Xero is a cloud-based accounting software platform used by individuals as well as small and medium-sized businesses.

How we work together

Sharesight has partnered with Xero to provide a seamless solution between portfolio management and portfolio accounting. If you like the insights you get from Sharesight, you’ll love the complete financial picture you get by connecting your portfolio to Xero.

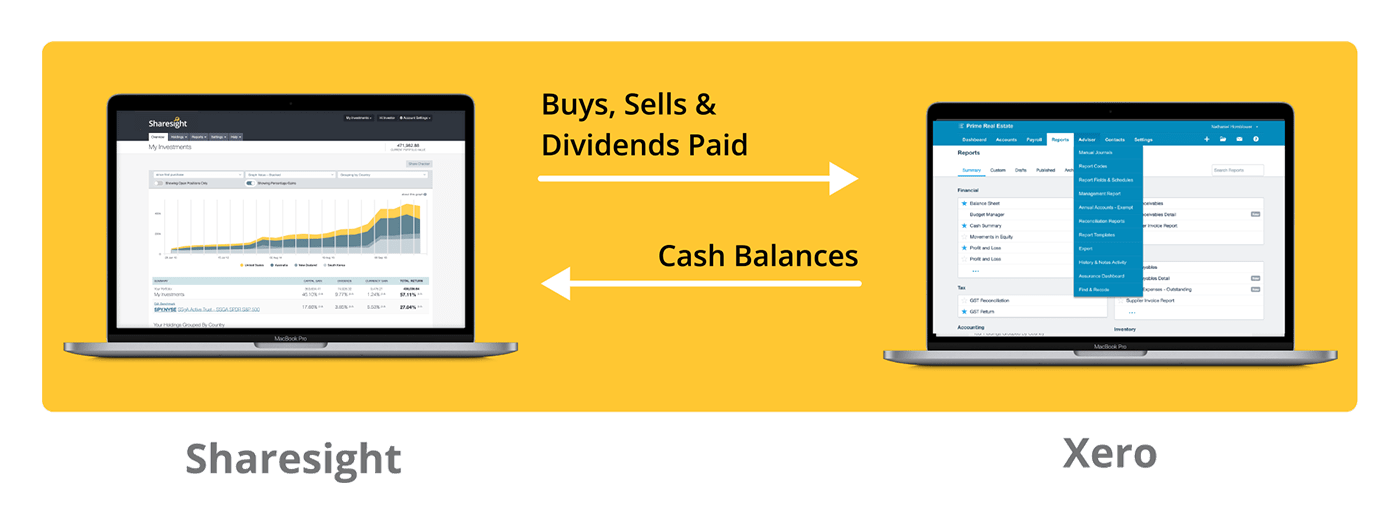

How Sharesight + Xero works

Reconcile your investment transactions

When you synchronise your Sharesight portfolio to Xero, details of your share purchases, sales, and dividends will flow into Xero automatically so they can be easily reconciled against your bank statement and incorporated into your personal wealth and budgeting picture.

