Top trades by New Zealand Sharesight users — January 2025

Welcome to the January 2025 edition of Sharesight’s monthly trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users. Below we will look at the top trades overall, plus the top trades in individual stocks, which allows us to observe the broader investment trends by Sharesight users in New Zealand, while also giving us an opportunity to zoom into the most popular stocks and the market-moving news behind them.

Top trades in January 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month, the top trades were strongly led by the Smartshares US 500 ETF (NZX: USF), followed by NVIDIA (NASDAQ: NVDA) and the Smartshares NZ Top 50 ETF (NZX: FNZ). Overall, it was a strong month for ETF trading, with 9 of the top 20 trades consisting of ETFs. It’s also worth noting that the majority of these trades are buy trades, which is to be expected in an ETF-heavy snapshot. Overall, this snapshot suggests that many New Zealand Sharesight users are employing a long-term buy-and-hold strategy.

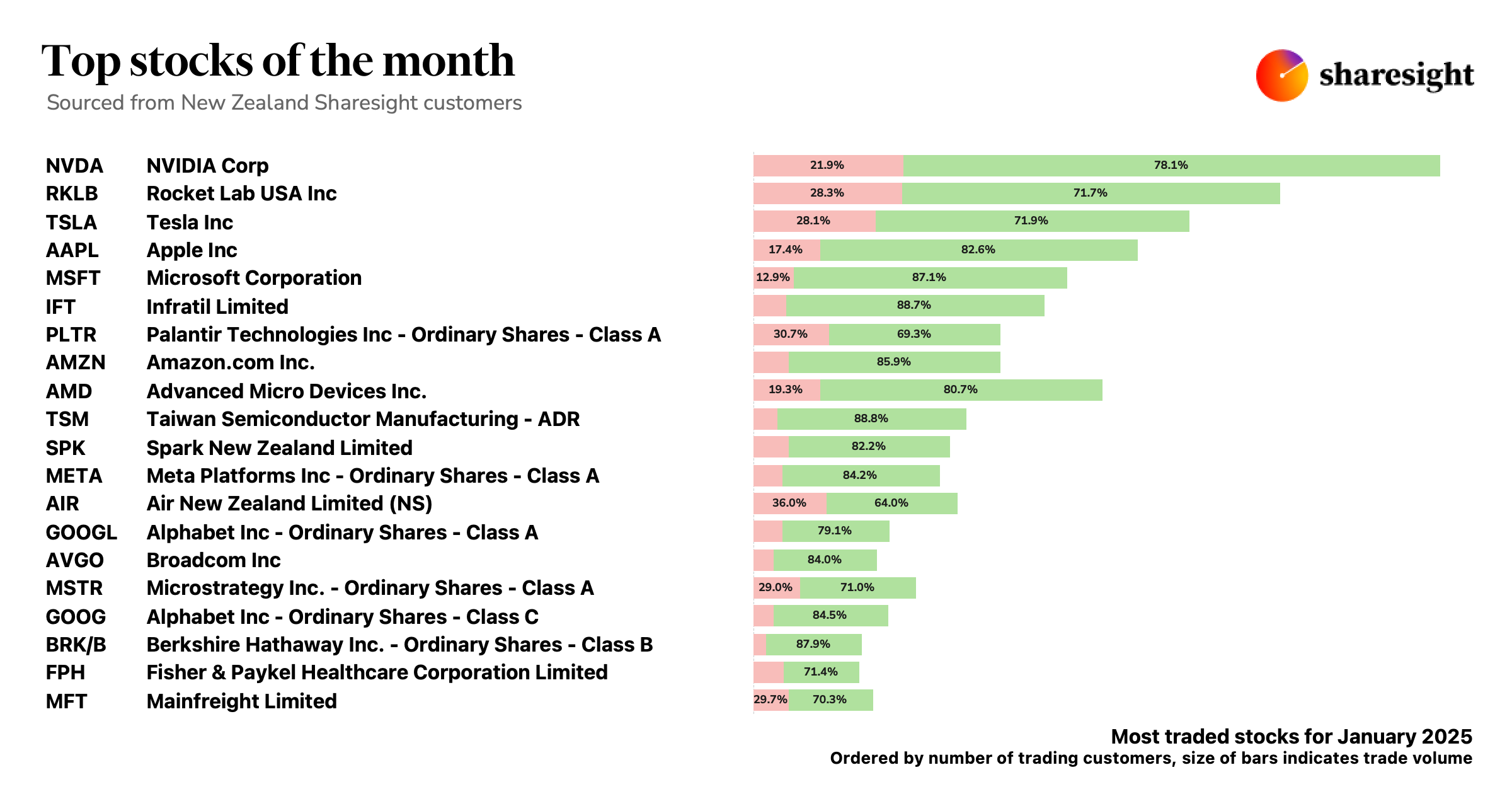

Most-traded stocks in January 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month’s top-traded stocks were led by NVIDIA (NASDAQ: NVDA), which lost almost US$600 billion in market value as investors panicked over the potential impact of Chinese AI startup DeepSeek. The top trades were followed by Rocket Lab (NASDAQ: RKLB), which announced a number of partnerships in January.

Let’s look at some of the market-moving news behind some of this month’s top stocks:

NVIDIA (NASDAQ: NVDA)

- NVIDIA share price suffers biggest one-day loss ever as concerns mount over Chinese AI startup DeepSeek

- NVIDIA share price meltdown highlights uncertain future for AI stocks

Rocket Lab (NASDAQ: RKLB)

- Rocket Lab to launch wildfire-monitoring satellites

- Signs 5-year contract to launch more hypersonic test vehicles for US military

Tesla (NASDAQ: TSLA)

- Tesla’s quarterly earnings miss expectations, with adjusted net income plummeting by 23%

- Pledges to build a cheaper vehicle

Apple (NASDAQ: AAPL)

- Will the Apple share price drop along with the plunging Chinese iPhone sales?

- Indonesia maintains ban on iPhone 16 despite Apple’s offer to build US$1.6 billion AirTag factory

Microsoft (NASDAQ: MSFT)

- Microsoft beats quarterly earnings estimates

- Share price falls on news of slowdown in cloud computing growth

Infratil (NZX: IFT)

- Infratil plans to invest further AU$250 million in Canberra Data Centers

- Infratil hit by global AI stock selloff fuelled by DeepSeek

Palantir Technologies (NASDAQ: PLTR)

- Palantir expected to deliver YoY increase in earnings in upcoming earnings report

- Declared the S&P 500’s top-performing stock of 2024

Taiwan Semiconductor Manufacturing (NYSE: TSM)

- Trump threatens to impose 100% tax on foreign semiconductors

- Taiwanese govt. says semiconductor business between US and Taiwan is a “win-win” for both sides

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you, with Sharesight you can:

- Track all your investments in one place, including stocks, ETFs, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.