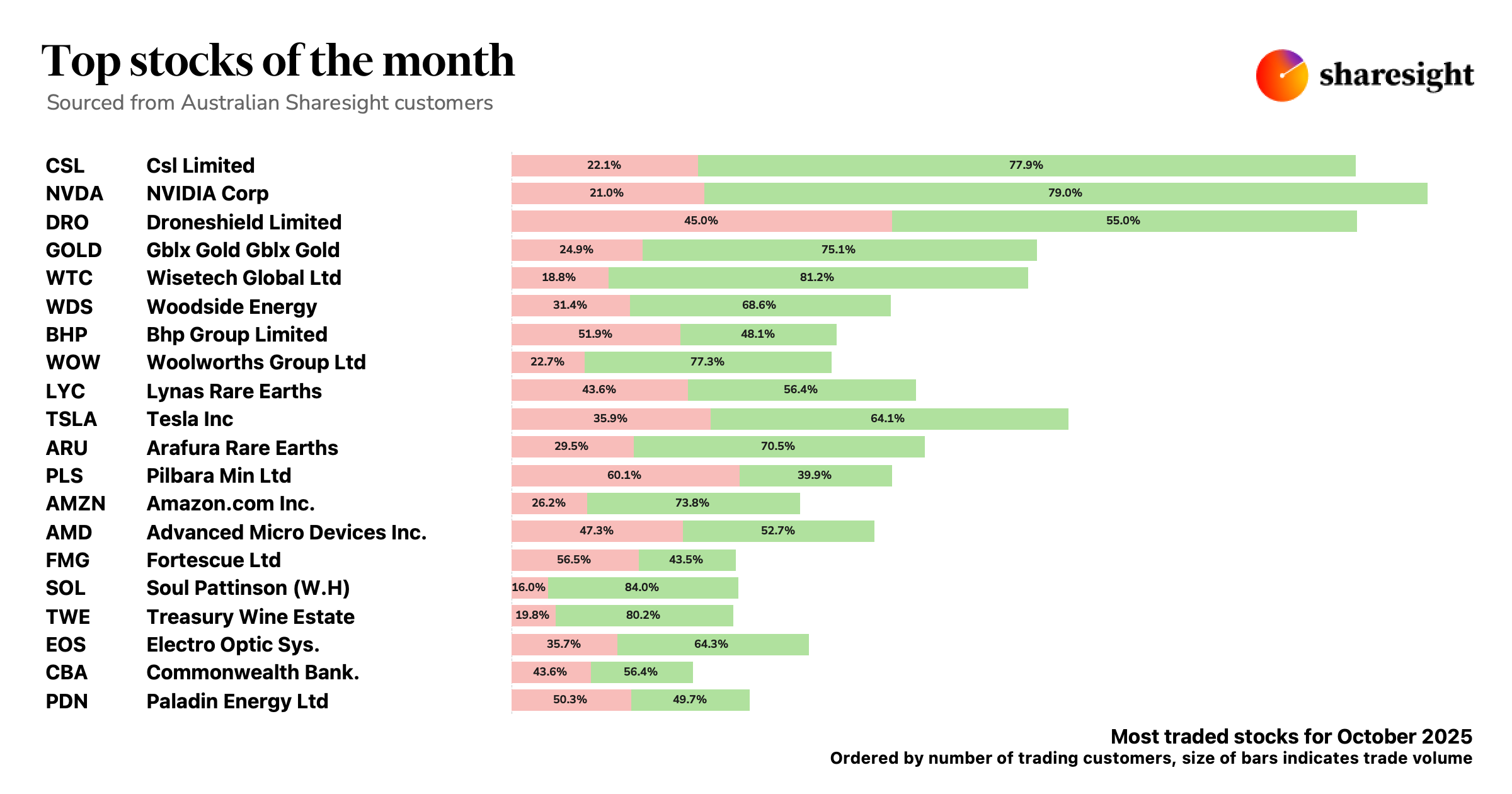

Most-traded stocks in October 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month’s top traded stocks were led by CSL (ASX: CSL), which saw its share price plunge following shareholder upset towards the end of the month. The top trades were followed by NVIDIA (NASDAQ: NVDA), which saw its share price reach all-time highs in October.

It should be noted that the assets in our trading snapshots are ordered by the number of Sharesight users trading that asset, while the size of the bars indicate the actual trade volume. So while there were more customers trading in CSL, the volume of NVDA trades was higher, meaning that while there were fewer people trading in NVDA compared to CSL, they made more trades.

Let’s look at some of the market-moving news behind some of this month’s top stocks:

CSL (ASX: CSL)

- CSL share price plummets as shareholders vote against executive pay

- CSL Chair vows to stay in role for at least two more years despite growing investor disquiet

NVIDIA (NASDAQ: NVDA)

- With 1,500% share price growth in three years, is NVIDIA in a bubble?

- NVIDIA becomes world’s first company worth US$5 trillion

Droneshield (ASX: DRO)

- Droneshield share price up over 700% in 2025

- Soaring defence tech demand sends Droneshield shares up

Wisetech Global (ASX: WTC)

- WiseTech shares plummet after ASIC and AFP raid Sydney office

- WiseTech under pressure to appoint independent directors following office raid

- Former WiseTech chair steps in amid insider trading probe

Woodside Energy (ASX: WDS)

- Major study links Woodside’s Scarborough gas project to hundreds of deaths

- Woodside delivers strong Q3 results and optimistic full-year outlook

BHP (ASX: BHP)

- BHP could form alliance with Rio Tinto in response to Chinese power struggle

- Blames mine closure and job losses on QLD’s coal royalties

- BHP considers re-opening defunct US copper mines due to Trump initiatives

Woolworths (ASX: WOW)

- Woolworths share price hits 5-year low as selloff continues

- Sales fall short of expectations despite price-slashing strategy

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you, with Sharesight you can:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, drawdown risk, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.