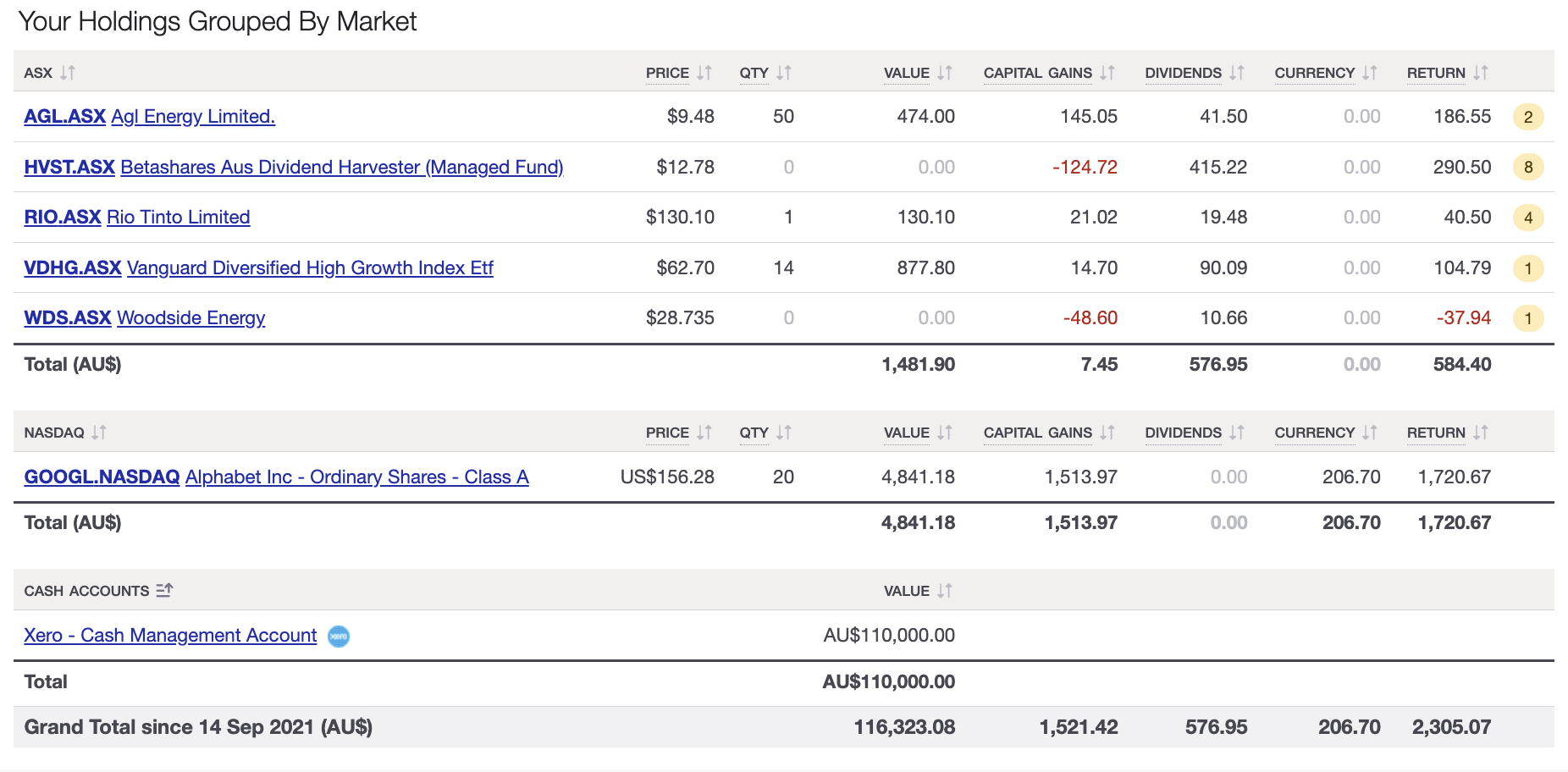

Manage your cash balances

Furthermore, Sharesight can pull in your bank account balances, term deposits and cash investments from Xero, so you can view your complete financial position directly within your Sharesight portfolio – automatically, and in real-time.

Why connect Sharesight to Xero?

-

Access your finances 24/7 — Categorise your bank transactions, reconcile your trade & dividend data, and track your cash balances alongside your investments — from anywhere, anytime.

-

Take the pain out of tax time — With your trade data in Sharesight and your deductions (including saved receipts) in Xero, you’ll save both time and money this tax season.

-

Share unlimited access — Share access with your accountant or financial adviser. They’ll have full visibility into your financial health — not just at tax time, but throughout the year.

Frequently asked questions

Q: I have an existing Xero account — how do I connect it to my Sharesight portfolio?

A: Follow these steps to connect your Sharesight portfolio to an existing Xero account: Connecting your portfolio to Xero.

Q: I don’t have a Xero account — how do I get one?

A: Ask your accountant or financial adviser if they can provide you with a Xero account. Alternatively, if you're based in Australia or New Zealand, you may add a Xero Cashbook as an Add-on to your Sharesight subscription — see the last FAQ for more information.

Q: What’s the difference between Xero Business Edition and Cashbook?

