Top trades by New Zealand Sharesight users — November 2025

Welcome to the November 2025 edition of Sharesight’s monthly trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users. Below we will look at the top trades overall, plus the top trades in individual stocks, which allows us to observe the broader investment trends by Sharesight users in New Zealand, while also giving us an opportunity to zoom into the most popular stocks and the market-moving news behind them.

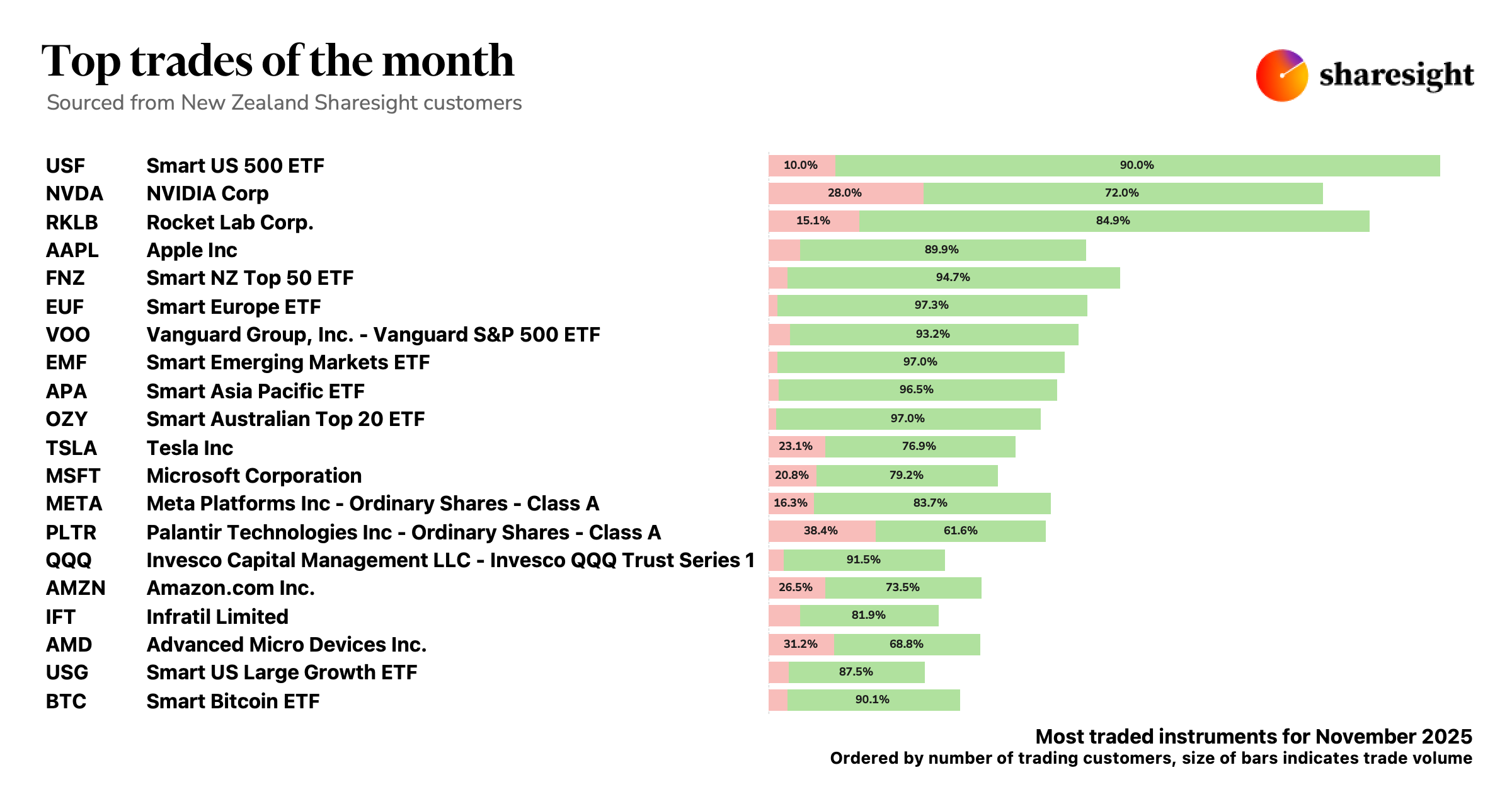

Top trades in November 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month, the top trades were led by the Smartshares US 500 ETF (NZX: USF), followed by NVIDIA (NASDAQ: NVDA) and Rocket Lab (NASDAQ: RKLB). It was an ETF-heavy month overall, with 9 of the top 20 trades consisting of ETFs. US tech stocks also dominated the rankings, with very little investment in local assets.

It should be noted that the assets in our trading snapshots are ordered by the number of Sharesight users trading that asset, while the size of the bars indicate the actual trade volume. So while there were more customers trading in NVDA, the volume of RKLB trades was higher, meaning that while there were fewer people trading in RKLB compared to NVDA, they made more trades.

Most-traded stocks in November 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month’s top stock trades were led by NVIDIA (NASDAQ: NVDA), which saw its share price steadily decline throughout the month after hitting an all-time high at the end of October. The top trades were followed by Rocket Lab (NASDAQ: RKLB), which also saw its share price decline over the month after hitting an all-time high in October.

Let’s look at some of the market-moving news behind some of this month’s top stocks:

NVIDIA (NASDAQ: NVDA)

- NVIDIA share price drops on news that Google plans to sell AI chips to Meta

- NVIDIA dismisses concerns over Google chip threat

- China bars ByteDance from using NVIDIA chips

Rocket Lab (NASDAQ: RKLB)

- Rocket Lab posts record quarterly revenue in Q3 results

- Share price plummets 40% from all-time high, but Wall St remains bullish

Apple (NASDAQ: AAPL)

- Apple preparing for CEO Tim Cook to step down next year

- Share price hits a new all-time high amid job cuts and iPhone 17 success

Tesla (NASDAQ: TSLA)

- Shareholders approve almost US$1 trillion pay package for CEO Elon Musk

- Share price declines following pay package approval, cutting Musk’s net worth by US$10 billion

- Share price rises following Musk’s claim that robotaxi fleet will double in Austin

Meta (NASDAQ: META)

- Meta to pay €479 million to Spanish digital media outlets for unfair competition and breaching data regulations

- Internal documents reveal Meta is earning billions of dollars from scam ads

- Is Meta positioned for growth in 2026?

Amazon (NASDAQ: AMZN)

- AWS plans to invest US$50 billion in AI infrastructure for US govt. agencies

- Is Amazon another stock to watch in AI chip push?

Infratil (NZX: IFT)

- Infratil revenue up more than one-third in first-half earnings report

- Share price drops 7%, with investors concerned about tightening earnings guidance and higher capital expenditure forecasts

Advanced Micro Devices (NASDAQ: AMD)

- AMD share price hits record high due to AI demand and OpenAI deal

- AMD has its worst month in three years, as investors worry about economy, AI competition

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you, with Sharesight you can:

- Track all your investments in one place, including stocks, ETFs, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, drawdown risk, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight product updates – January 2026

Our latest updates include Abu Dhabi exchange support, enhanced dividend insights, overview page refinements, mobile app improvements and more.

2026 market outlook: Expert insights on risks, rates and opportunities

We talk to industry experts about their expectations for markets in 2026 — from inflation and interest rates to market opportunities, the AI bubble and more.

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.