Top trades by New Zealand Sharesight users — April 2025

Welcome to the April 2025 edition of Sharesight’s monthly trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users. Below we will look at the top trades overall, plus the top trades in individual stocks, which allows us to observe the broader investment trends by Sharesight users in New Zealand, while also giving us an opportunity to zoom into the most popular stocks and the market-moving news behind them.

Top trades in April 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month, the top trades were led by the Smartshares US 500 ETF (NZX: USF), followed by NVIDIA (NASDAQ: NVDA) and the Vanguard S&P 500 ETF (NASDAQ: VOO). It was a strong month for ETF trading, with 9 of the top 20 trades consisting of ETFs.

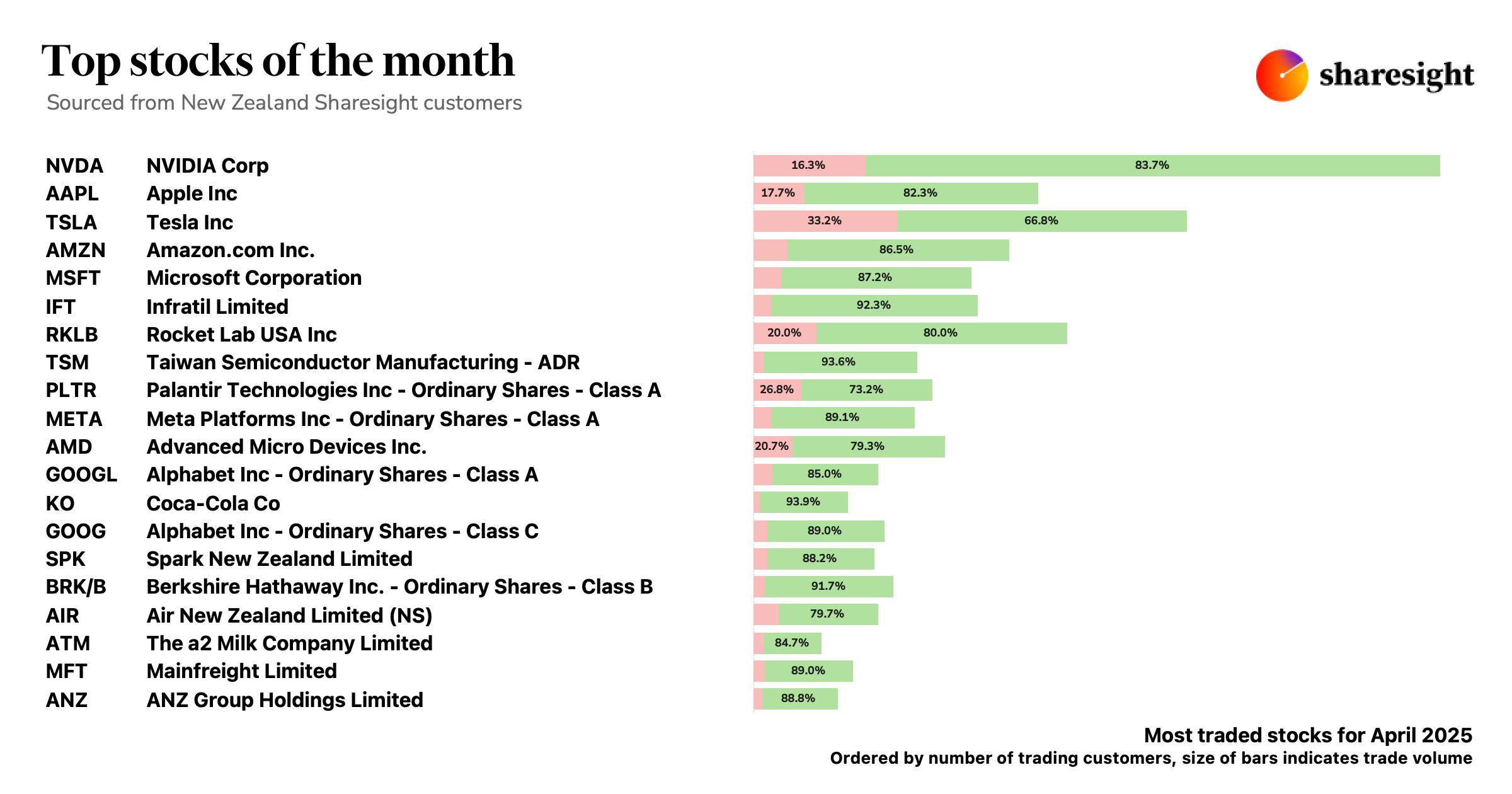

Most-traded stocks in April 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month’s top-traded stocks were led by NVIDIA (NASDAQ: NVDA), which was a popular choice for investors looking to buy the dip in the company’s share price. The top trades were followed by Apple (NASDAQ: AAPL), which experienced significant volatility throughout April.

Let’s look at some of the market-moving news behind some of this month’s top stocks:

NVIDIA (NASDAQ: NVDA)

- NVIDIA share price plunges as it reveals US$5.5 billion impact of new Chinese export controls issued by US govt.

- NVIDIA has lost more than US$1.3 trillion in market cap

Apple (NASDAQ: AAPL)

- Apple share price jumps on news of temporary tariff exemption for smartphones

- Survey reveals surprisingly strong demand for iPhone upgrades

- Share price has tumbled over 30% from its all-time high

Tesla (NASDAQ: TSLA)

- Tesla share price soars despite mounting US tariffs

- Tesla reveals 71% profit drop in quarterly earnings report, fuelled by negative sentiment around Elon Musk

Amazon (NASDAQ: AMZN)

- Amazon share price drops as analysts downgrade price target by 29%

- Stock rallies following Trump’s comments on easing trade war with China

Microsoft (NASDAQ: MSFT)

- Trade war uncertainty could impact Microsoft’s AI plans, earnings

- Analysts cut price target for Microsoft amid macroeconomic uncertainty; say Q1 results likely unaffected but 2025 outlook is weak

Meta (NASDAQ: FB)

- Analysts continue to cut Meta price targets

- Worries over impact of Chinese tariffs on Temu’s Meta ad spend

Alphabet (NASDAQ: GOOGL)

- Alphabet share price drops following court ruling against its illegal monopoly in the online advertising space

- Alphabet produces solid Q1 earnings, fuelled by growing AI monetisation

Coca-Cola (NYSE: KO)

- Coke beats earnings expectations, says tariffs will be ‘manageable’

- Is Coke a safe stock in today’s volatile market?

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you, with Sharesight you can:

- Track all your investments in one place, including stocks, ETFs, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, drawdown risk, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.