A: Xero Cashbook is a simplified version of Xero Business Edition that does not include accruals, invoicing, payroll, or GST reporting. Cashbook is designed to help you manage your cashflow – all over the internet and in real-time.

Q: How can I get Xero Cashbook, and how much does it cost?

A: Xero Cashbook is available as an Add-on to paid Sharesight plans in Australia and New Zealand. Here’s how to get started:

- Log in to your Sharesight account (or sign up for a new account).

- Upgrade to a Sharesight Investor or Expert plan.

- Add Xero Cashbook to your account — it’s free for 30 days, then AU$18/month per Cashbook account for AU customers and NZ$20/month per Cashbook account for NZ customers that you wish to connect to a Sharesight portfolio. The charge for your Cashbook account(s) will be included on your monthly or annual Sharesight invoices.

Award-winning integration

-

Sharesight became a certified Xero Add-on partner in 2009

-

Sharesight was named Xero Add-On Partner of the Year in 2014

-

Sharesight reached Xero Gold Partner status in 2021

Sharesight has partnered with leading online accounting system Xero in order to provide a seamless solution between portfolio management and portfolio accounting.

The Xero Synchronisation feature allows you to connect your Sharesight portfolio to your Xero account. This allows you to synchronise details of share purchases, sales, and dividends to Xero which can be reconciled against your bank statement and included in your financial accounts.

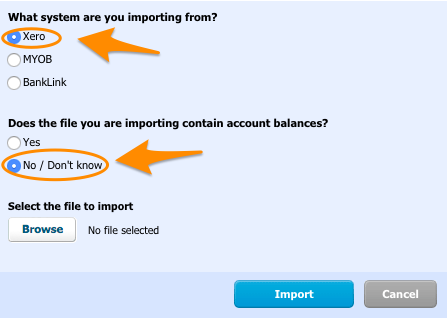

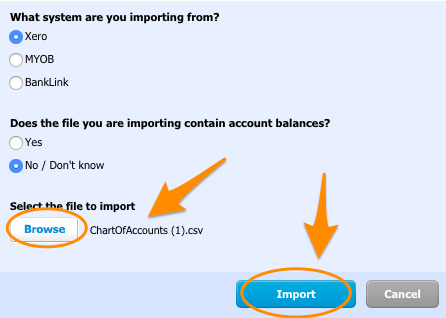

Before you begin

These instructions assume that you have a Xero subscription. If you're on a paid Sharesight subscription, you may add Xero Cashbook as an add-on from the Sharesight Plans & Billing page. Otherwise, you may sign up directly to one of Xero's retail subscription options.

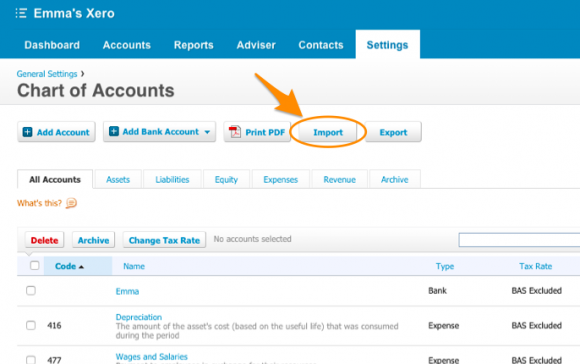

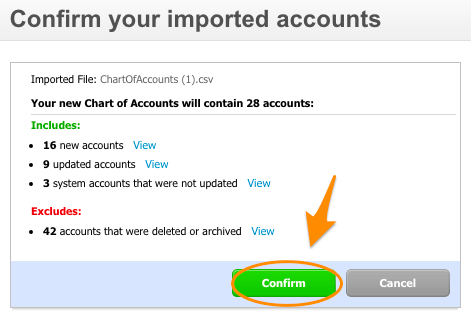

In your Xero chart of accounts you need to have an account set up for each of the following items:

- Dividends Received (Revenue Account)

- Realised Gains/Losses (Revenue Account)

- Tax Credits (Current Asset)

- DRP Balance (Current Asset)

- Share Market Investments (Asset)

