Why I use Sharesight to track my portfolio

When I first started working at Sharesight, I set out to understand why an investor wouldn’t just use their broker to check how their shares were performing. I learnt quickly that you can’t rely on your broker for portfolio performance, and have my very own experience to share with you.

A few months ago I made my first investment. I wanted to experience exactly what a Sharesight customer would experience to help with my marketing role. Plus, based on some of the tips I picked up from Sharesight staff it sounded like a good financial decision.

I was logging in to my broker’s website many times a day to see how my shares were performing because it was all so new and exciting. It was incredible to see that in just one day I was making (or losing) a lot more than the interest I was earning each month on my savings account.

One day I logged in to see a market value of zero. I figured it was a glitch but after a day or two with no change and no communications, I became a bit concerned. I contacted my broker who notified me that there had been a share split, and my investment was currently trading under a different symbol. As a new investor, I was confused and unsure if everything would go back to normal. What was I meant to do with this new symbol? I decided to wait and see.

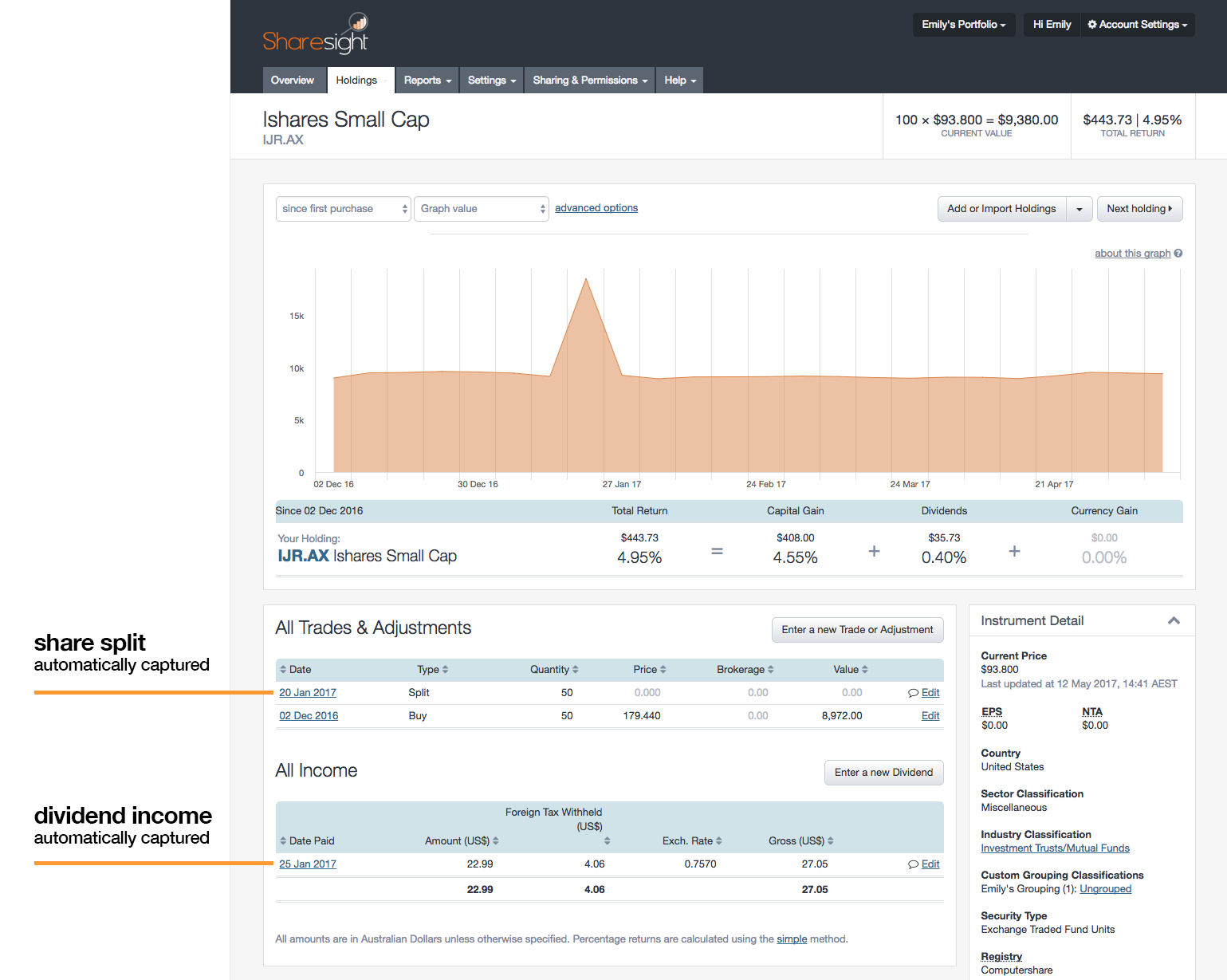

This is when the Sharesight magic truly started for me. An email came through to let me know there had been a share split, and prompted me to sign in and confirm the corporate action. Everything was filled out for me, I just had to press a button to confirm everything looked correct and my portfolio went back to normal.

At the same time, my investment reappeared in my broker’s profit/loss -- but my return was way off.

I purchased my 50 shares of ASX:IJR for a grand total of $8,972 ($179.44 per share). After the share split I owned 100 shares at market value of $9,380 ($93.80 per share), but my broker told me that my return was -47.73%.

I only have one holding, so it was pretty obvious that it was incorrect. Would other investors with multiple investments have noticed this on a quick portfolio performance check, or would that return figure have been drowned out? I’m not so sure.

So what happened? Why was my broker telling me I lost 47.73% of my money when my current value was almost the same as when I made my initial investment? It seems the only thing my broker had done after the share split was update the number of shares I owned from 50 to 100. And to calculate my initial value, they simply multiplied 100 by the price I paid for my 50 shares: 100 x $179.44 = $17,944. Ah-ha!

| Reality | My broker says | Sharesight says | |

|---|---|---|---|

| Purchased | 50 shares | 100 shares ❌ | 50 shares ✅ |

| Paid | $8,972 ($179.44 per share) |

$17,944 ❌ | $8,972 ✅ |

| After share split I own | 100 shares | 100 shares ✅ | 100 shares ✅ |

| Today my 100 shares are worth | $9,380 ($93.80 per share) |

$9,380 ✅ | $9,380 ✅ |

| My return is | -47.73% ❌ | 4.95% ✅ including dividend income |

Not only is my broker calculating my performance based on the wrong initial value, it also isn’t incorporating my dividend income into my performance calculations.

When it comes to trading, you go to your broker. When you need to understand performance, you can count on Sharesight. For all investors out there, the best time to set up your Sharesight portfolio is on day one. The next best time is right now!

FURTHER READING

Sharesight nominated for 2025 Wealth Tech Innovator of the Year

Sharesight has been chosen as a finalist in the 2025 Australian Wealth Management Awards, in the Wealth Tech Innovator of the Year category.

Prepare your annual accounts with our historical cost report

Sharesight's historical cost report is a powerful tool for investors who need to prepare annual accounts or financial statements with mark-to-market accounting.

Sharesight product updates – July 2025

This month's focus was on rolling out predictive income forecasting, as well as improved cash account syncing across different brokers and currencies.