Track your investment watchlist stocks with Sharesight

In the fast-paced world of investing, keeping an eye on potential opportunities is just as important as managing your existing portfolio. Whether you’re monitoring stocks for a potential buy, tracking ETFs and funds for diversification, or watching cryptocurrency trends, an investment watchlist is a crucial tool. With the Sharesight app, you can create a custom watchlist to track the price movements of over 750,000 global stocks, ETFs, funds and cryptocurrencies. This article explores the benefits of watchlists, how you can benefit from using a watchlist alongside your portfolio tracker, and how Sharesight helps you stay on top of your investment strategy.

Why you need an investment watchlist

By adding assets to a watchlist, you can monitor the performance of these assets before you actually invest your money. The ability to track price movements, performance trends and market shifts will then help you make informed decisions about when to enter or exit a position. Here are some more reasons why a watchlist is an essential tool for investors:

- Stay informed on market trends: Watching potential investments over time helps you recognise patterns and trends before making a purchase

- Compare investment opportunities: A watchlist allows you to evaluate multiple stocks, ETFs or funds side-by-side

- Avoid emotional investing: Tracking investments before committing helps you make more rational, data-driven decisions rather than reacting impulsively to market movements

- Monitor emerging markets and sectors: Keeping an eye on specific industries or sectors can help you identify potential growth opportunities

- Fine-tune your investment strategy: By tracking a watchlist, you can test your hypotheses by observing how potential investments perform before incorporating them into your actual portfolio.

Watchlist vs. portfolio tracker: What’s the difference?

With Sharesight, you have the option to track your portfolios and a custom watchlist from one convenient app — but it’s important to understand the differences between these tools.

As mentioned above, a watchlist is a collection of assets that you are monitoring but have not yet purchased. It provides real-time pricing and allows you to track performance over time before deciding whether to buy.

A portfolio tracker provides detailed insights into the investments you own, including dividends, capital gains and overall performance. It offers a comprehensive view of your financial position, accounting for factors such as market movements, foreign exchange fluctuations and reinvested dividends.

The value of using both a watchlist and a portfolio tracker

If you’re tracking your portfolio without a watchlist, you could be missing opportunities to refine your investment strategy. At the same time, a watchlist is no substitute for a portfolio tracker. Relying solely on a watchlist without a dedicated portfolio tracker means you miss out on crucial data such as dividend tracking and tax reporting.

One of the key benefits of using a watchlist is that it makes it easy to keep an eye on price movements, so you can act quickly. By pairing it with a portfolio tracker, you can compare these potential buys side-by-side with assets in your portfolio. A useful tool is Sharesight’s exposure report, for example, which reveals the underlying holdings of your ETFs — a quick way to ensure that the asset you want to invest in is not already overrepresented in your portfolio.

Create a watchlist with the Sharesight app

If there are stocks, ETFs, funds or cryptocurrencies that you are interested in, but not quite ready to invest in, you can monitor them on the Sharesight app (available on iOS and Android). To create your custom watchlist, you can navigate to the Watchlist section of the app and select ‘Add to watchlist’, where you will be given the option to search for any of the 750,000+ investment assets that Sharesight supports.

The Sharesight app also allows you to track up to 10 portfolios, making it the perfect place to check your investments and your watchlist on the go.

Track your watchlist and portfolios with the Sharesight app

If you're not already using the Sharesight app, download it on the Apple App Store or Google Play Store to get started tracking your watchlist and portfolios today.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

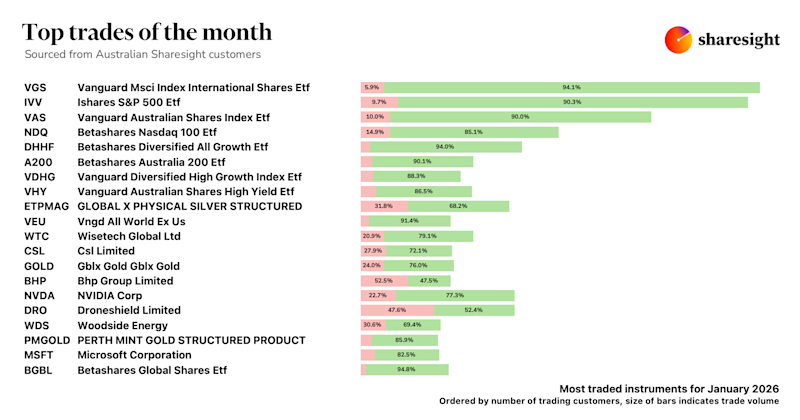

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.