- Brokerage (Expense Account, Optional: brokerage can be reconciled to your Share market investments asset account if you wish to include brokerage as part of the cost base of the asset)

Setting up Xero synchronisation in Sharesight

Embedded content: https://www.youtube.com/watch?v=ikW-ehg1kzw

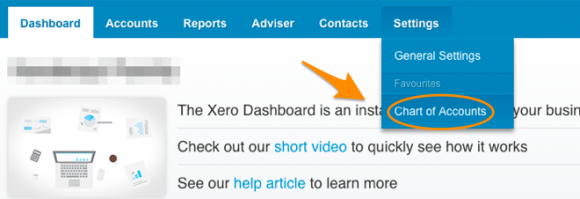

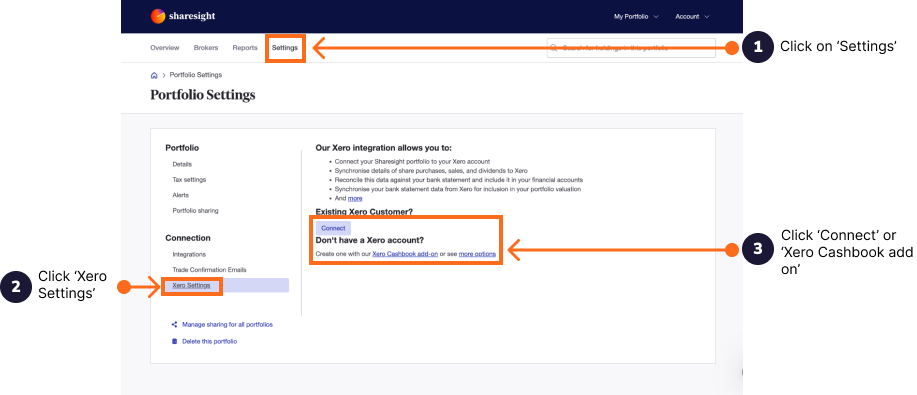

1 -- Click on 'Settings' tab.

2 -- Click ‘Xero settings’

3 -- Click the 'Connect' button. This will direct you to log into you Xero account and authorise access to Sharesight. You'll be redirected back to Sharesight when you're finished. If you don't already have a Xero cashbook select 'Xero Cashbook add-on'.

4 -- Map the following items to the appropriate account from your Xero organisation’s chart of accounts:

- Dividends => Revenue

- Realised Gains / Losses => Revenue

- Tax Credits => Current Asset

- DRP Balance => Current Asset

- Share Market Investments => Asset

- Brokerage => Expense

Synchronise using invoices or bank transactions

The following additional settings are available:

- Synchronise using invoices -- we recommend this method in most instances.

- Synchronise using bank transactions -- choose this if you're on the Xero Starter plan since there's a limit to how many invoices you may send.

Sending invoices

- Send invoices in 'draft' status -- Draft invoice require an additional approval step in Xero before they are included in your accounts.

- Send invoices in unconverted currency -- Sharesight won't convert foreign currency transactions where the currency is supported by your Xero Organisation (this option is only available if your Xero account supports multi-currency).

Synchronise trades and corporate actions

- Synchronise trades received via Sharesight Connect -- Trades received via Sharesight Connect will be automatically Synchronised to Xero.

- Synchronise trades received by Contract note emails -- Trades created by the Trade Confirmation Emails function will be automatically Synchronised to Xero.

- Synchronise corporate actions automatically -- System generated dividends and Return of Capital payments will be automatically Synchronised to Xero on their paid date.

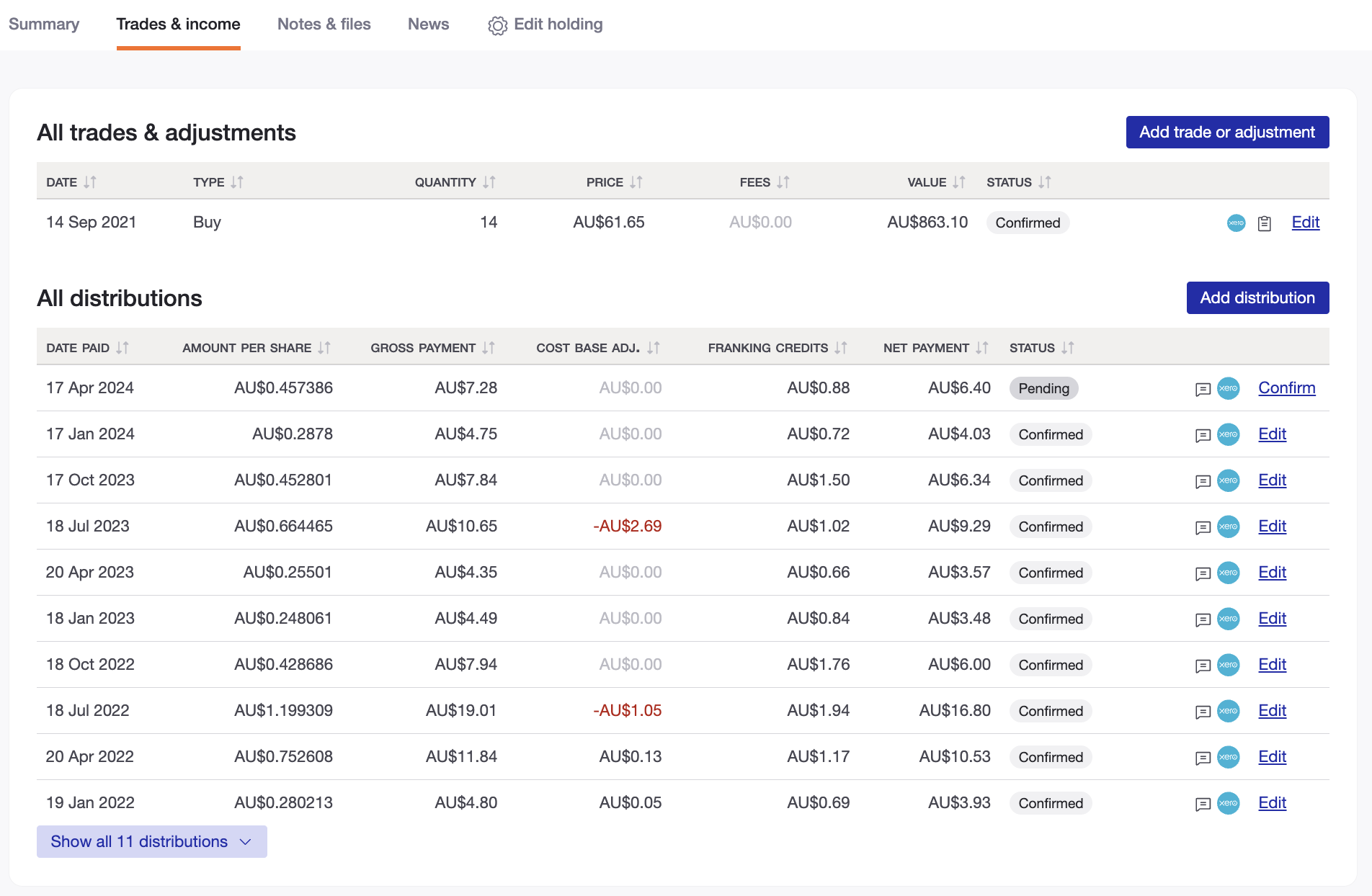

Synchronising your portfolio with Xero

Once Xero synchronisation is configured, a tick box will appear on the add and edit screens for trades and dividends. To send the trade or dividend record to Xero, simply select the tick box and then click the ‘Save’ button.

When you edit a trade or dividend in Sharesight, you'll see an option to synchronise any modifications to Xero (you can disable this option by unchecking the box if you don't want to re-synchronise the data). If the transaction has been reconciled in Xero, the option to synchronise to Xero will be disabled as it's not possible to update a transaction that has been reconciled.

Synchronisation indicator

A synchronisation icon provides live feedback of the synchronisation status:

Synchronisation in progress

Synchronisation completed successfully

Synchronisation failed (hover over the icon to view the error message)